Printing Tax Forms

CDM+ has partnered with Aatrix, a tax forms service company, to provide all federal, state and some local tax forms. These forms can be printed or e-filed (fees may apply).

Note! An active Internet connection and enrollment in CDM+ Premier Support is required to produce tax forms.

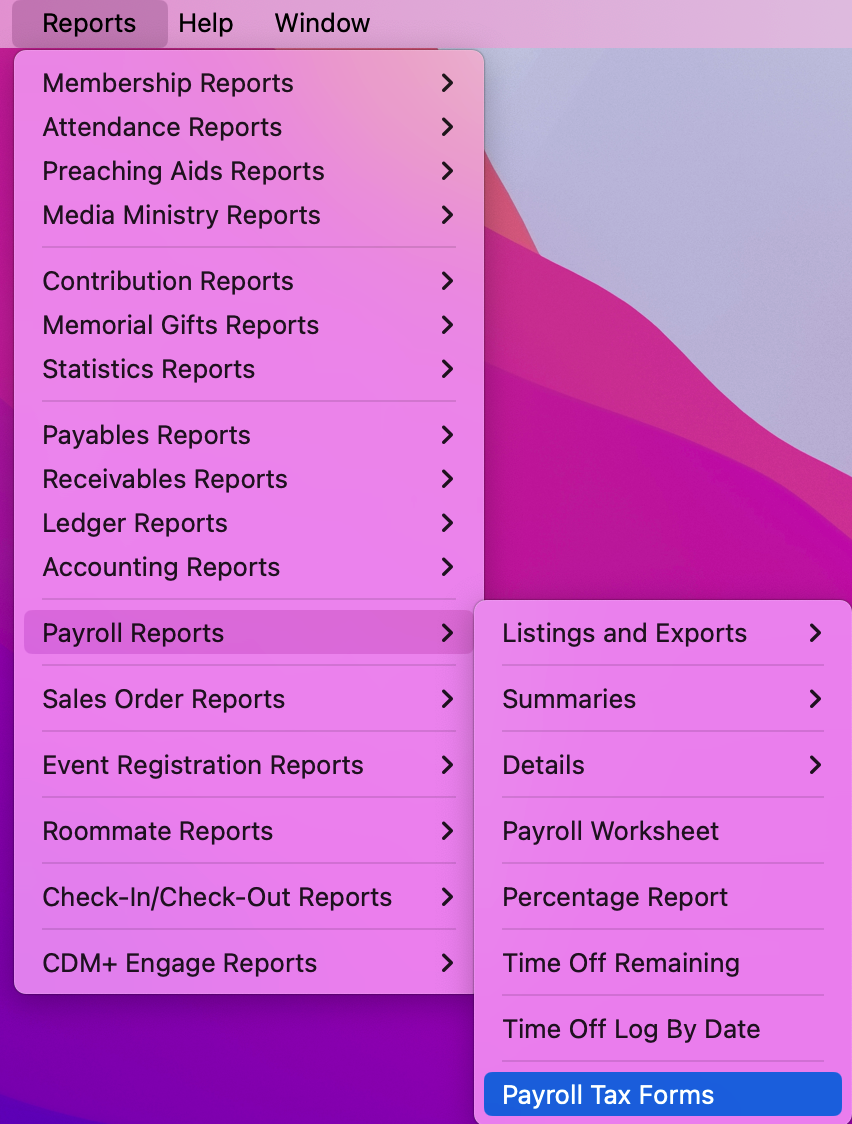

From the Reports menu, go to Payroll Reports, then to Tax Forms.

If you have chosen under Preferences-Toolbars to show the Payroll toolbar, you may click on the Reports icon and then select Tax Forms.

Note! You will need an active Internet connection to open this window.

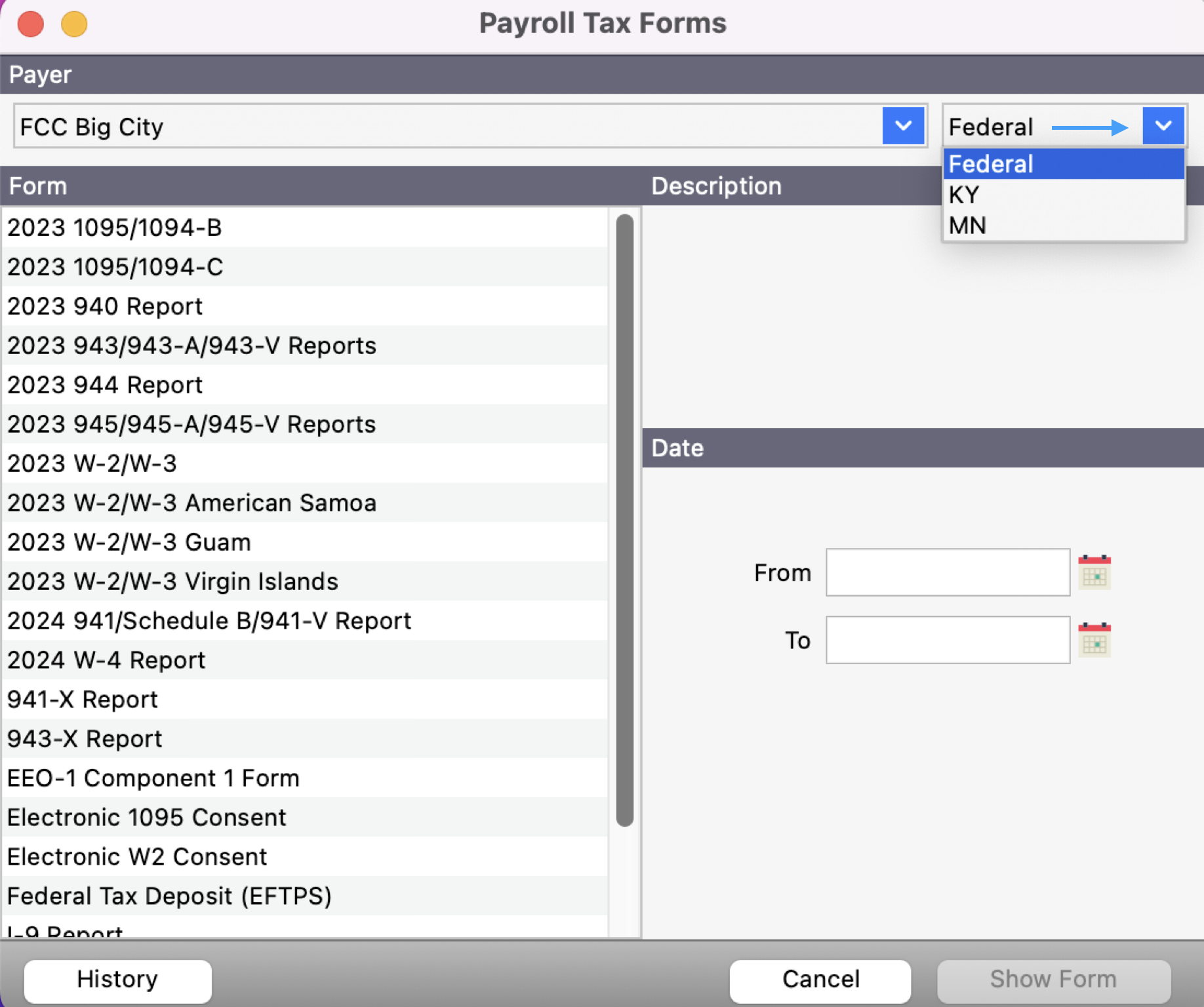

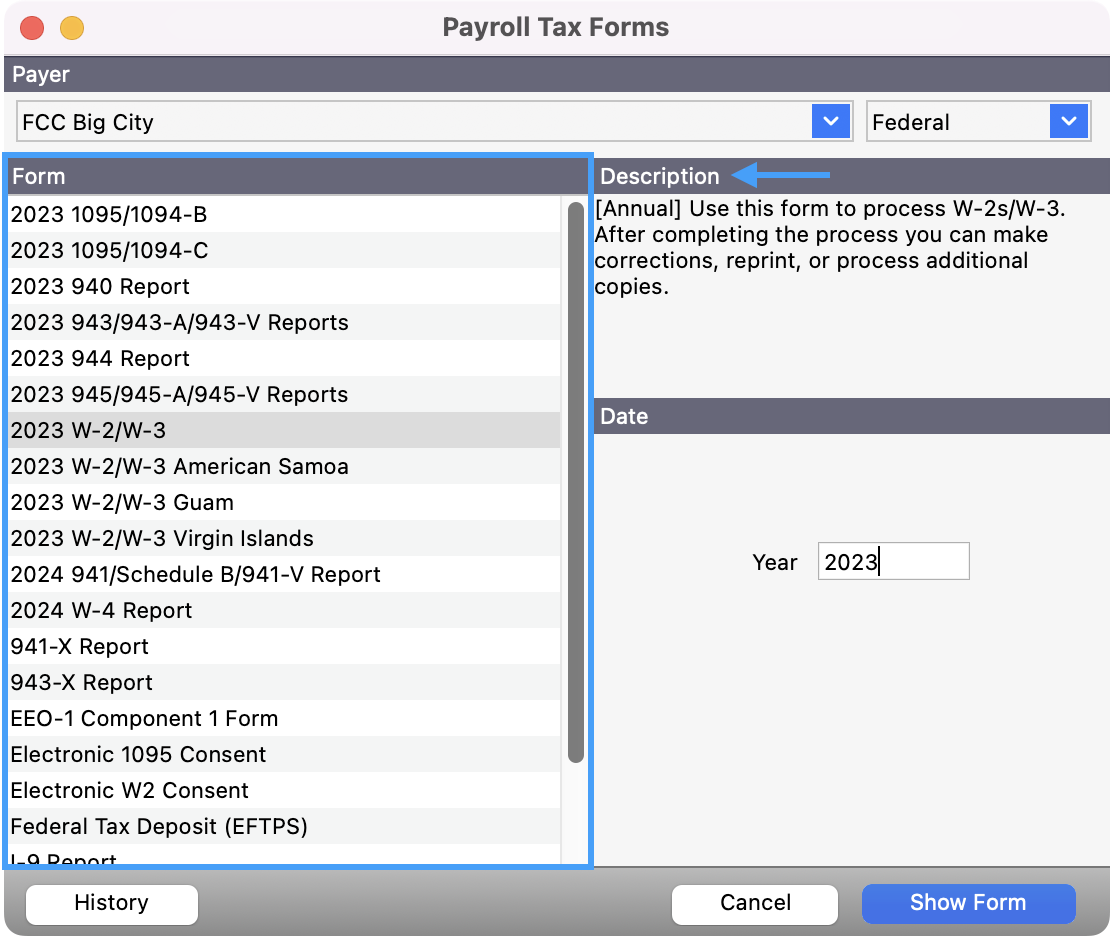

The Fed/State drop list on the right lets you toggle between federal and state forms.

The list on the left will change to display the current forms available to you based on your selection. Click to highlight a form to see the Form Description below. Note that all dates on tax forms are based on Paid Date. After choosing the appropriate form, enter in a Year, and click Show Form button.

Aatrix Form Viewer Installation and Setup

If this is the first time you've clicked the Show Form button on the Tax Forms window in CDM+ Payroll, you will be prompted to download and install the Aatrix Form Viewer application. Click Yes to this message and follow the prompts. If during installation you get a message that required fonts are missing, click Yes to install them. After you have installed the fonts, return to the Tax Forms window in CDM+ and click Show Form again.

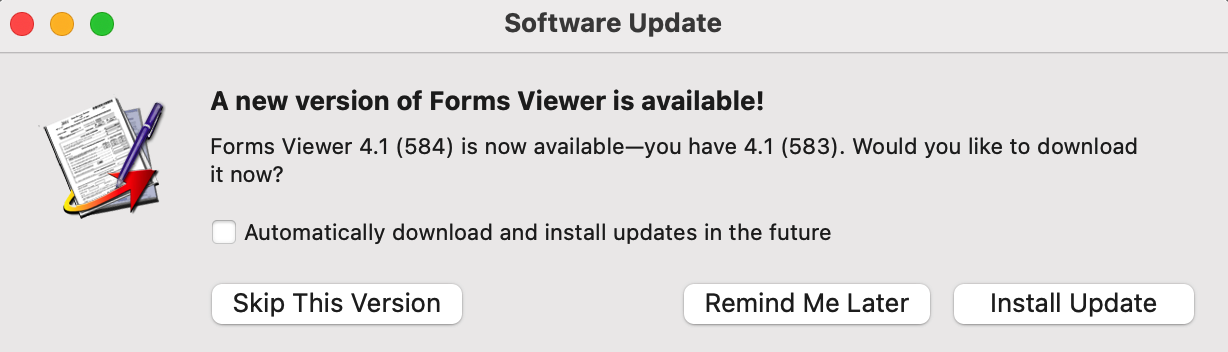

If you have downloaded Aatrix previously, you may see this message if you need to install an update. Click Install Update and follow the prompts.

At this point you are in the Aatrix Form Viewer application. Note! Extensive documentation on how to use the Aatrix Form Viewer program can be found on the Help menu while in that program.

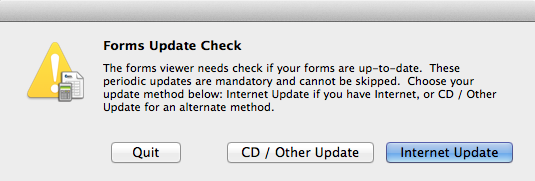

CDM+ will check to make sure you have the current tax forms available. The window below will appear the first time you access forms in a day. Click on Internet Update. If you do not have access to the Internet, you will not be able to generate tax forms.

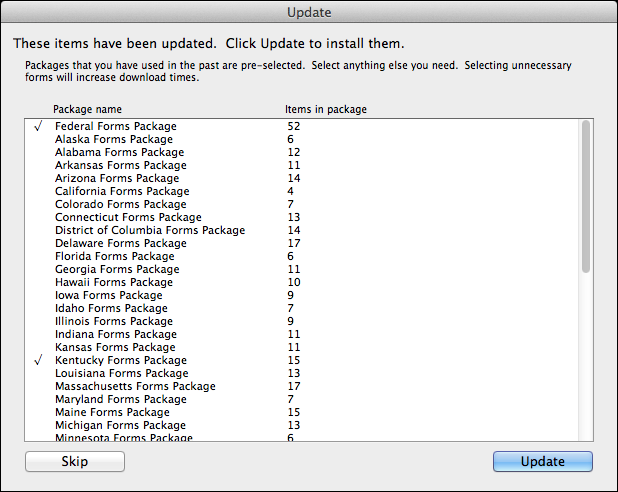

If you need to update tax forms, the following window will open. Make sure there is a checkmark next to only the line items that apply to you— Federal Forms Package and [Your State] Forms Package. Checking more items than you need will only cause the update to take longer. Click Update.

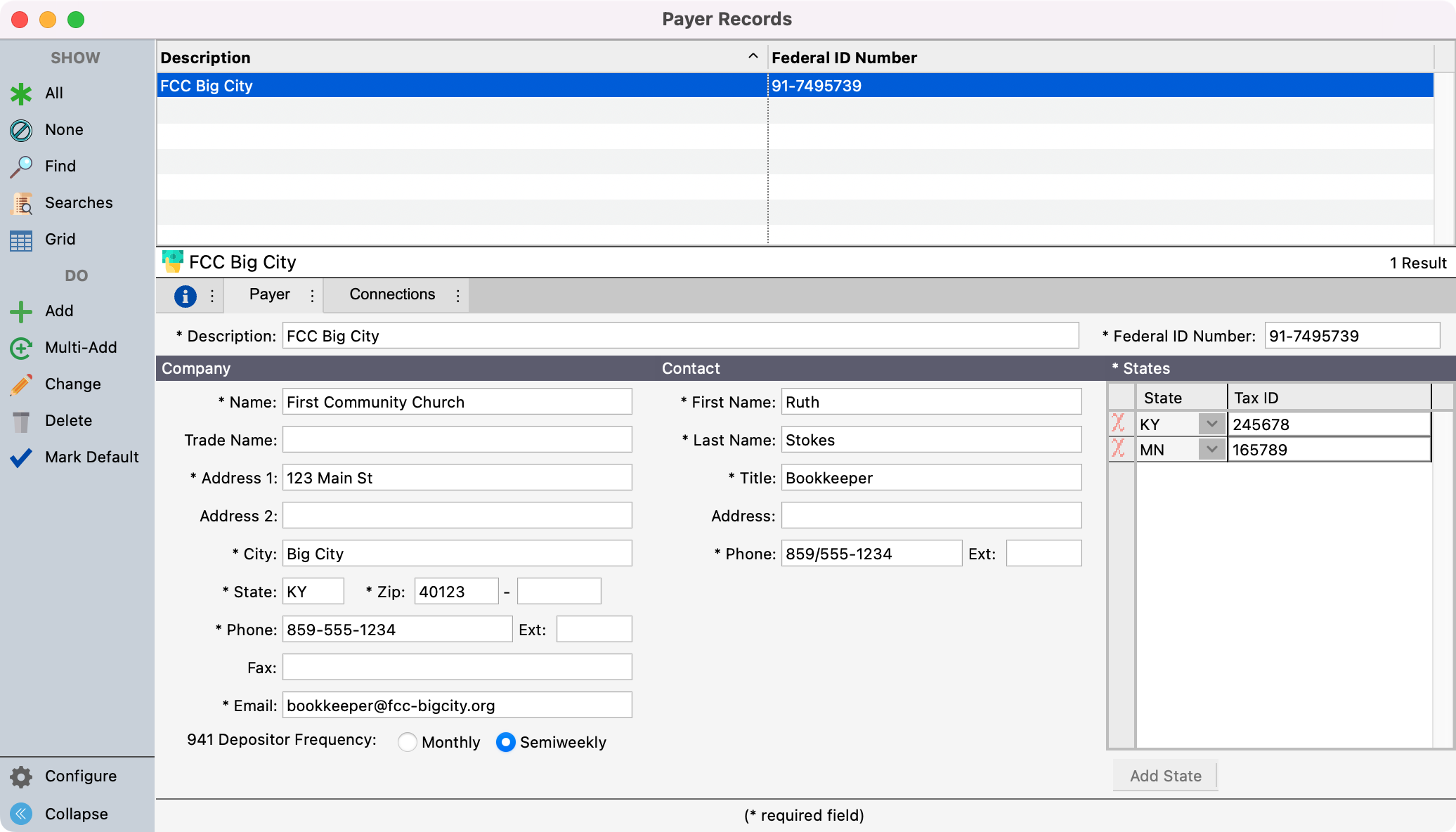

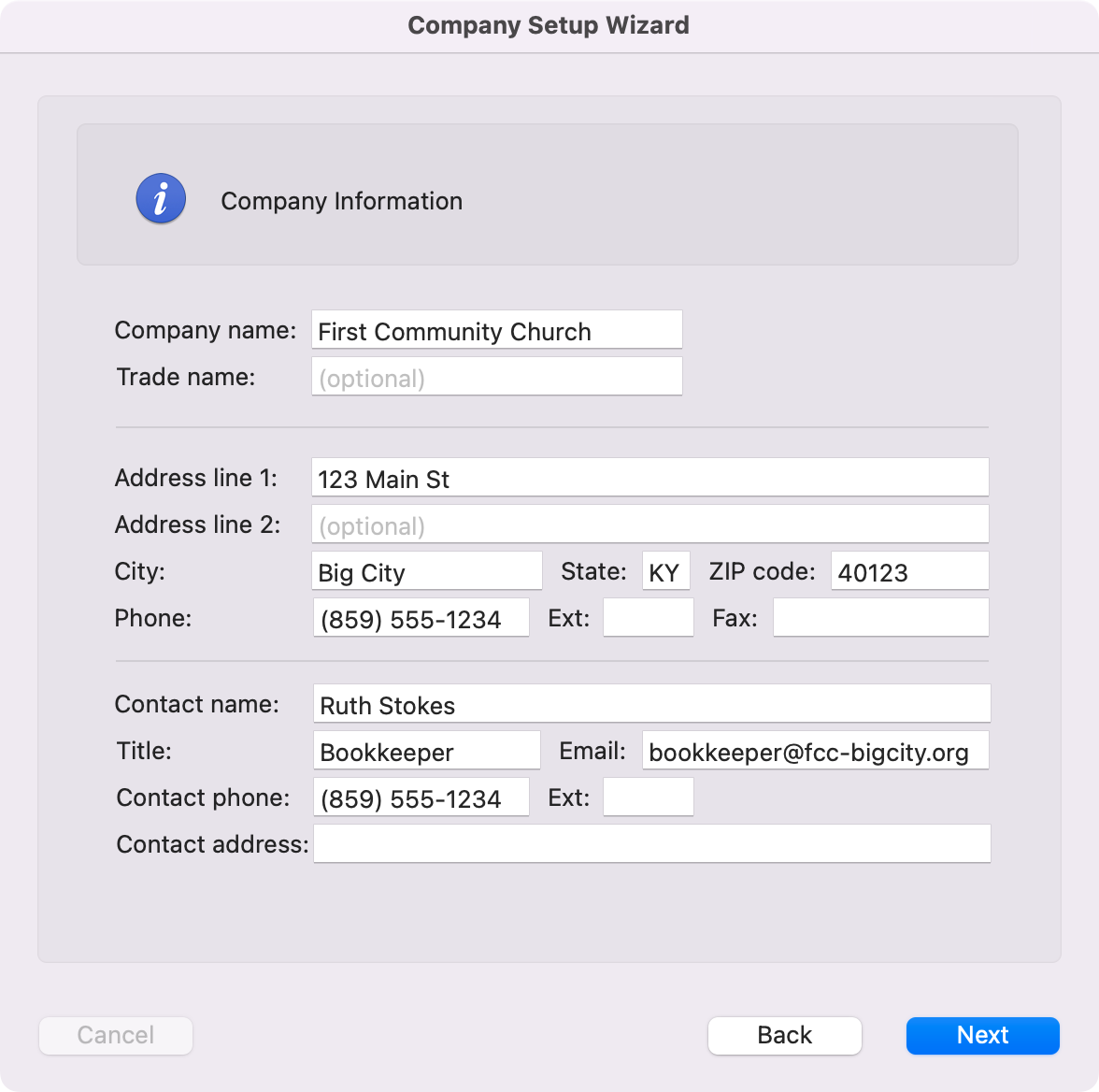

Information from the Payer Records window in CDM+ (shown below) has been transferred to Aatrix to complete the necessary tax forms, as reflected in the Company Setup Wizard.

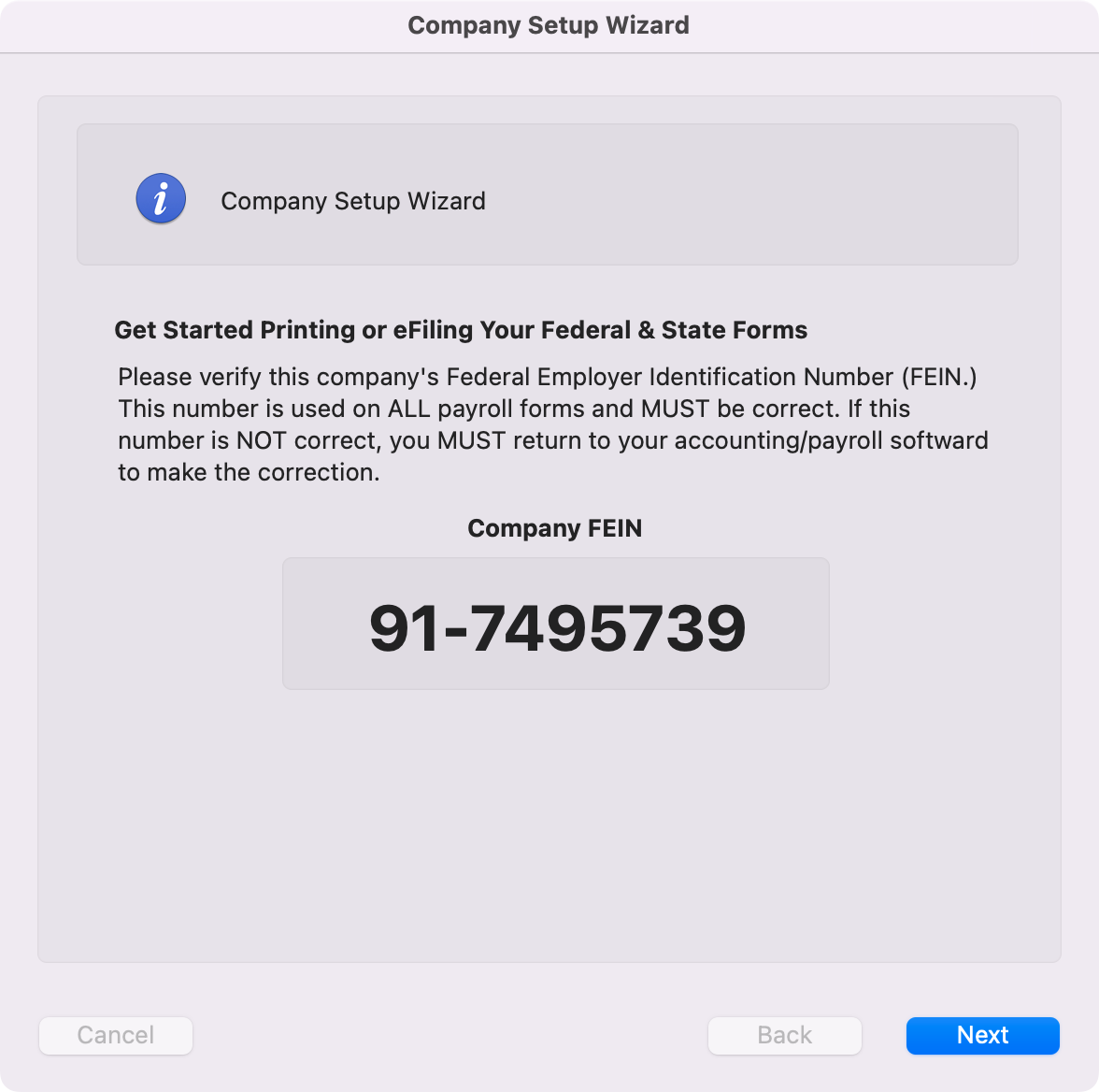

You will first be asked to confirm your Federal Employee Identification Number (FEIN).

Click Next and the Company Information window will open.

You can make changes to your company information. However, note that any changes to company information made here will not be updated in CDM+. We recommend that if there are changes to your company information or tax forms that you click Cancel. Then open the Payer Record window in CDM+ and correct or update that information on the Tax Forms Payer Info tab before re-running the form. This will save you work in the future.

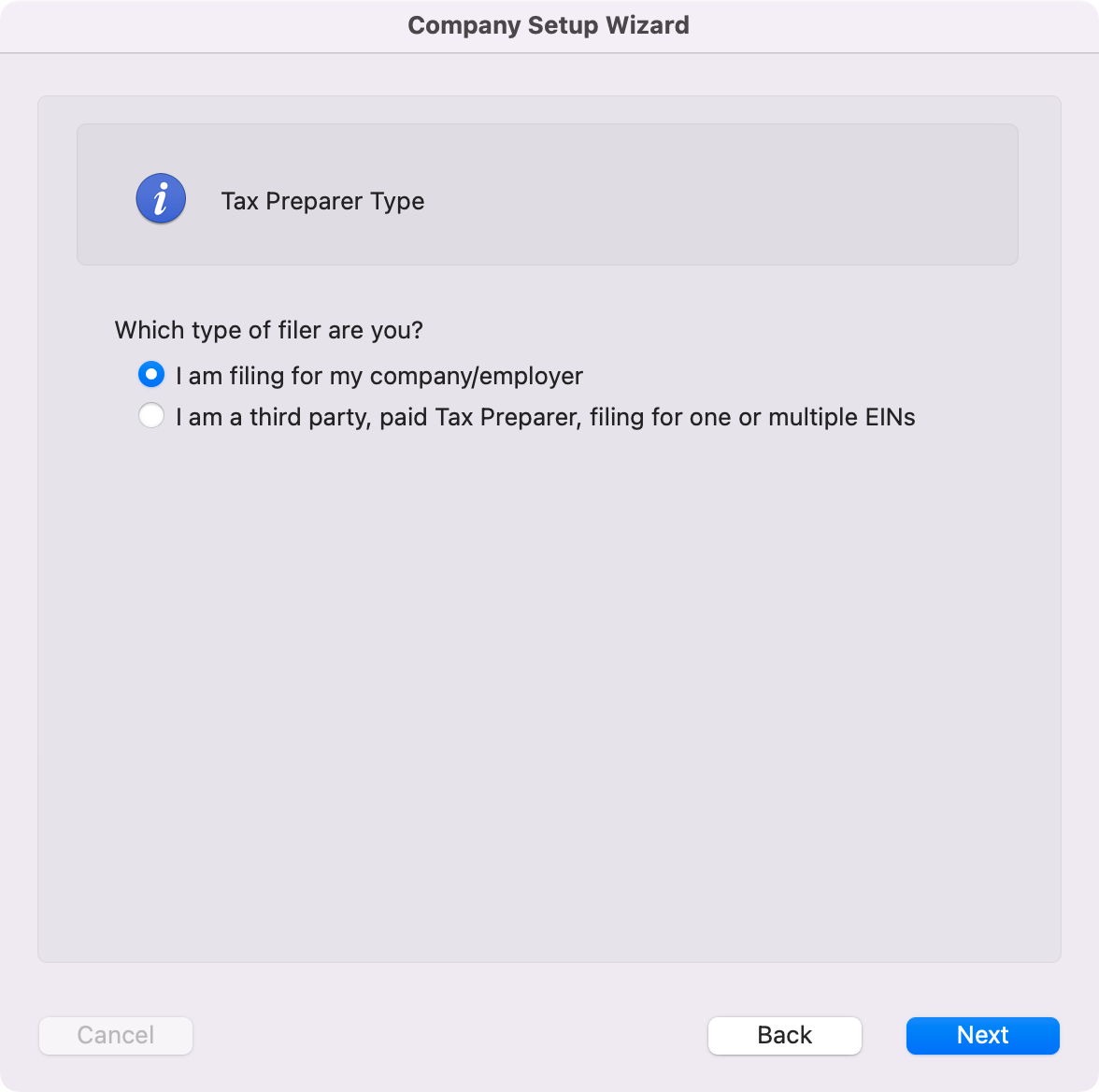

Click Next. Indicate your Tax Preparer Type on the window that opens and click Next.

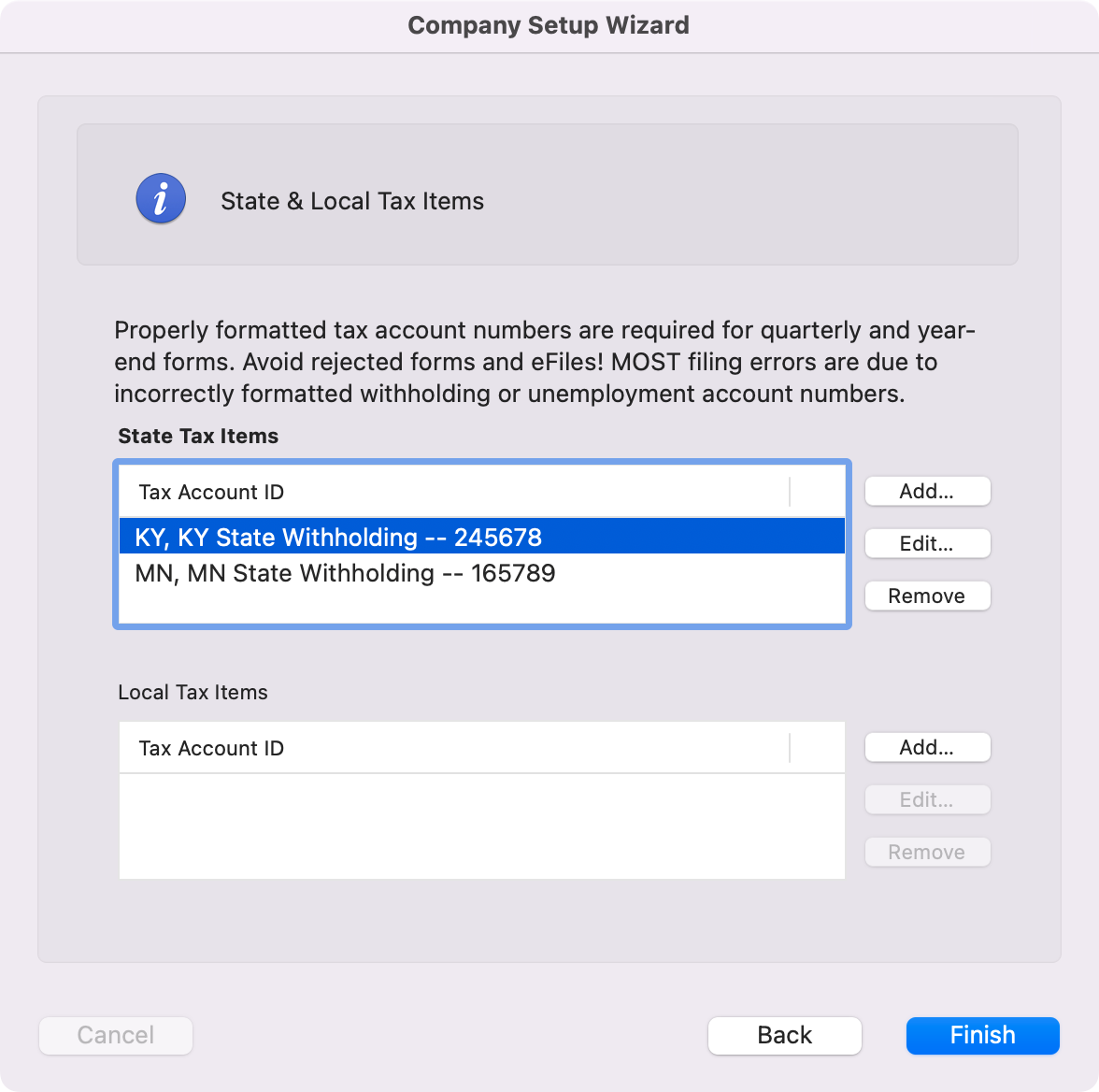

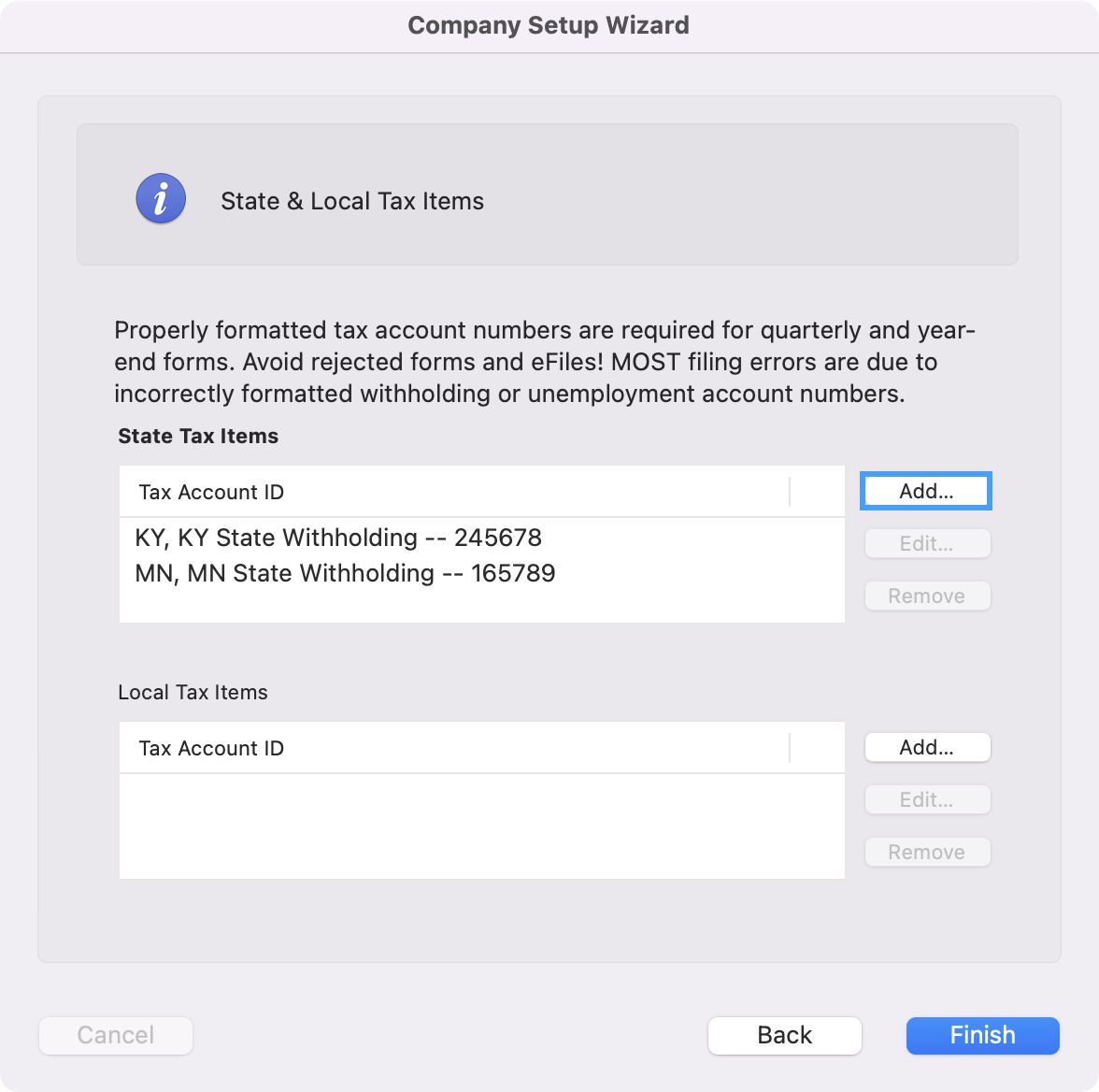

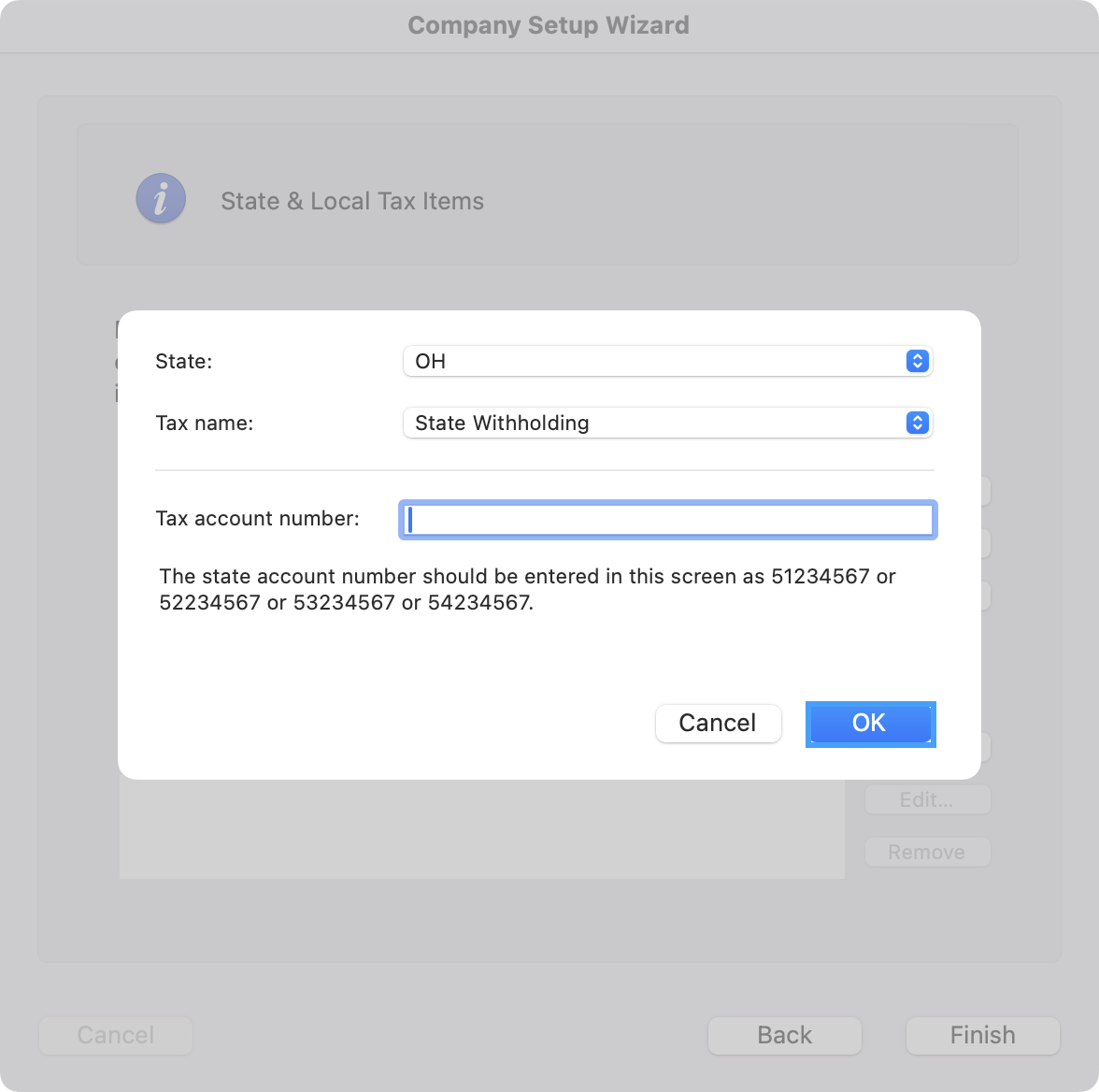

If they do not already appear, click Add to provide your tax account numbers for state and local tax items.

Note that after choosing your state from the drop list, the proper format for that state's accounts numbers is displayed. After entering your state’s number click OK.

After you have finished adding state and local tax items, click Finish. The form you selected on the Tax Forms window will open, ready for you to review and complete.