Entering Credit Card Purchases

CDM+ makes it easy to track invoices paid by credit card. This process handles:

Producing a 1099 to the original vendor

Making payments on a credit card balance

Submitting payments from CDM+ Mobile

Setup

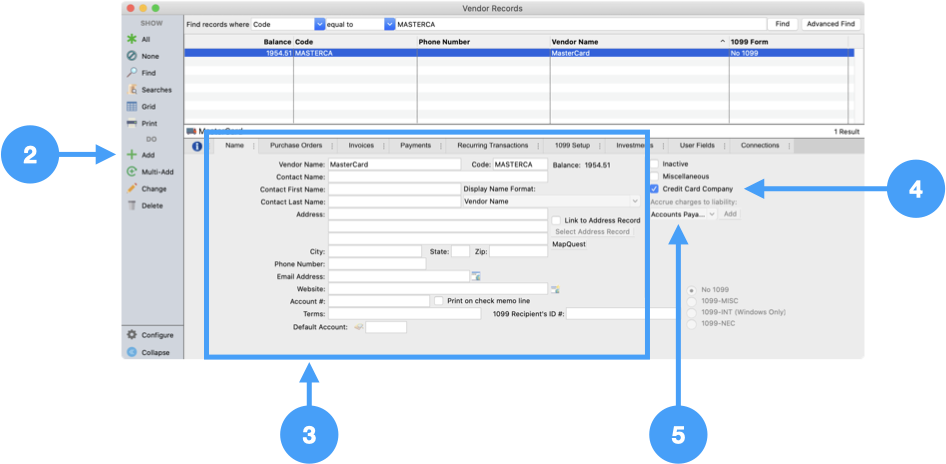

Begin by creating a vendor record for the credit card company.

Program → Payables → Vendor Records

Click Add

Enter the vendor name, code, address, and any other relevant details

Check Credit Card Company

Select a liability account to track monies owed on a credit card

Save

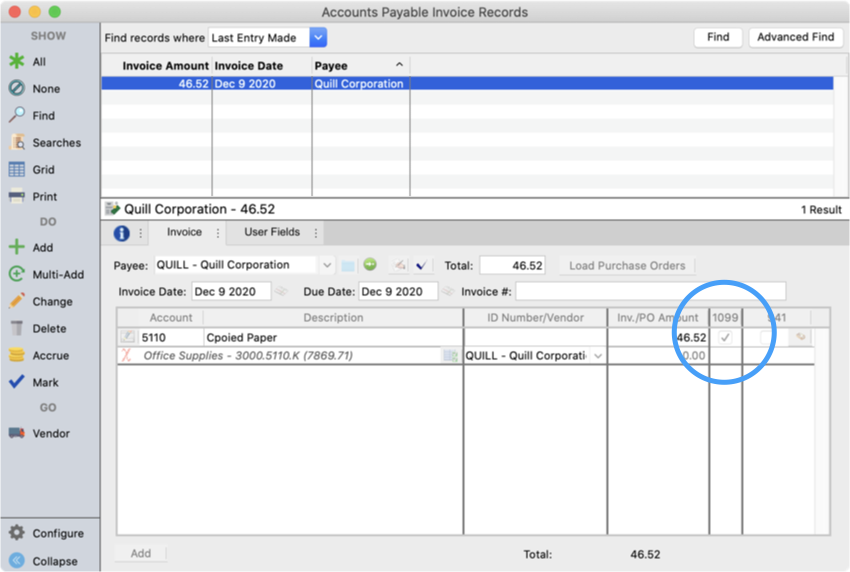

Enter the Invoice

When making a purchase by credit card, enter an invoice to the vendor from whom you made the purchase. There is nothing different for this invoice from one that would be paid by check or electronic auto draw.

If this vendor should receive a 1099 ensure the 1099 box is checked.

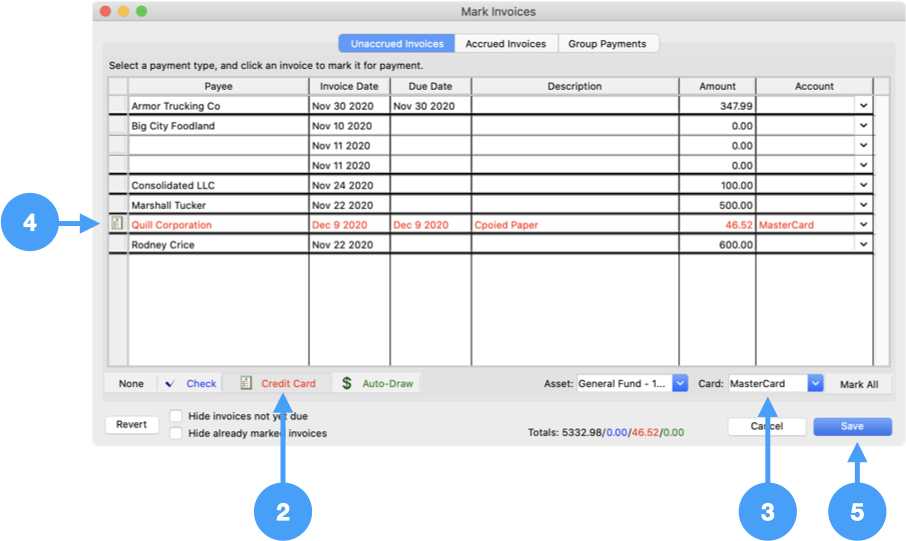

Mark the Invoice to be Paid

Mark the invoice to be paid using the credit card payment type.

Program → Accounts Payable → Mark Invoices to Pay

Choose the Credit Card payment method

Choose the credit card vendor

Click the invoices to be paid by credit card

Save

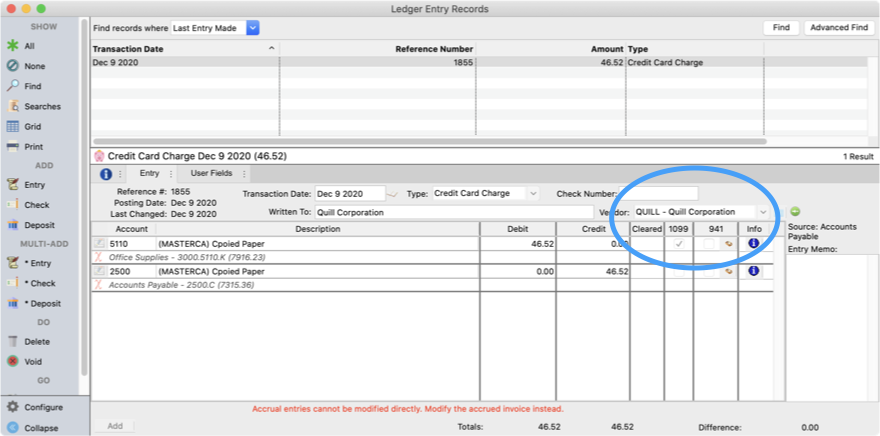

Post the Invoice

Post the invoice under Program → Payables → Post Payable Payments to the Ledger. The following two records will be produced.

Ledger Accrual

A ledger entry accruing the invoice to the credit card company liability is created. This is the entry that will be reported on a 1099 to this vendor.

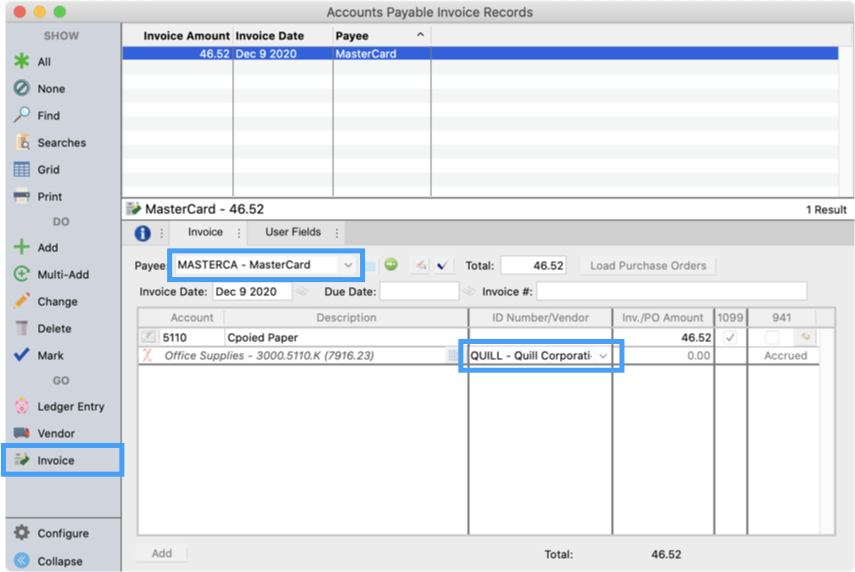

Invoice Payable to the Credit Card Company

A new Accounts Payable Invoice will be created payable to the credit card company from the accrued liability. To help connect this invoice to the original invoice, the line item vendor will be set to the original vendor. You can also jump to the original invoice by clicking Invoice in the sidebar.

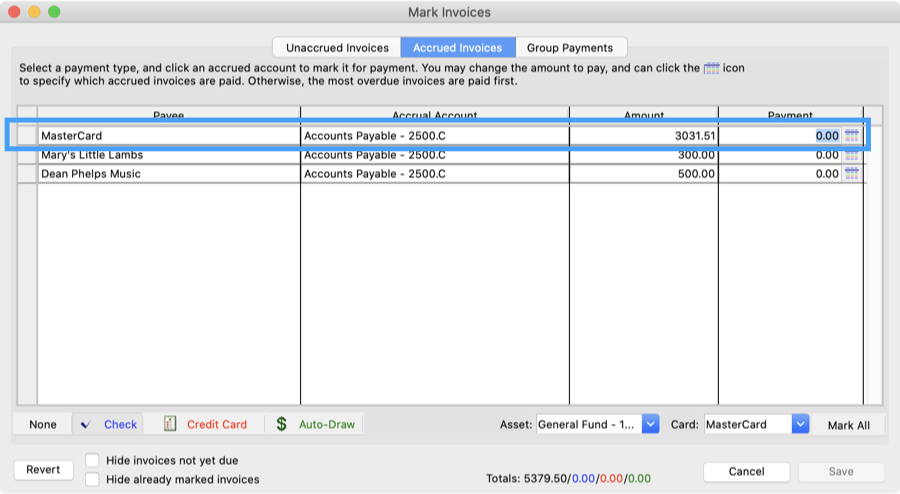

Pay the Credit Card Company

On Mark invoices you will see an accrued invoice payable to the credit card company. When it's time to make a payment, pay this accrued balance like any other accrued invoice.

Using Mobile Receipts

Consider using Mobile Receipts to easily enter invoices paid by credit card. You can attach a scan (photo) of the receipt, and invoices will be entered into CDM+ ready to be posted.

Changing the Credit Card Charge

You can edit the credit card charge to make adjustments to the account number, amount, description, and so on. How you make this change depends on that the state of the charge.

Invoice to the vendor has not yet been posted

If you have not yet posted the original invoice you can make any changes to the invoice you'd like. This is the most flexible time to adjust the invoice.

To make this change:

Go to Program → Payables → Invoice Records

Find the invoice

Click Change

Make your changes

Click Save

Invoice to the vendor has been posted, but credit card company not yet paid

In this situation, the original invoice to the vendor cannot be modified since it has been posted. However, you can modify the invoice payable to the credit card company to adjust the account number(s) and description.

To make this change:

Go to Program → Payables → Invoice Records

Find the invoice payable to the credit card company

Click Change

Make your changes

Click Save

If you need to edit the invoice amount, create a new invoice for the adjustment payable to the vendor. Pay this invoice with the credit card using the process outlined above.

Editing the amount of the invoice payable to the credit card company does not properly update the accrual in your ledger.

The credit card company has been paid

If you've already made a payment to the credit card company and need to adjust an account number, enter a ledger entry to make the adjustment.

Go to Program → Ledger → Ledger Entry Records

Add a journal entry

Credit the original expense account

Debit the new expense account

Save

If you need to edit the invoice amount, create a new invoice for the adjustment payable to the vendor. Pay this invoice with the credit card using the process outlined above.