How to issue a Bonus Check

There may be a time, especially around year-end, when you may want to provide a bonus check to your employee. There are a few ways to do this. The steps below outline the most common way this is accomplished.

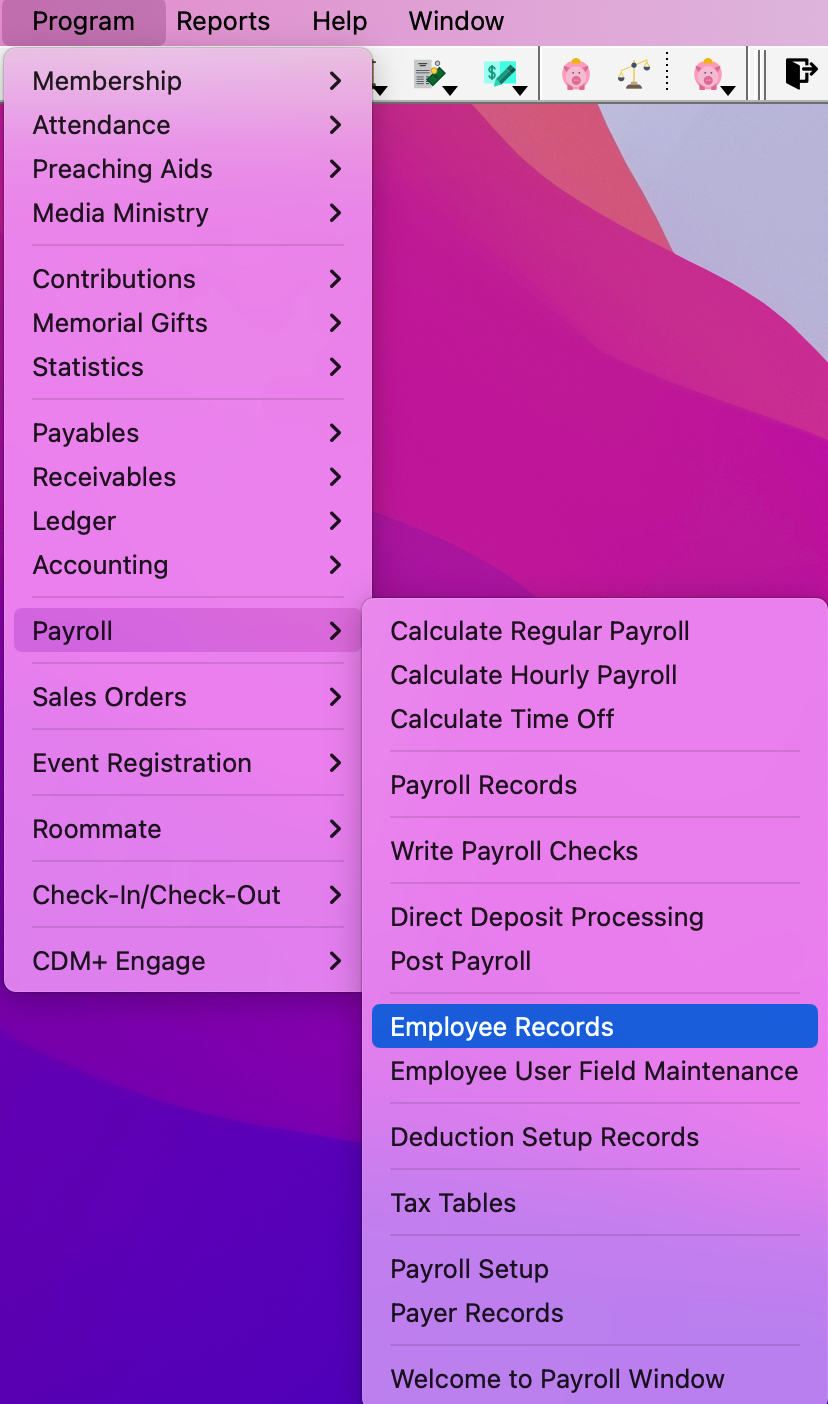

Go to Program → Payroll → Employee Records.

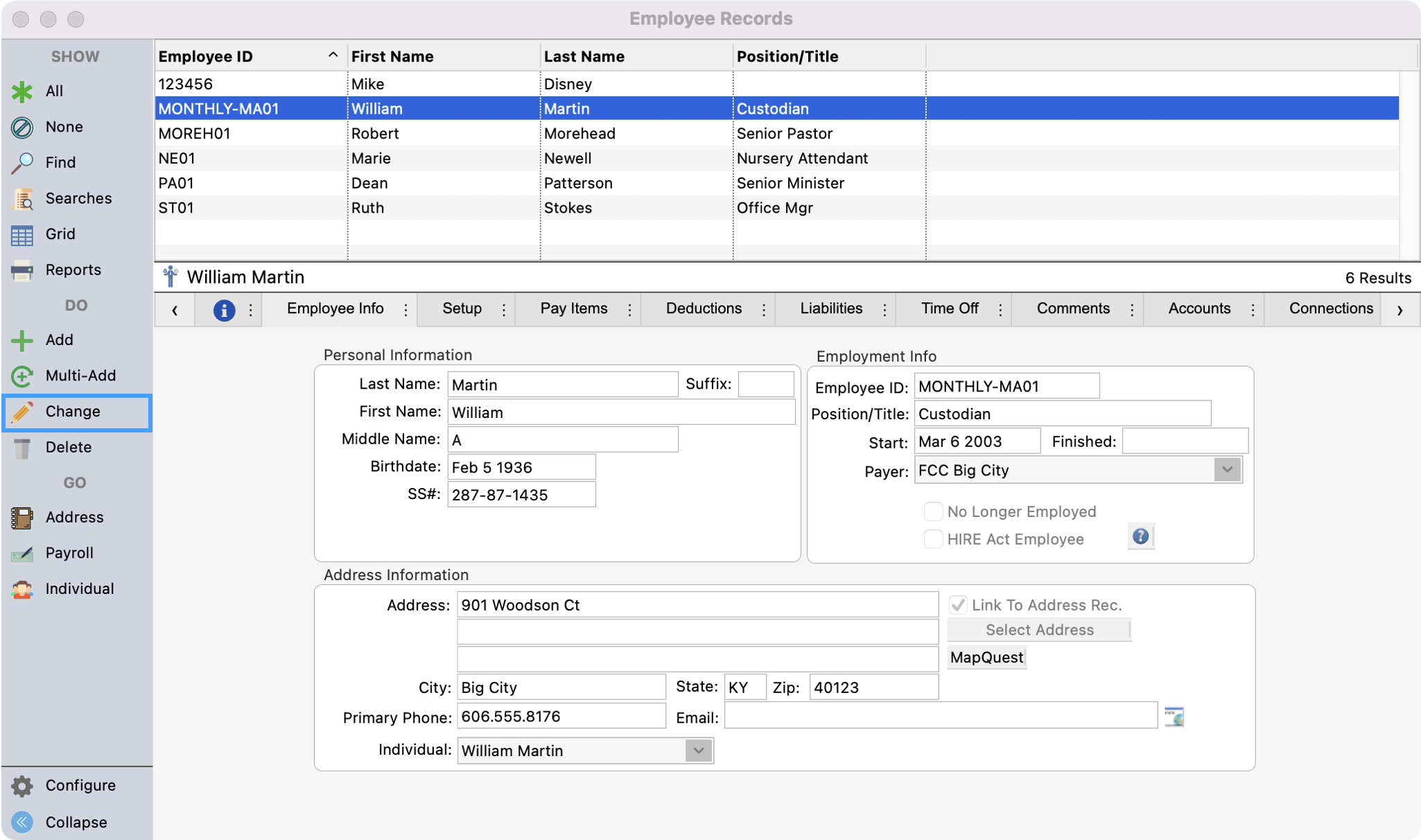

Setup a find to search for an employee. Click to highlight their name and click Change from the left sidebar.

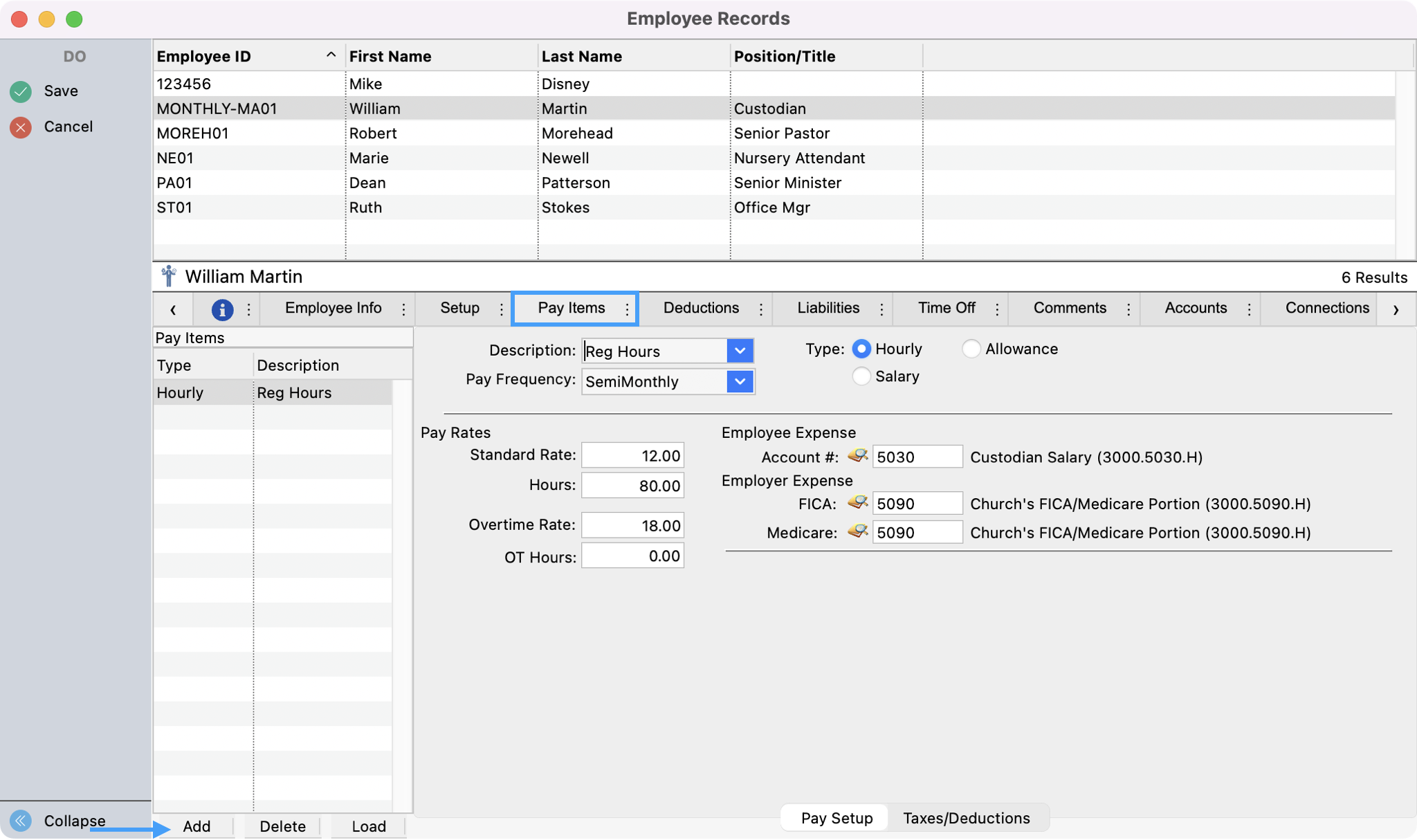

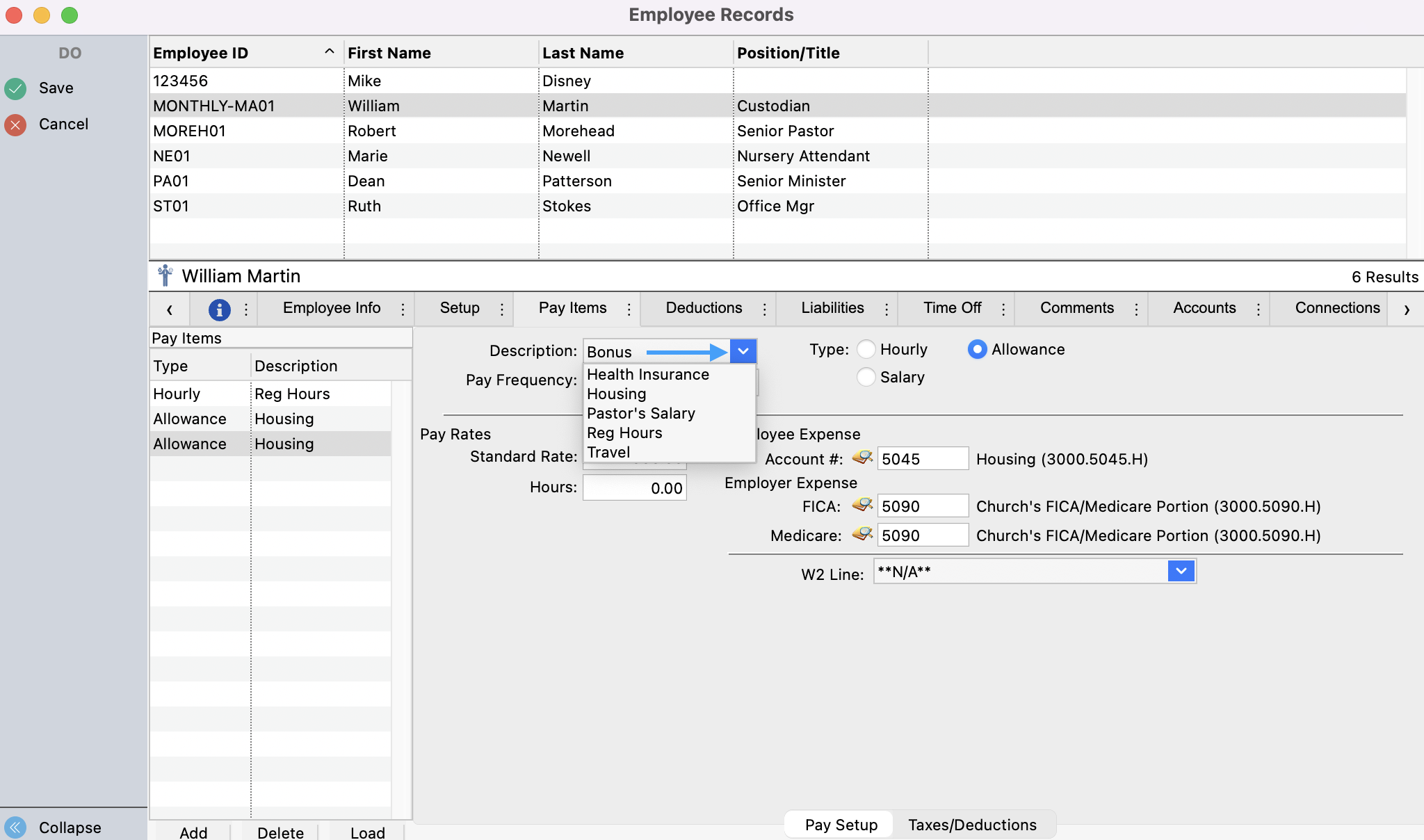

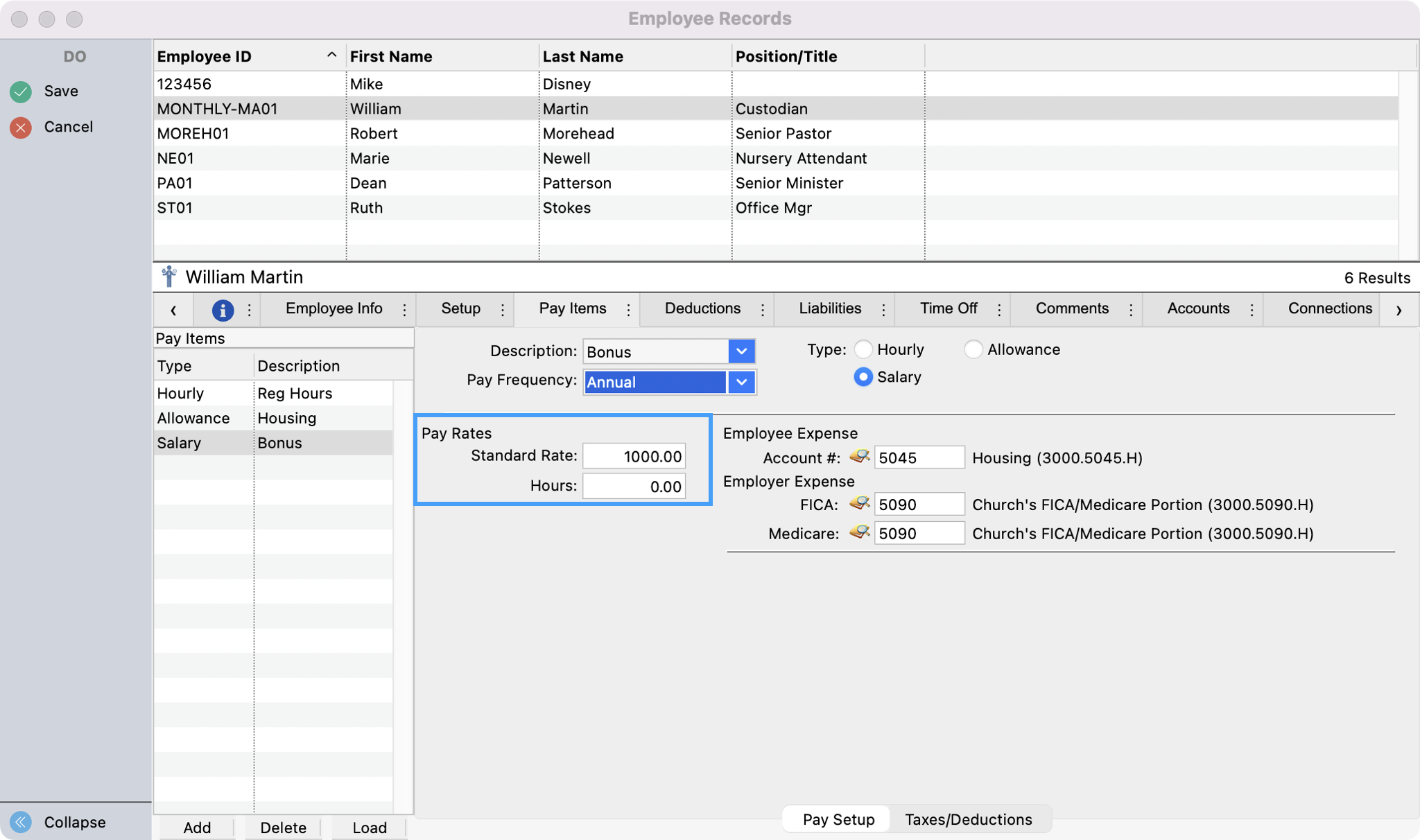

Click the Pay Items tab and then click Add in the bottom left corner.

In the Description field select Bonus from the drop-down list. If it is not there, start typing Bonus and tab to the next field.

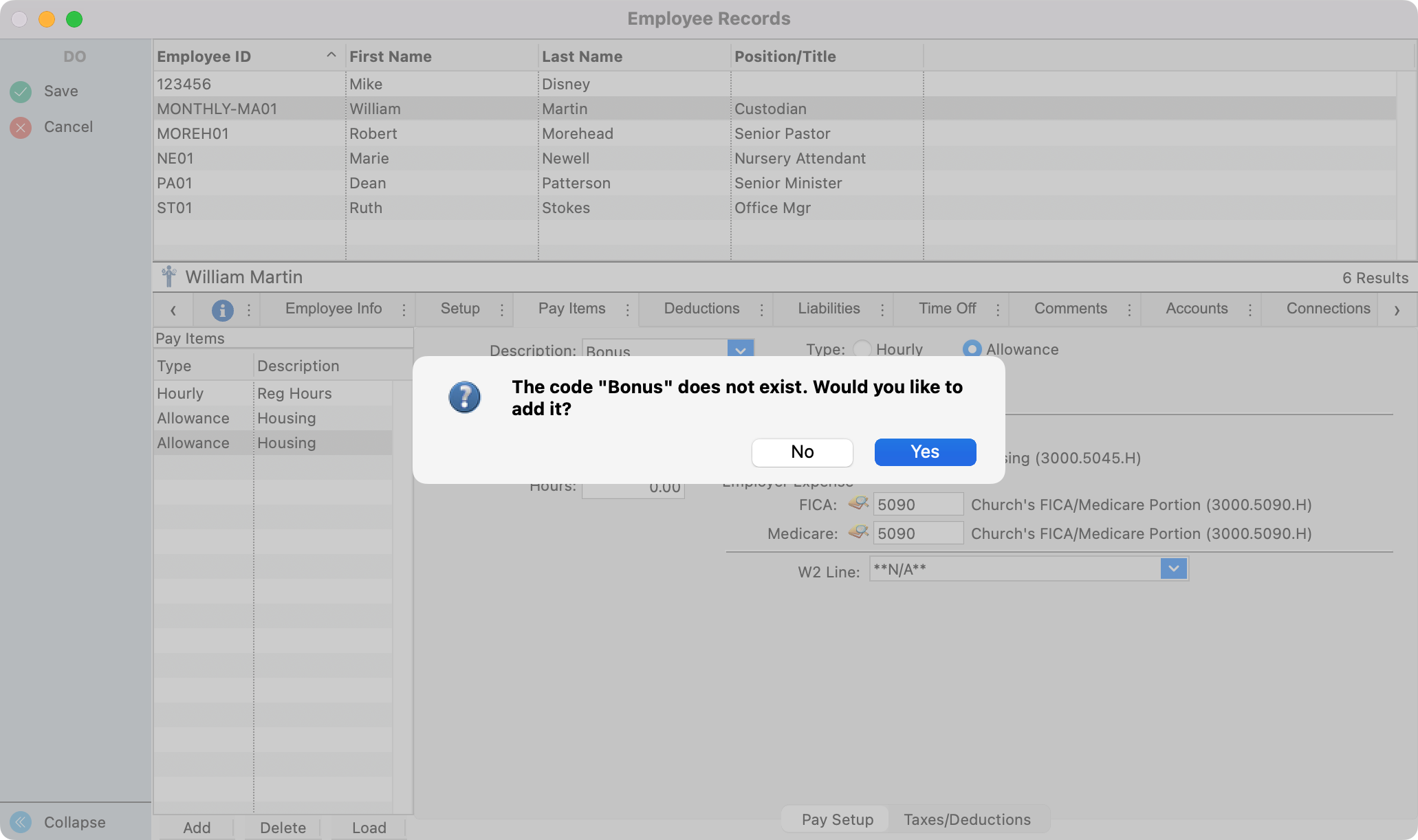

If you typed in Bonus you will see a pop-up saying, The code “Bonus” does not exist. Would you like to add it?. Click Yes.

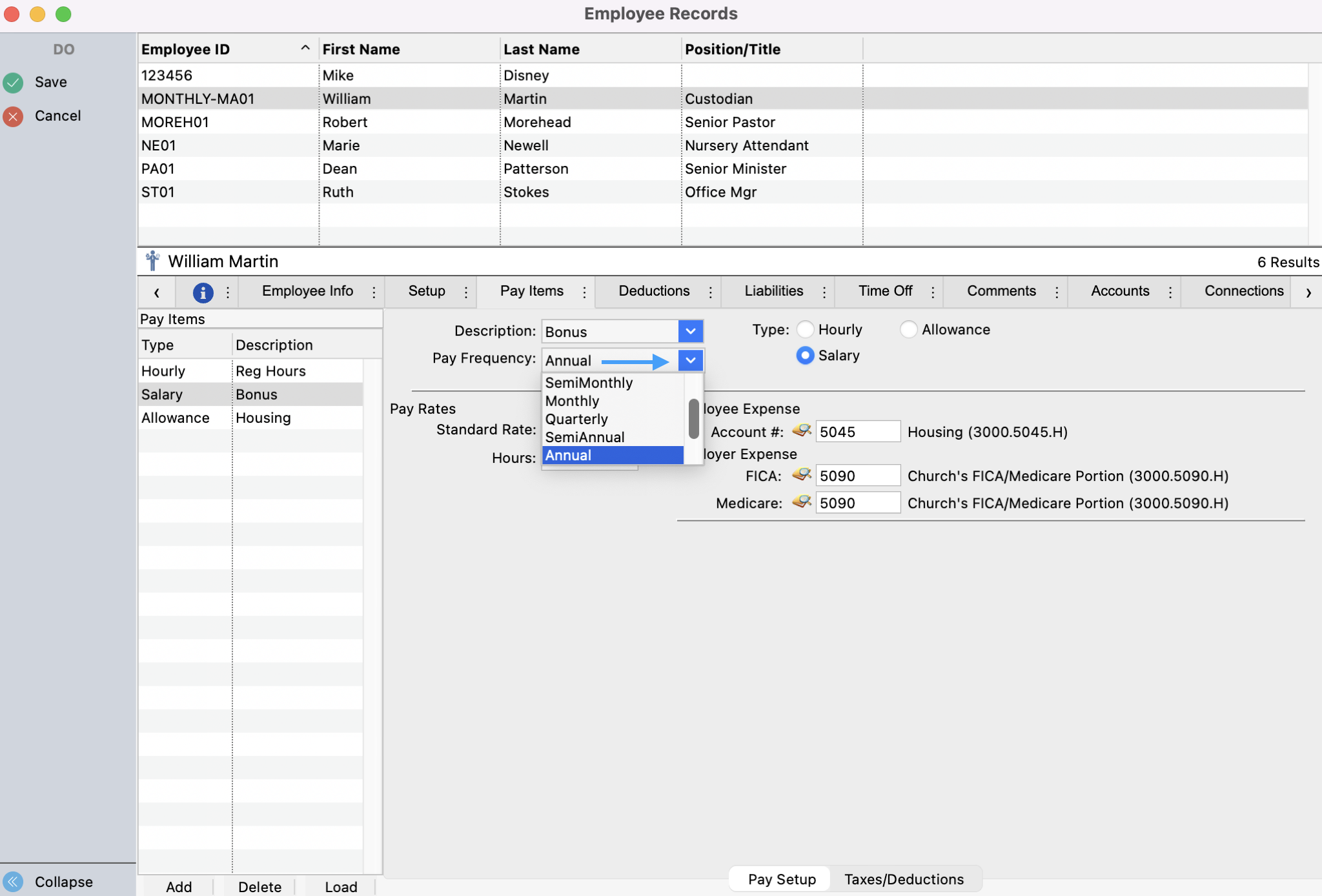

Next, set the Pay Frequency. The pay frequency is determined by how often the employee will receive this bonus througout the year. For example, if they receive this bonus once a year, it would be an annual frequency.

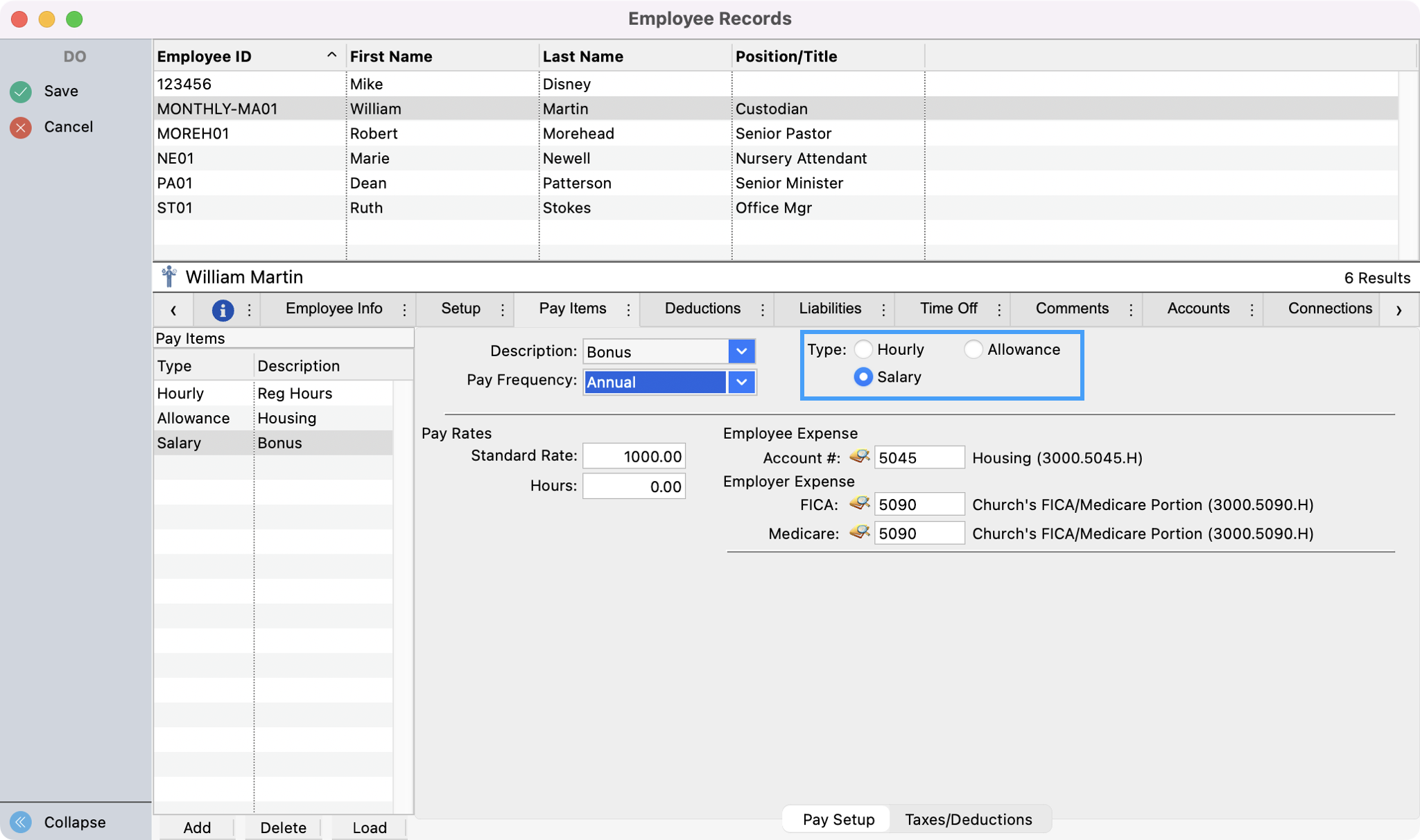

Set the pay Type according to whether the person is a salaried or hourly employee.

Set the Standard Rate to what you want to pay as a bonus for salaried employees and the hourly rate for hourly employees.

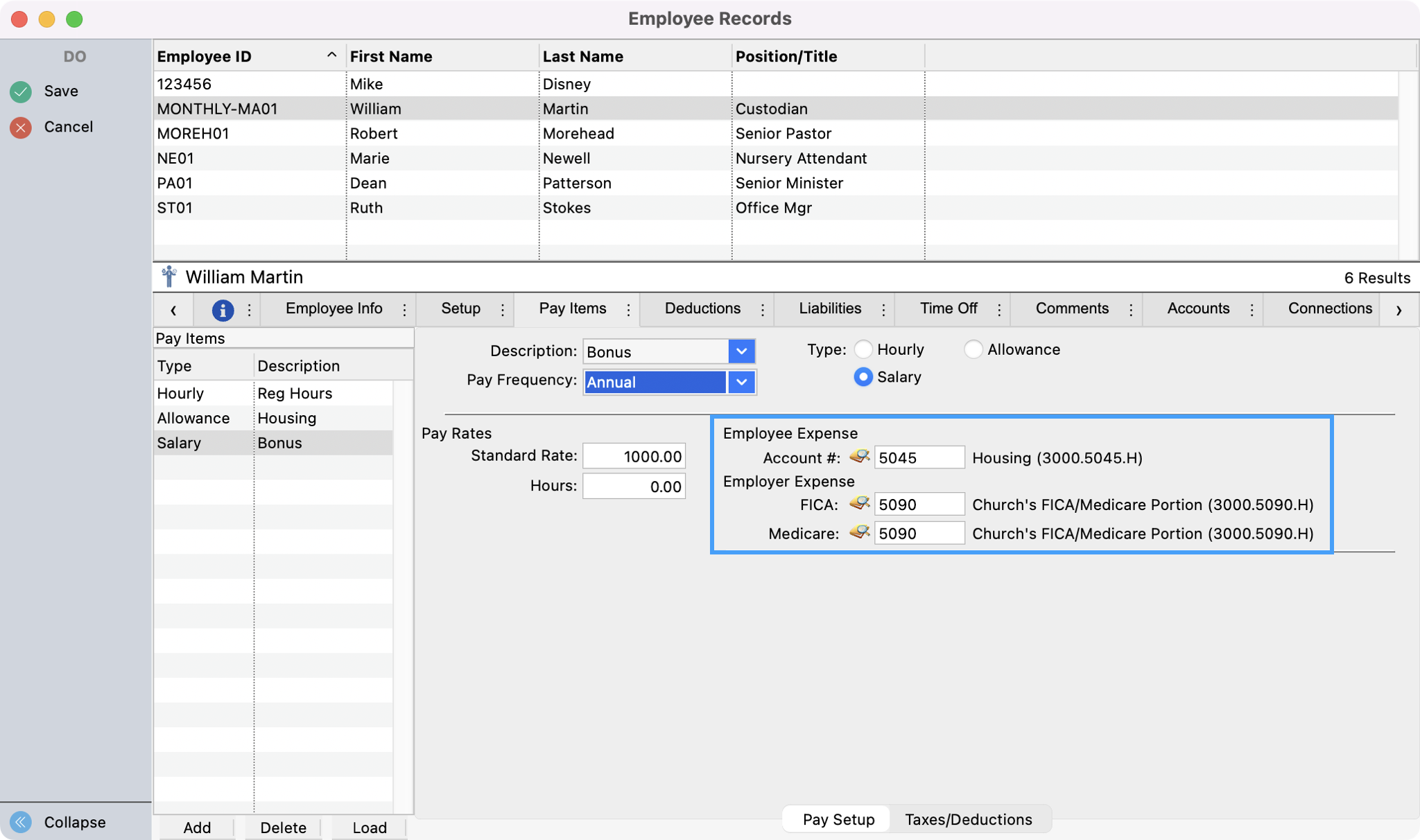

Then, set all of the appropriate expense accounts.

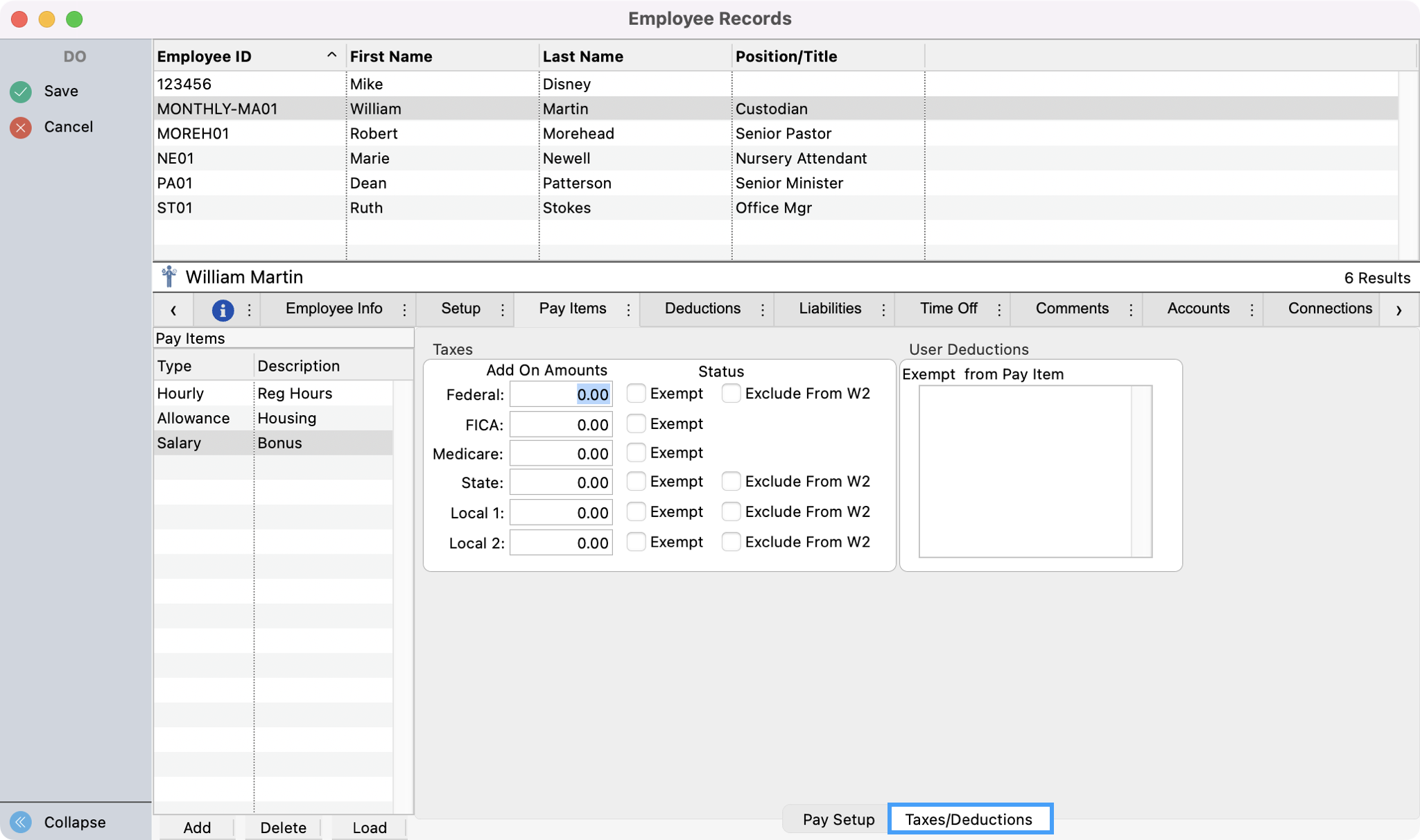

If the employee qualifies for tax exemption please proceed to step #11. If not, Save your changes and proceed to step #13.

If the bonus should be exempt from taxes, click Taxes/Deductions at the bottom to make the necessary changes.

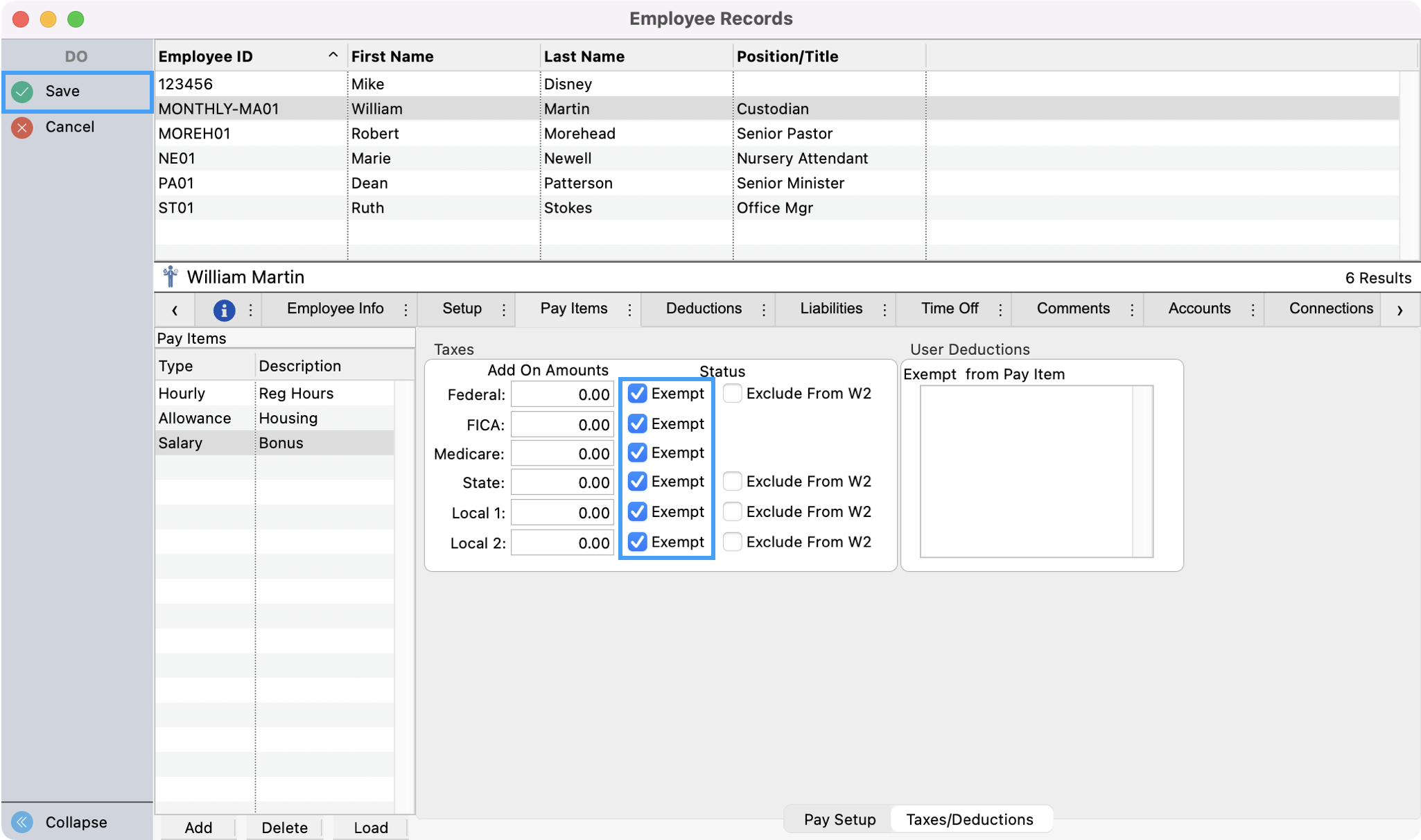

Put a check in each Exempt checkbox to the right of all the Add On Amounts and Save your changes.

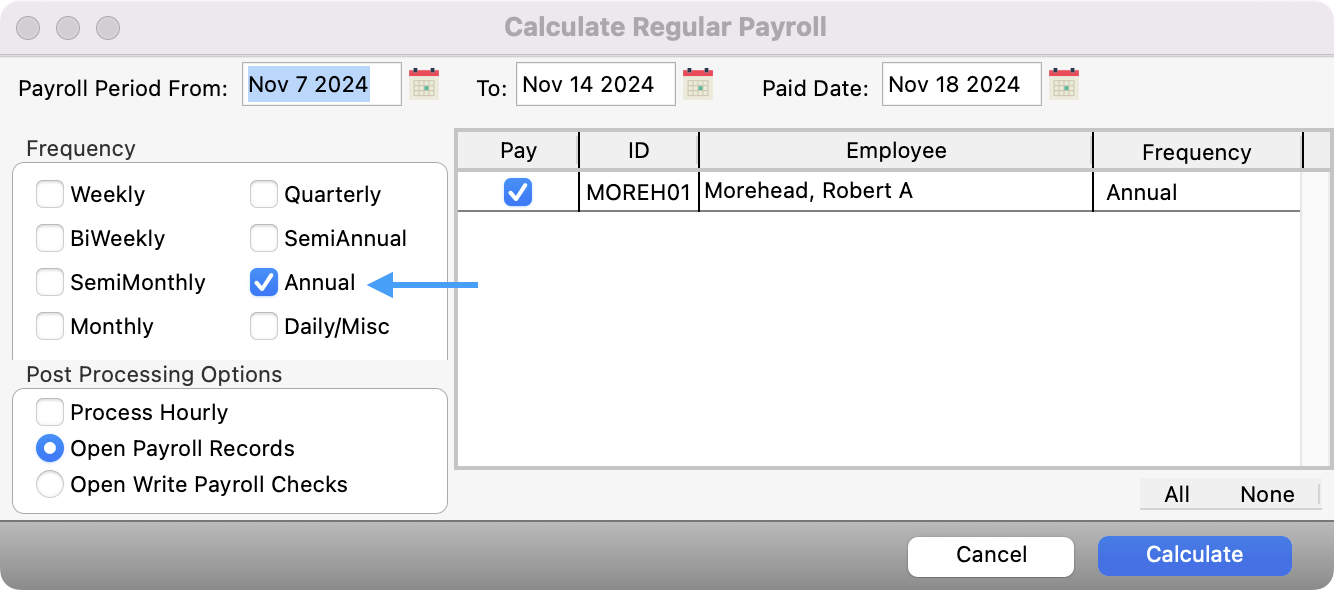

When calculating payroll for bonuses be sure to click the Frequency of the bonus you entered on step #6. This will either add the bonus as part of the current payroll or you can select to pay only the bonus by choosing the applicable frequency.