Voiding a Payroll

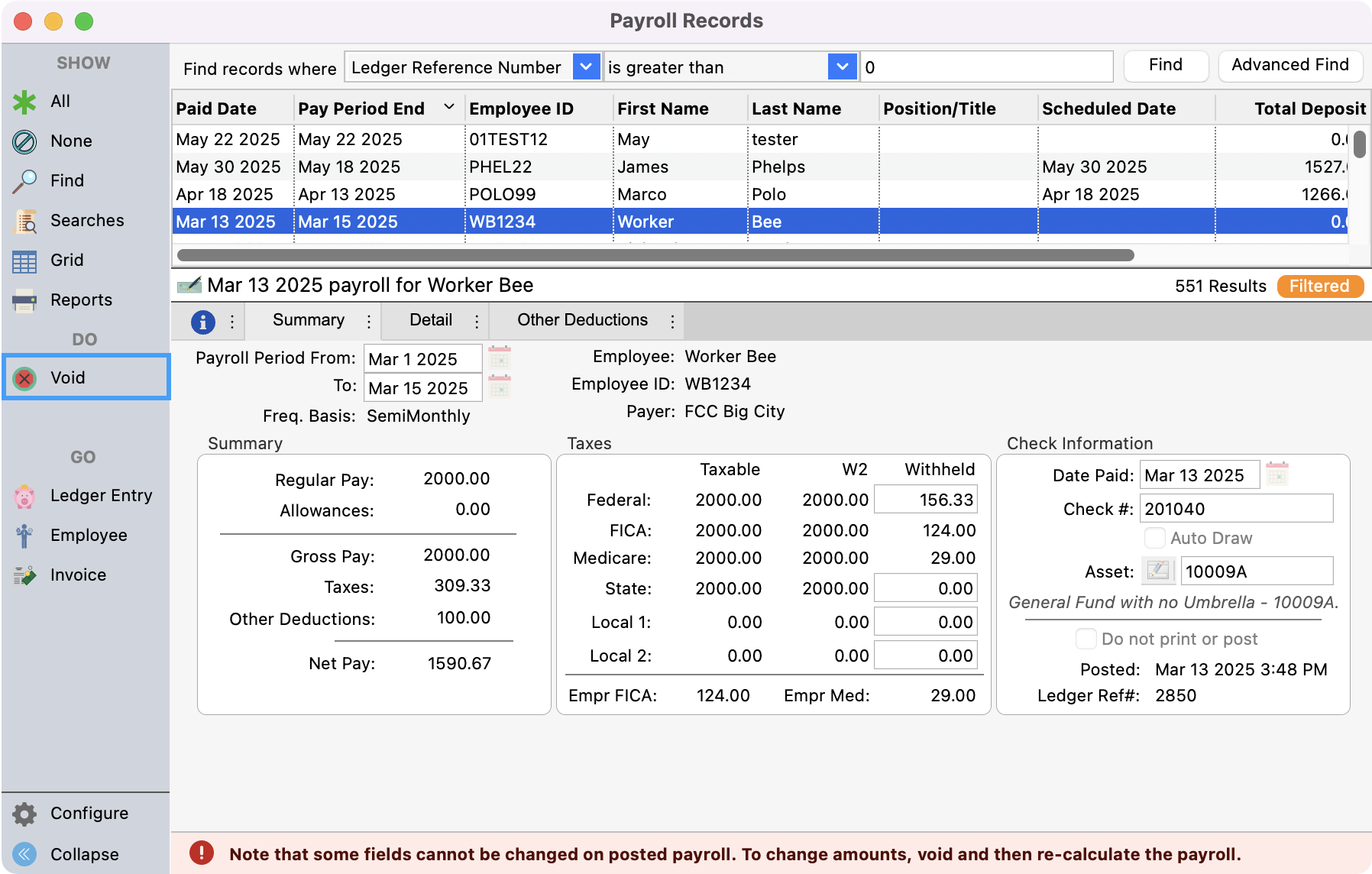

Once a payroll has been posted to the ledger, the only way to void a payroll check or checks is from the Payroll Records window.

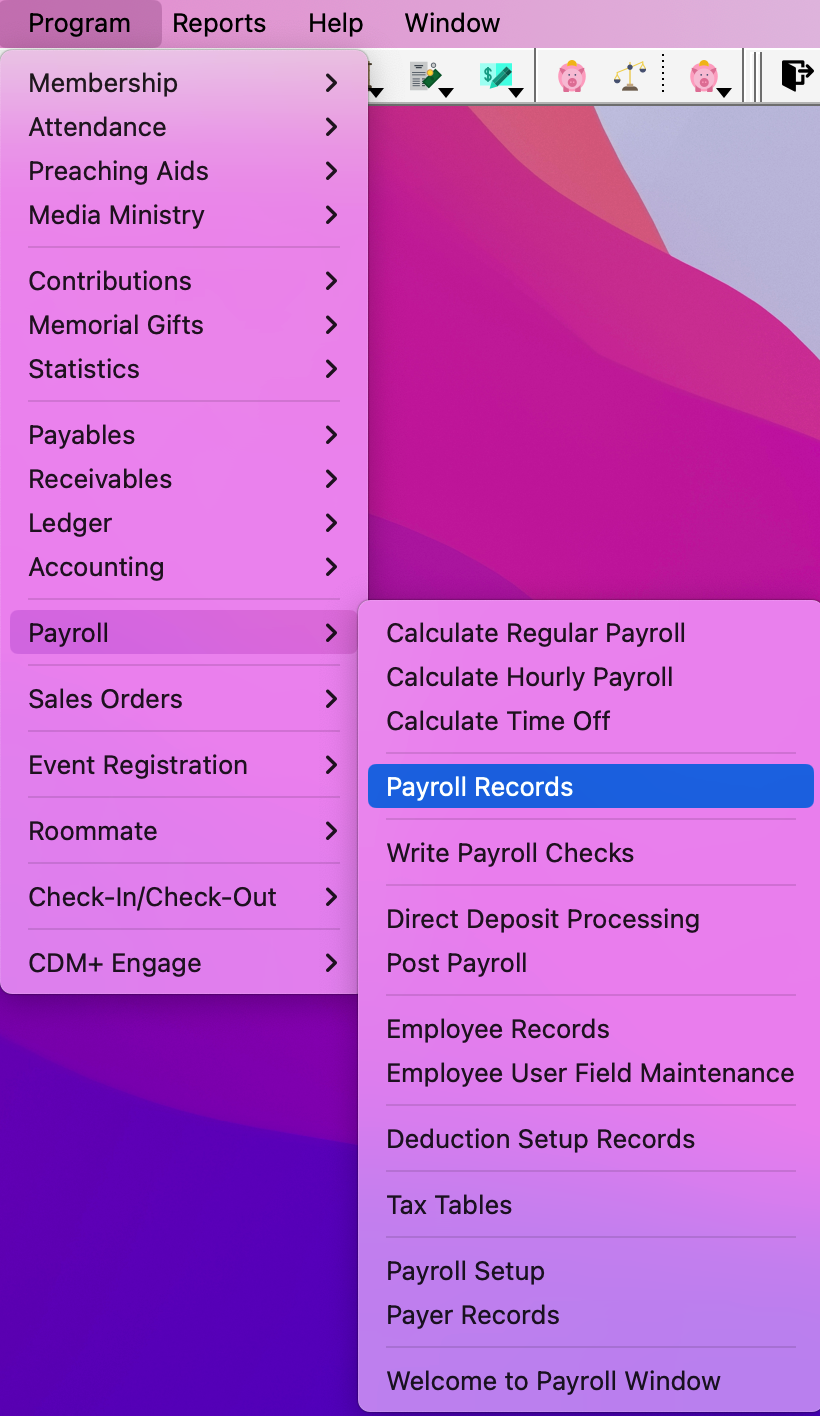

Go to Program → Payroll → Payroll Records.

Find the Payroll you need to void and click to select. If the payroll can be voided, click Void from the left sidebar.

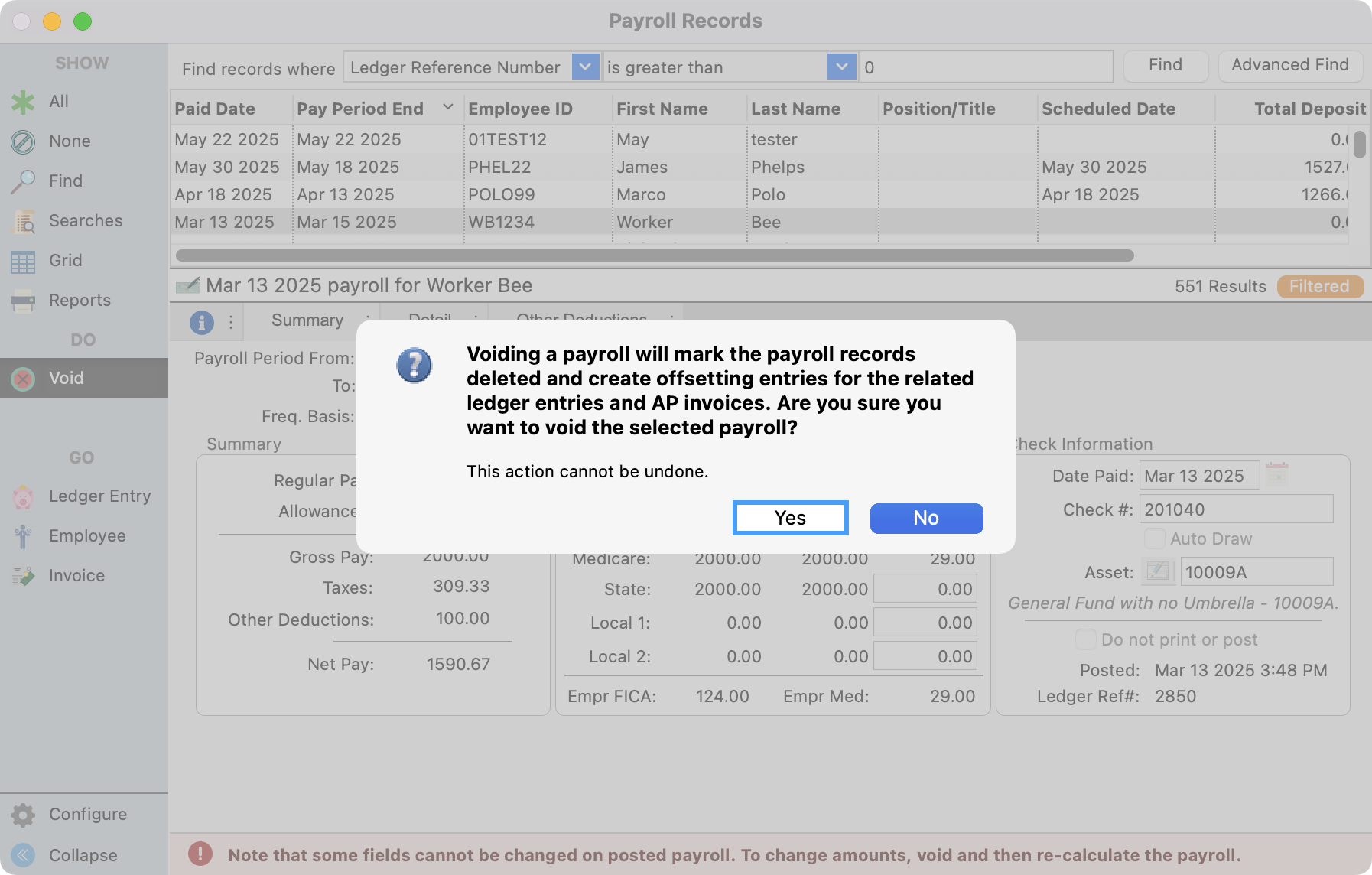

You’ll see a pop-up letting you know that by voiding this payroll:

Mark this payroll record as deleted

Create offsetting entries for the related ledger entries

Create offsetting entries for AP invoices, if applicable

Click Yes to proceed.

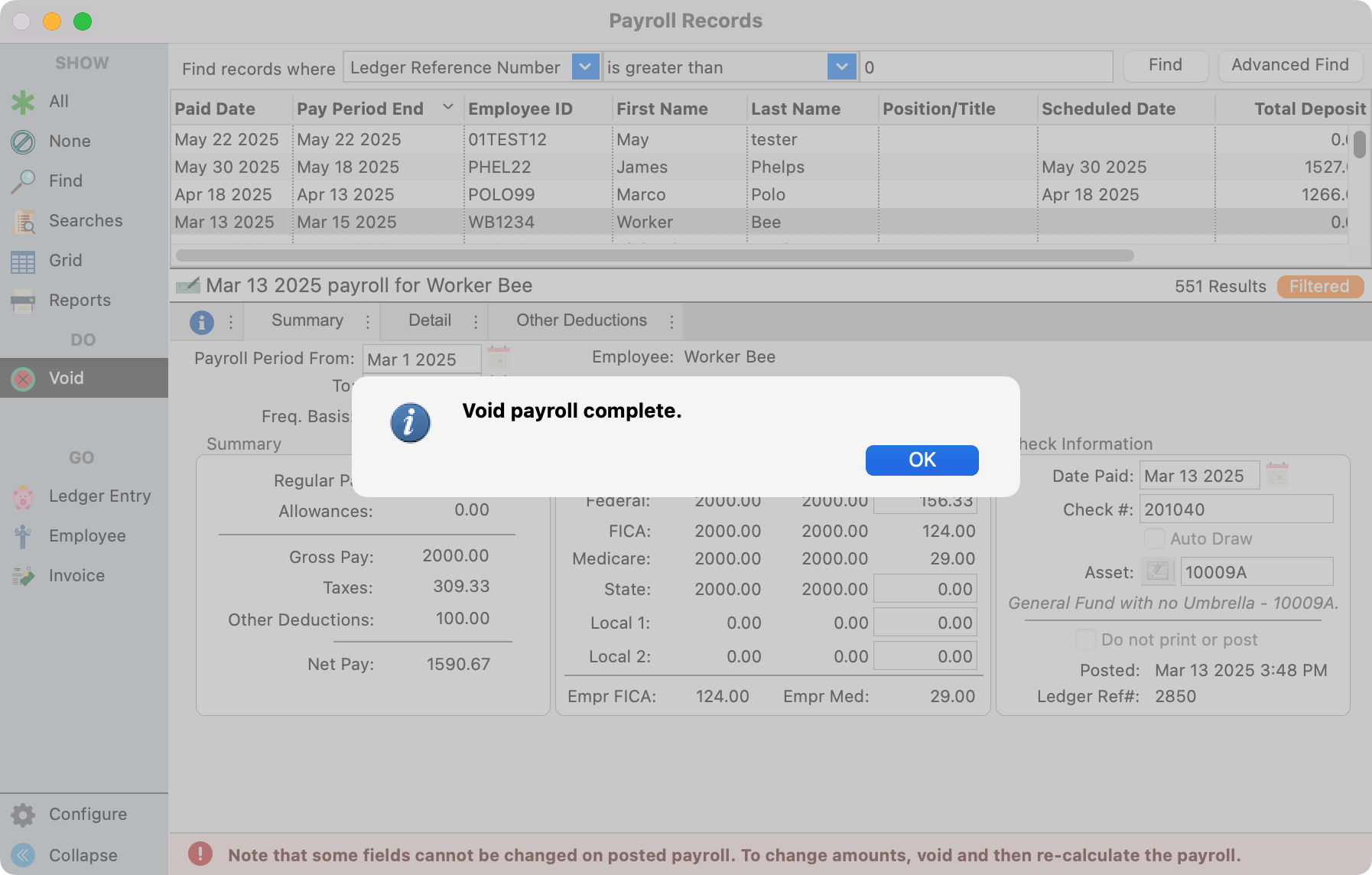

You’ll get a pop-up message letting you know the payroll was deleted. Click OK.

Note: Voiding a payroll check in a quarter/year after 941s and W-2s have been reported to the IRS may require you to file a replacement 941 or corrected W-2s. There are ledger options to re-print lost or destroyed payroll checks without voiding them.