Form 941

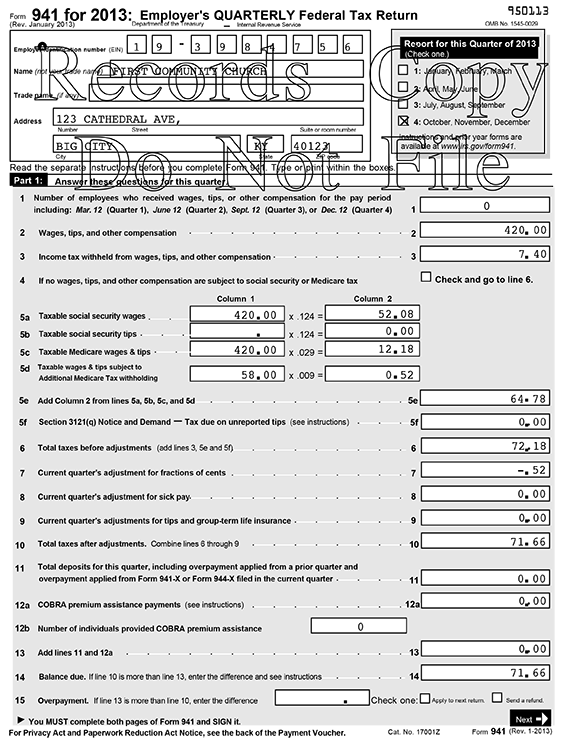

CDM+ produces IRS Form 941 based on the information in CDM+ Payroll, which is fed to the Aatrix Form Viewer application for proper placement on the tax form. Tax forms may be printed or e-filed (charges may apply for e-filing). A live Internet connection is required. Extensive documentation on how to use the Aatrix Form Viewer program can be found on the Help menu while in the program.

For troubleshooting issues with Aatrix, CDM+ allows you to shift-click the Show Form button to generate Aatrix data files and reveal them in the Finder or Windows Explorer instead of opening Aatrix. For platforms that encrypt these files, CDM+ adds a prompt to use the encrypted, or AEF format or use the un-encrypted, or AUF format.

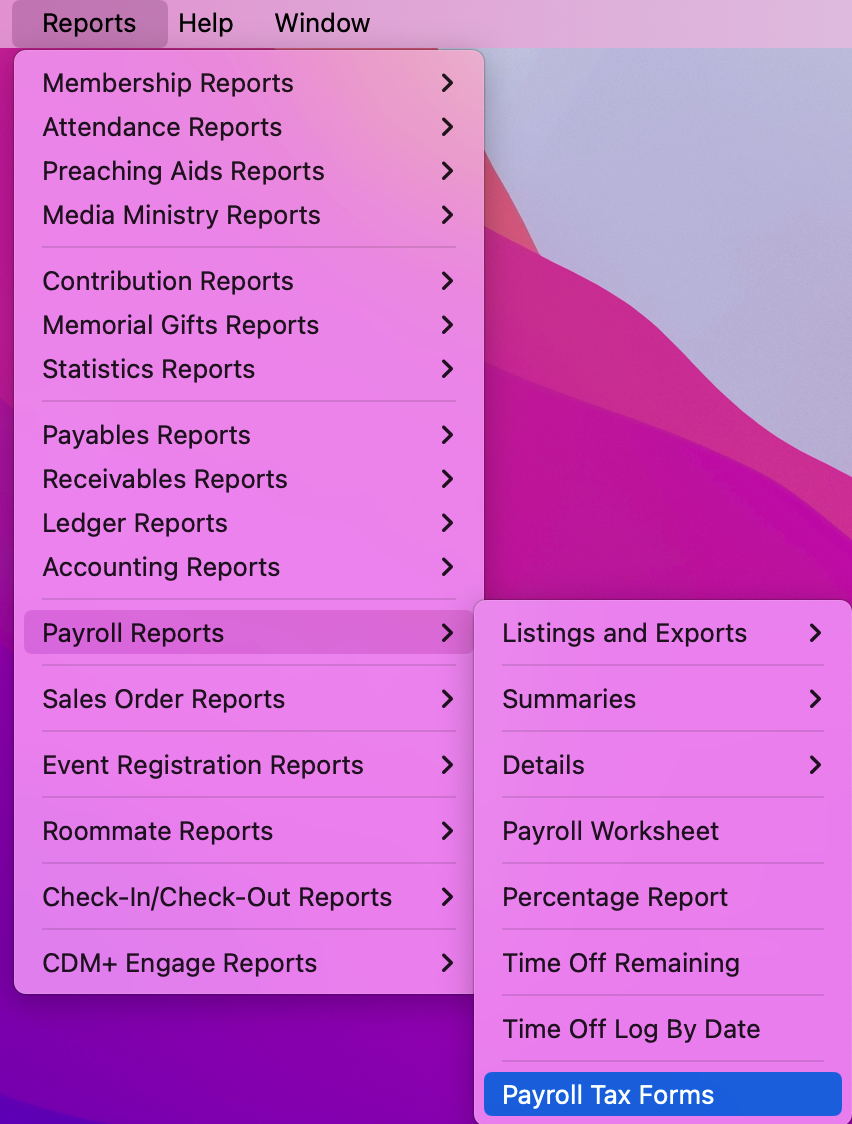

From the Reports menu, go to Payroll Reports → Tax Forms.

If you have chosen under Preferences-Toolbars to show the Payroll toolbar, you may click on the Reports icon and then select Tax Forms.

Note! You will need an active Internet connection to open this window.

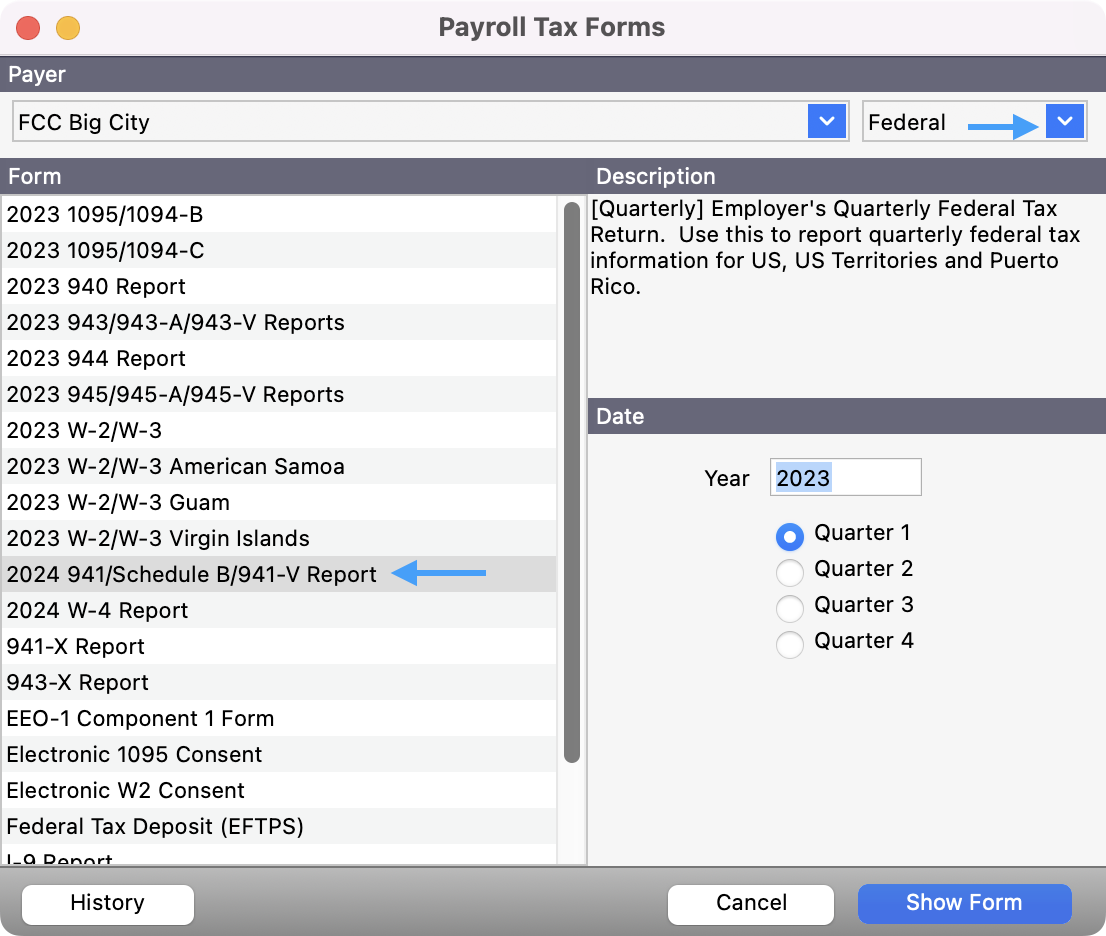

Select Federal from the Fed/State drop list at the right and click on 941/Schedule B/941-V Report to highlight it in the list on the left. Enter your Year, select your Quarter, and then click Show Form.

Please note that the IRS Form 941 is listed as 941/Schedule B/941-V Report. The 941-X Report is used when filing an amended 941 form.

The Aatrix Form Viewer application will open. If this is the first time you have printed any tax form in CDM+ , you will be prompted to setup your company information. Click here for information on that process.

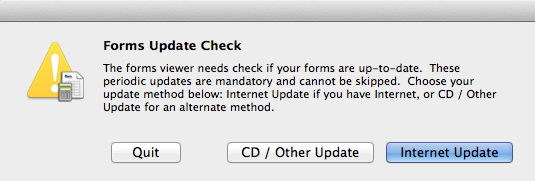

If this is the first time in the day you have launched the Aatrix Form Viewer application, it will check for tax updates. It will only do this once per day.

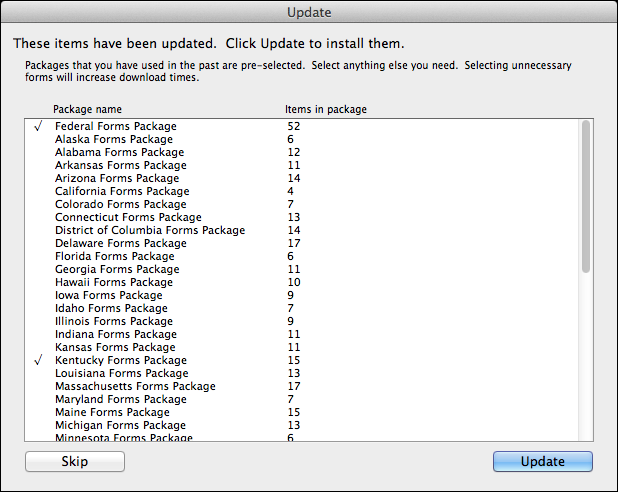

Click the Internet Update button. If there are updates available the following window will open. Click the Update button.

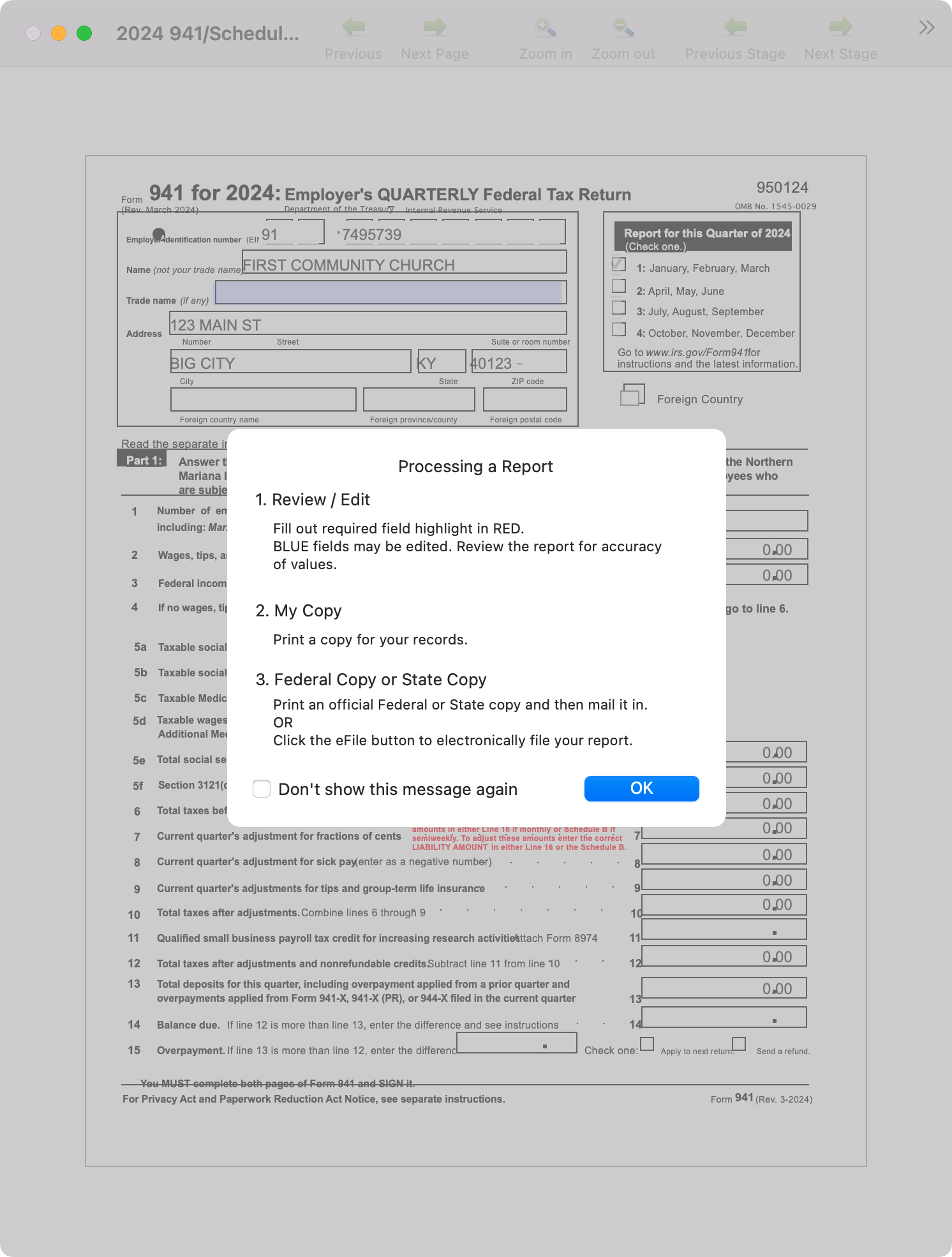

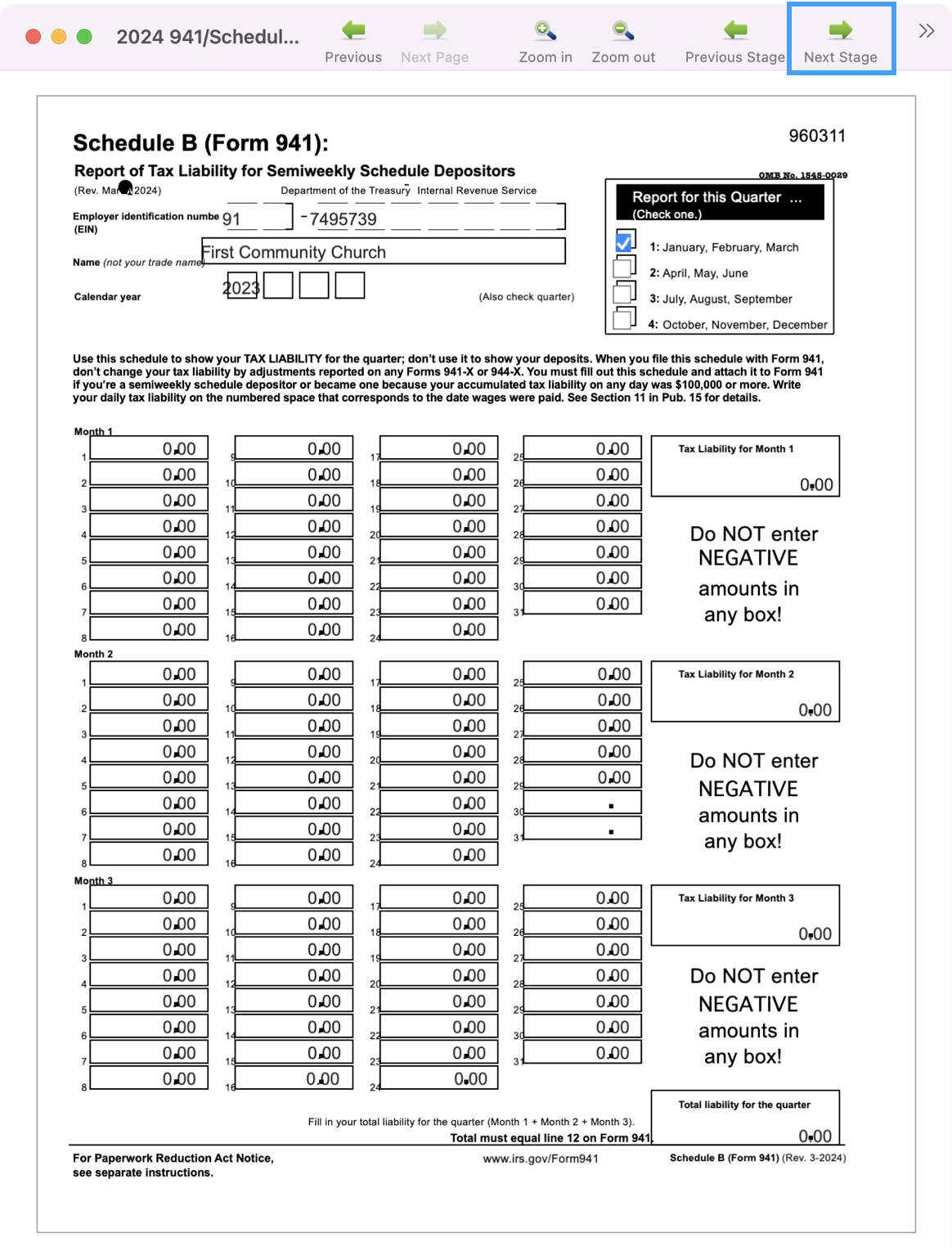

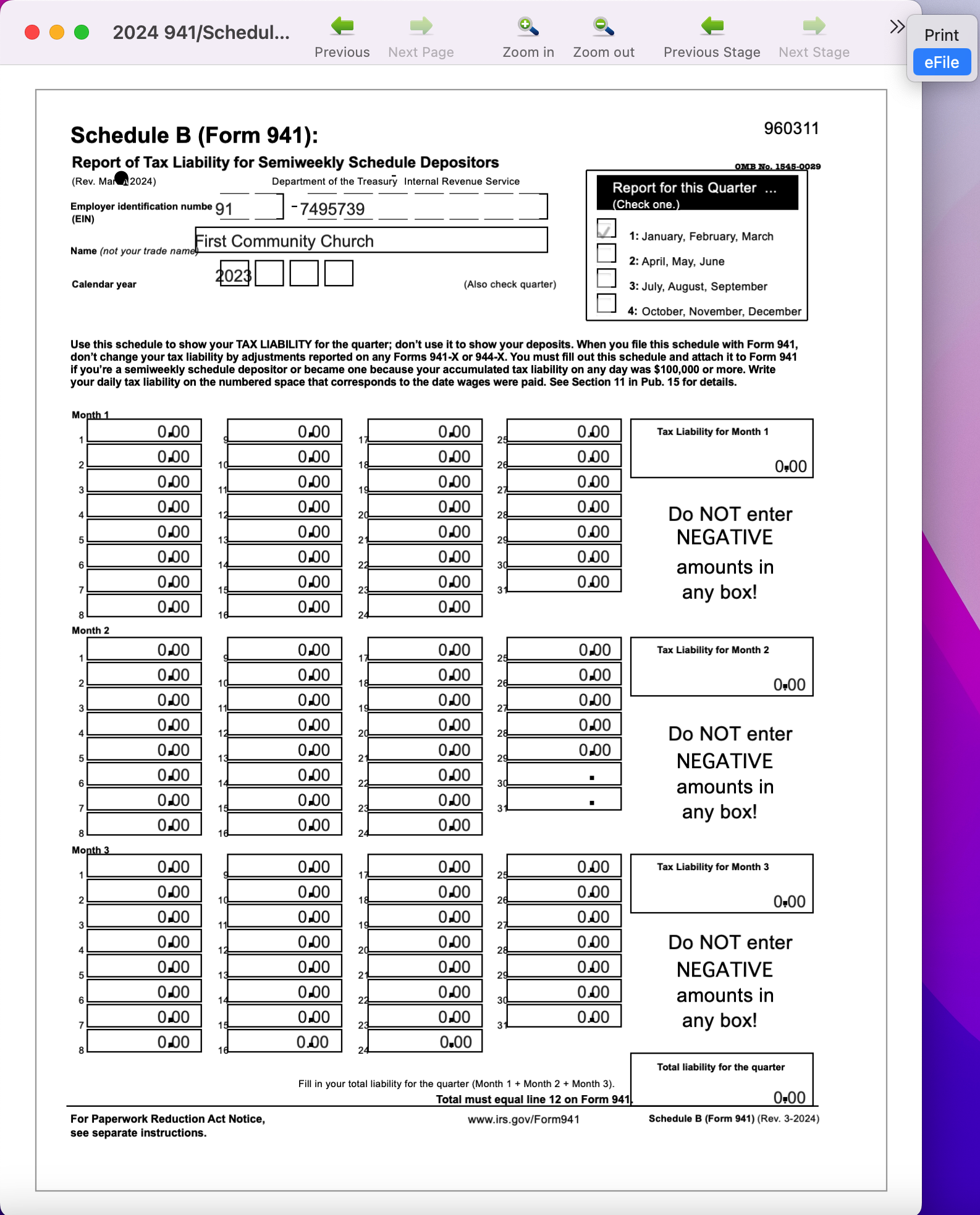

The 941 window will open, along with a pop-up window that outlines the steps for Processing a Report in the Aatrix Form Viewer. Click OK to close the window.

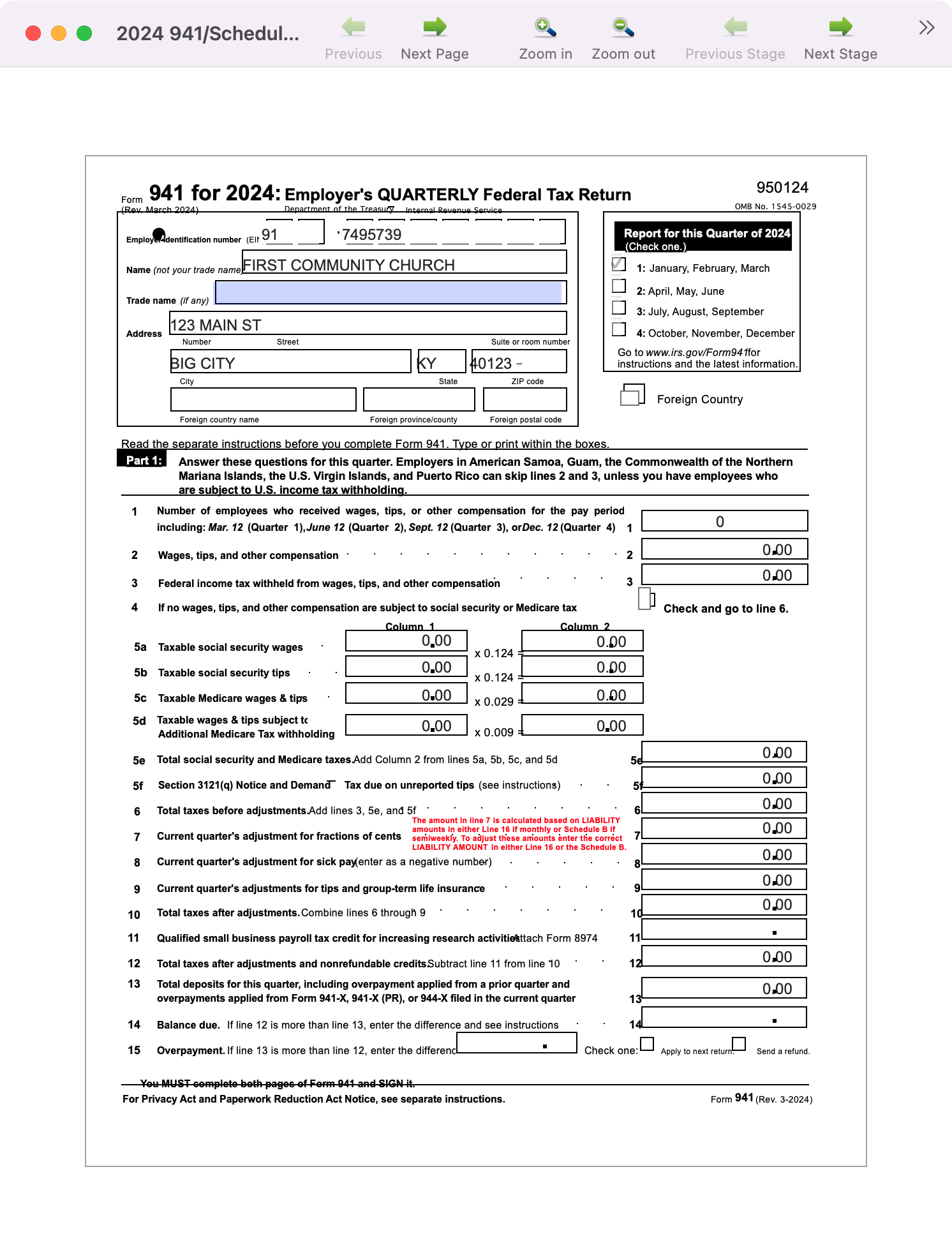

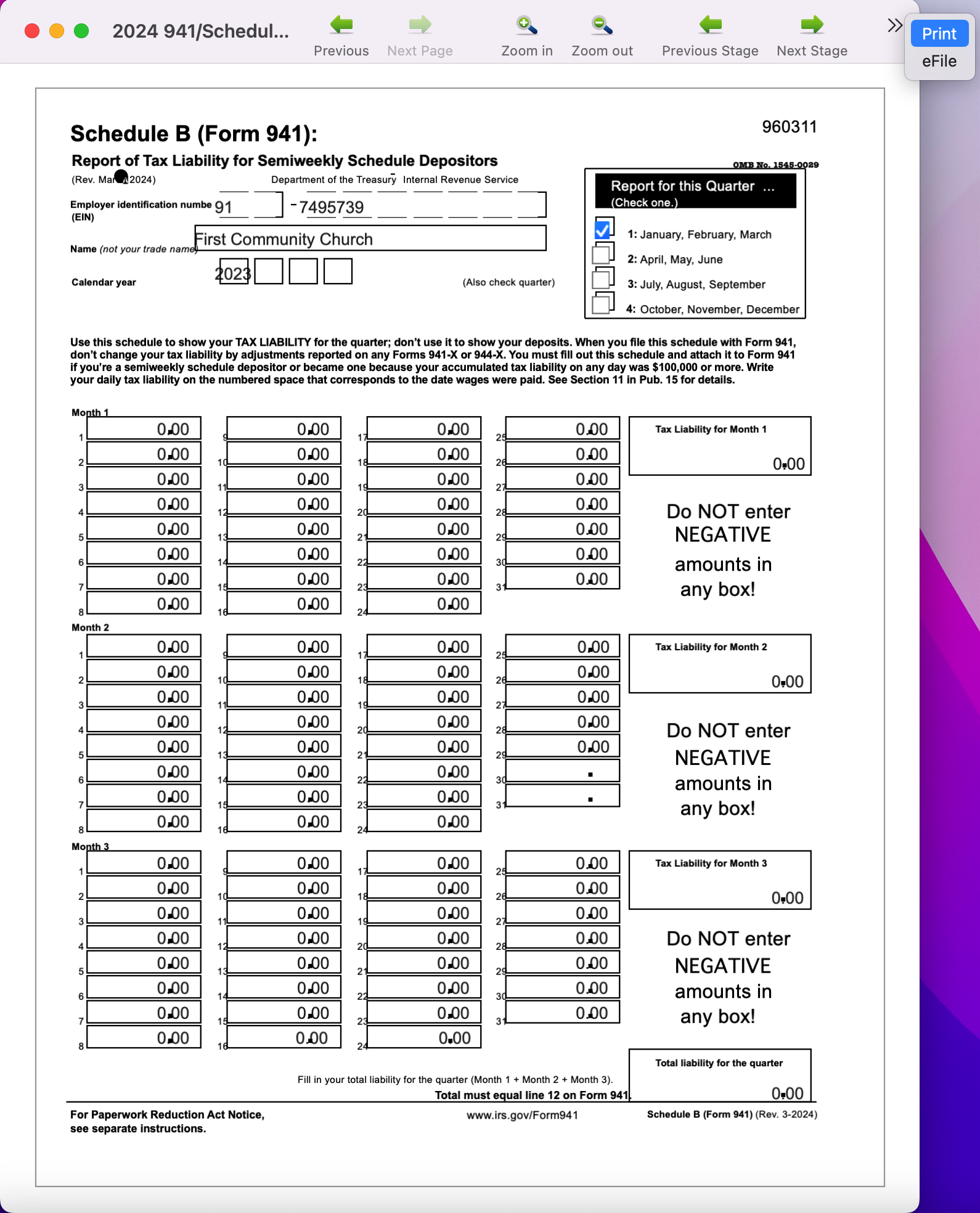

941 Form

The fields on the 941 Form window will be pre-populated with information from CDM+ Payroll. Complete any fields marked in red before you click the blue arrow at the top of the window to move the next page of the form. Complete all 3 pages of the Form 941.

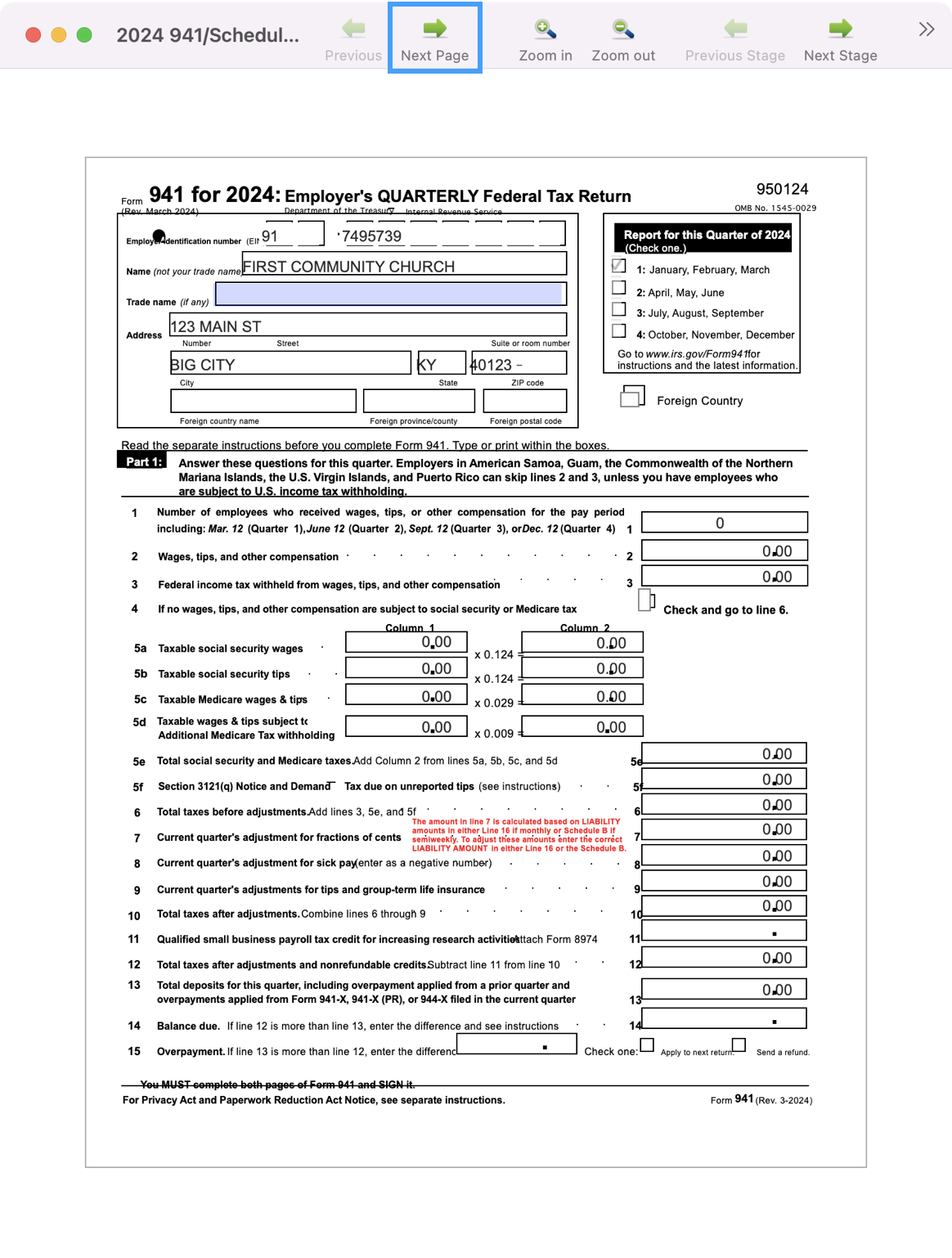

Click the green Next Page arrow at the top of the window. If you missed any red fields, you will be prompted to return to them and complete them. In that case, you will need to click Next Page again.

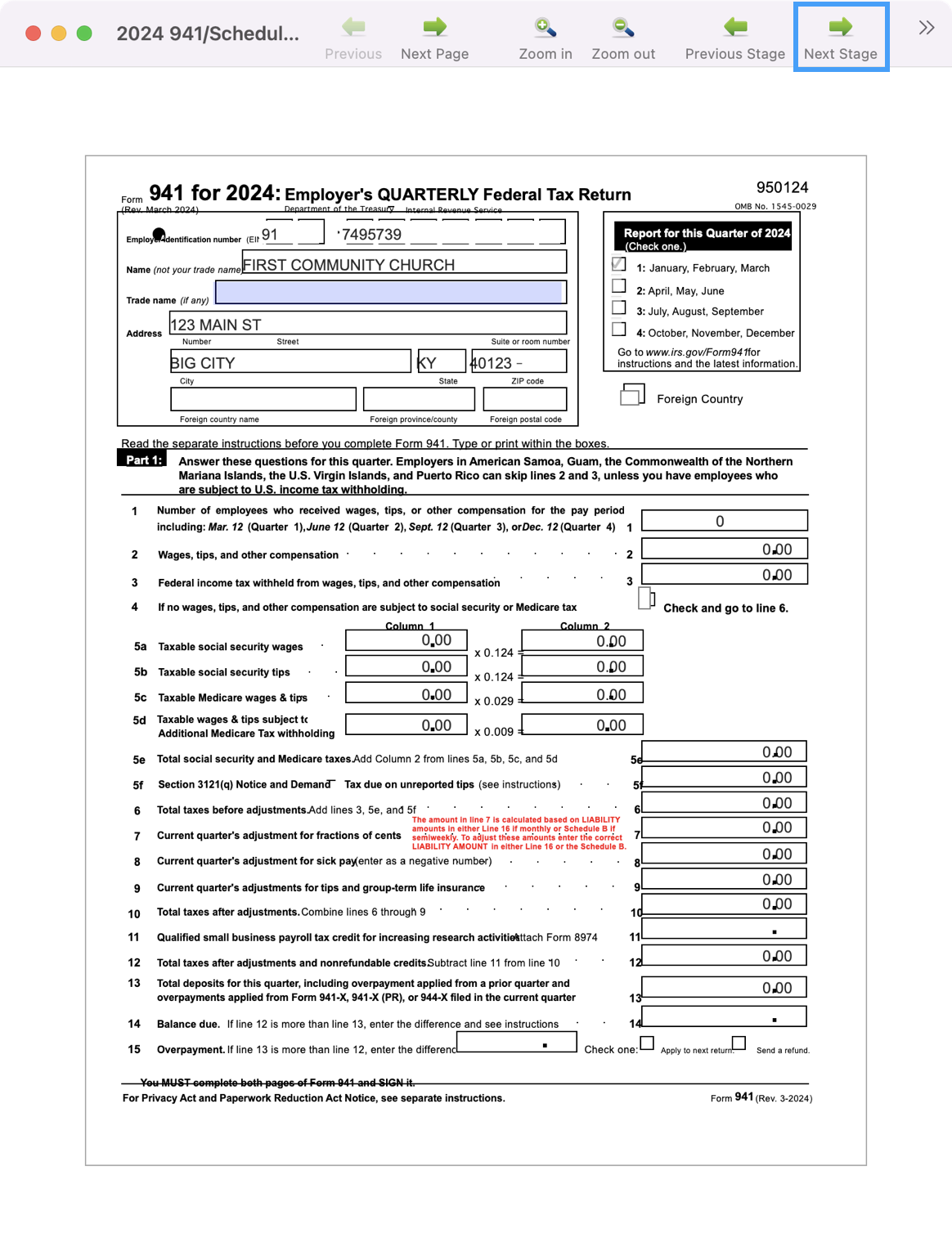

Once you have completed each page, go back to Page 1 and click Next Stage.

You need to be on the first page in order to go to the next stage. If you’re on a different page you’ll see this Form Navigation Error message. Click Yes and you’ll go to the correct page.

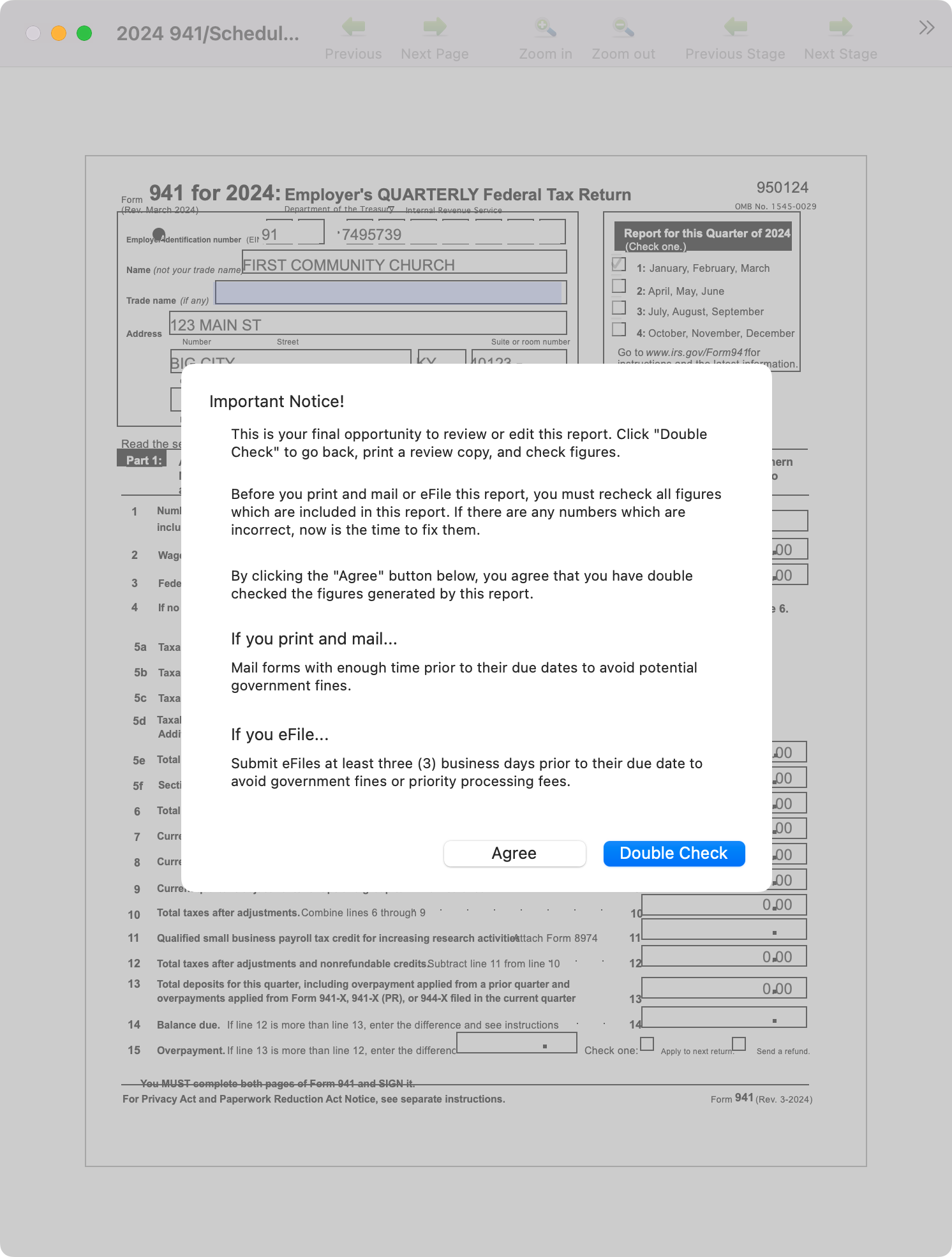

A pop-up window will open. Please read it, then choose Double-Check to review your form for accuracy. Click Agree to confirm the content is correct.

Click the double gray arrow a the top right of the window and you will see an option to Print your copy of the 941.

Click the green Next Stage arrow.

Click the double gray arrow a the top right of the window and you will see an option to Print the Federal copy of the form. You also have the option to e-file your 941s through Aatrix. Enrollment is necessary and a fee will be charged for the service.

8. Quit or exit the Aatrix Form Viewer application when you are finished.