Getting Started in Payroll

Use of CDM+ Payroll requires an active enrollment in a CDM+ subscription. Reach out to our Sales team at sales@cdmplus.com to enroll today!

Navigating to Payroll

You can navigate to CDM+ Payroll in many ways.

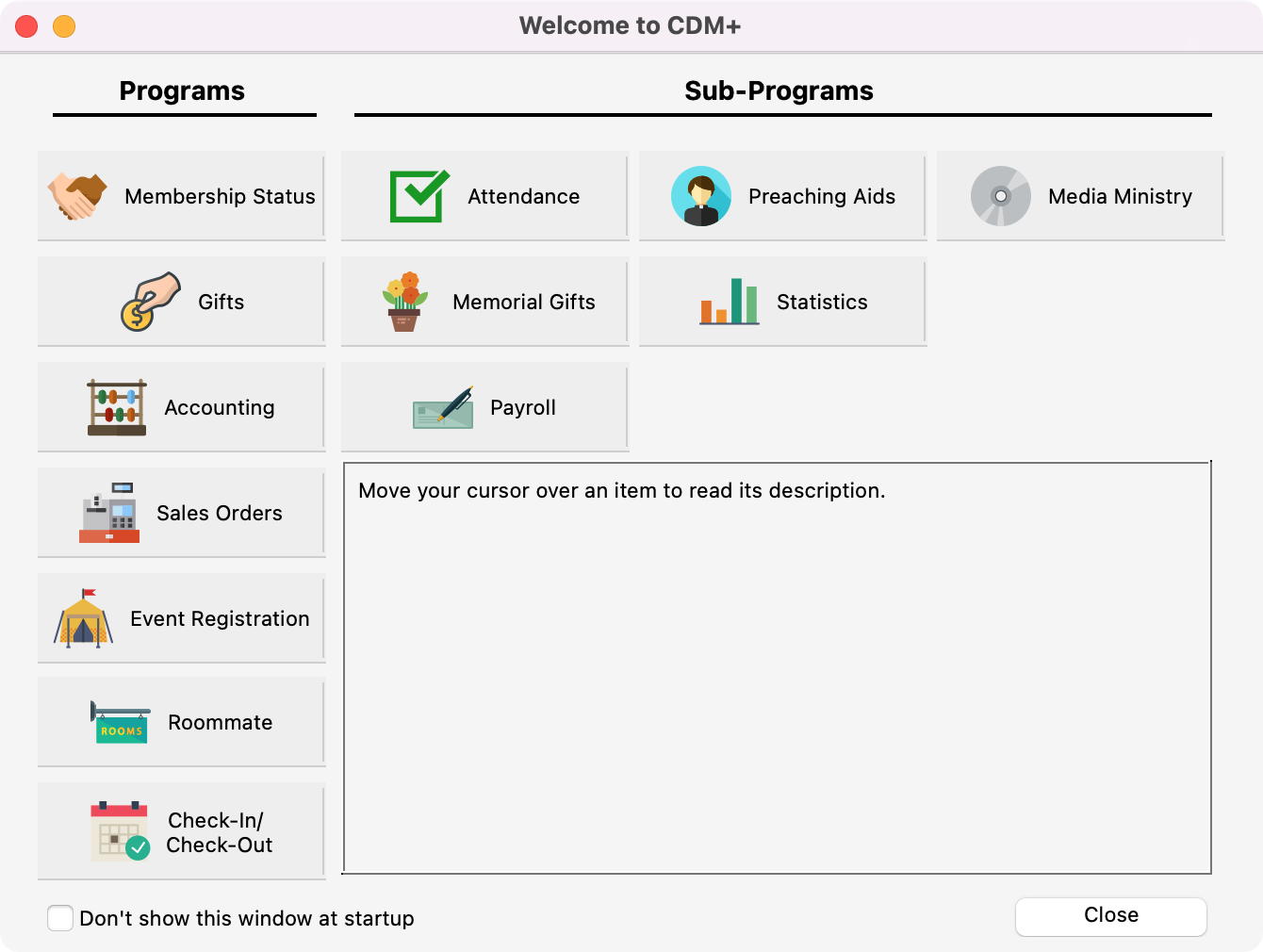

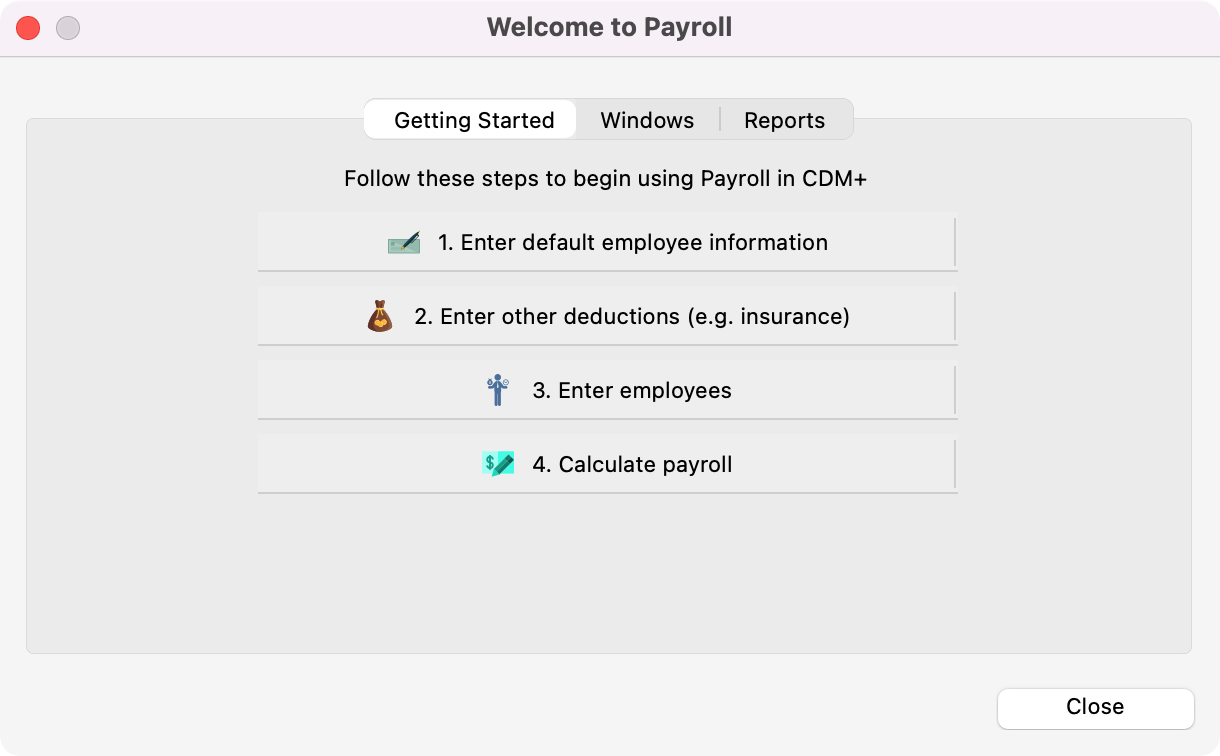

From the Welcome to CDM+ window you can click Payroll and then the menu options will walk you through each step.

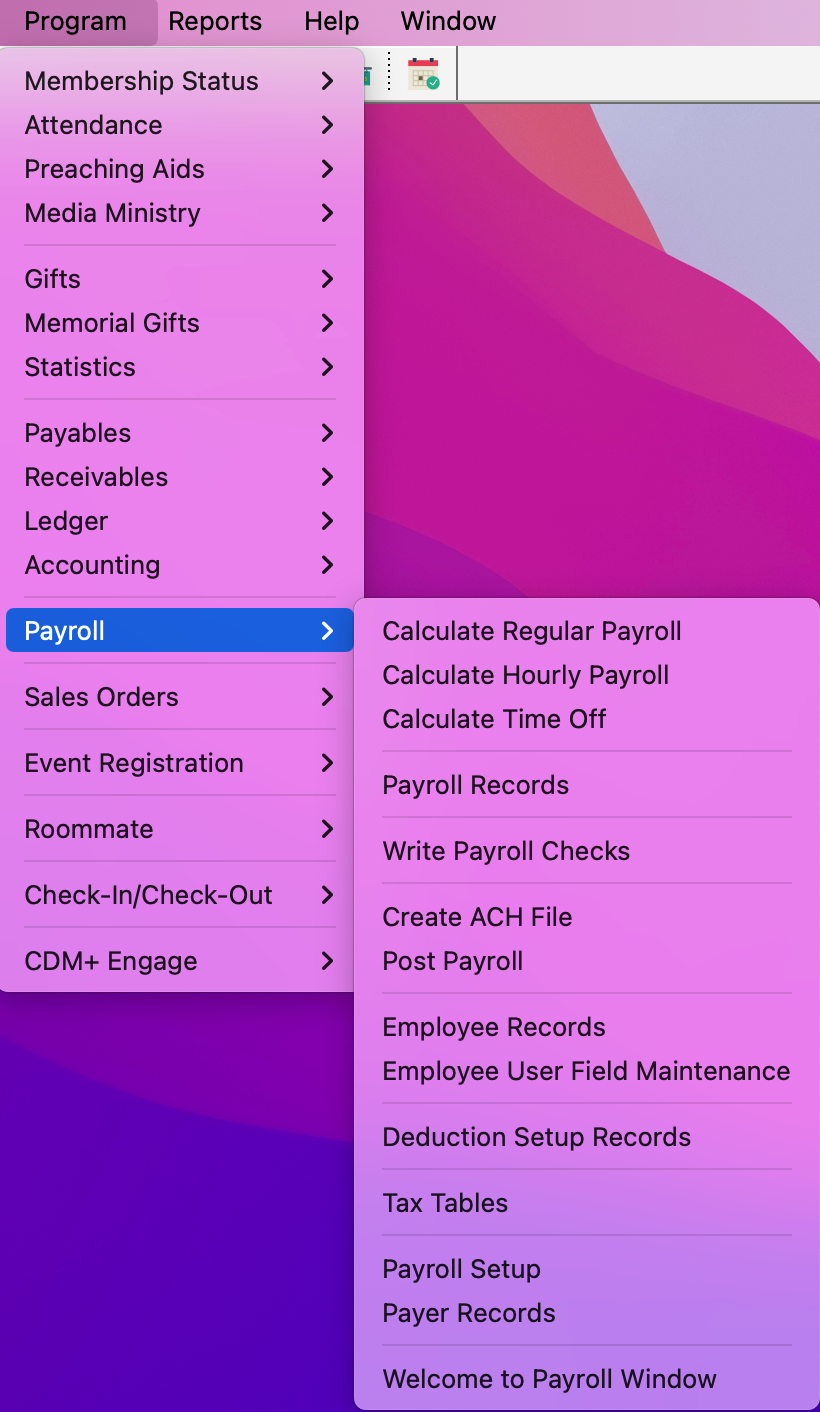

You can also navigate to Payroll through the menu options by going to Program → Payroll. Here you will see the different windows you’ll need for the payroll process.

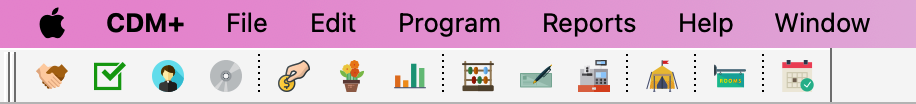

Lastly, under Preferences-Toolbars you can choose to show the Payroll toolbar, when you can click to open the payroll menus that you need.

Gather Your Resources

Before you begin setting up your payroll it is important to have these details handy:

Federal EIN

State EIN (if applicable)

Local Tax Number (if applicable)

Completed Employee Tax Forms

W-4

State Form (if applicable)

I-9

Prepping CDM+

One of the beautiful things about CDM+ is how accounting and payroll integrates with one another. In order for this integration to happen, you’ll want to make sure you have created the following setups.

Recommendations:

Liability Accounts for Withholding and Deductions

Compensation and Allowance Expense Accounts

Employer Tax

- Vendor Record Setup - Setup Vendor Records for Liabilities

- Payer Record Setup

- Payroll Setup

- Deduction Setup

- Employee Setup

Running Payroll

Once these setups are in place you’ll be ready to Run Payroll.

After calculating payroll there are three ways to deliver the checks to your employees.

Write Checks- print out a physical check for your employees

Direct Deposit (Recommended)- allow CDM+ to process and directly deposit the payroll checks to your employee’s bank account.

ACH Payroll- create a file to send to your banking institution for your bank to directly deposit the payroll checks to your employee’s bank account.

For each option you’ll need to calculate payroll and calculate time off. The next step you take will depend on how you want to deliver the checks.

- Calculating Payroll

- Calculating Time Off

- Write Payroll Checks and post to Ledger.

- Payroll Direct Deposit in CDM+ (if using)

- ACH Direct Deposit (if using)

Post Payroll

Since payroll and accounting are already integrated. The final step after running a payroll is to post it to your ledger.

You can also give your employees access to their Payroll online through Engage. Check out Engage Payroll to see steps to setup your employees.