Setting Up Clergy Payroll

Setting up employee information and pay items for clergy requires additional considerations beyond those for non-clergy employees. Three key differences require us to think about clergy records differently in CDM+ Payroll.

Clergy have a dual tax status. That is, as far as federal income tax is concerned, the minister is considered an employee and so receives Form W-2. However, regarding Social Security (FICA) and Medicare, the minister is considered self-employed. Whereas non-clergy employees pay FICA and Medicare taxes through payroll withholding and employer matching, clergy pay these taxes by filing Form SE with their tax return.

Members of the clergy may elect to have federal and state taxes withheld. Many clergy, however, make quarterly estimated tax payments for state and federal income taxes.

Ministers may claim a portion of their cash compensation as a housing allowance. This amount must be approved by the governing body of the church or organization and documented in the minutes. A housing allowance is not subject to federal income tax, but it must be included in calculating self-employment tax (Form SE) for FICA and Medicare. The housing allowance is reported in Box 14 on Form W-2.

How to Set Up Clergy Salary in CDM+

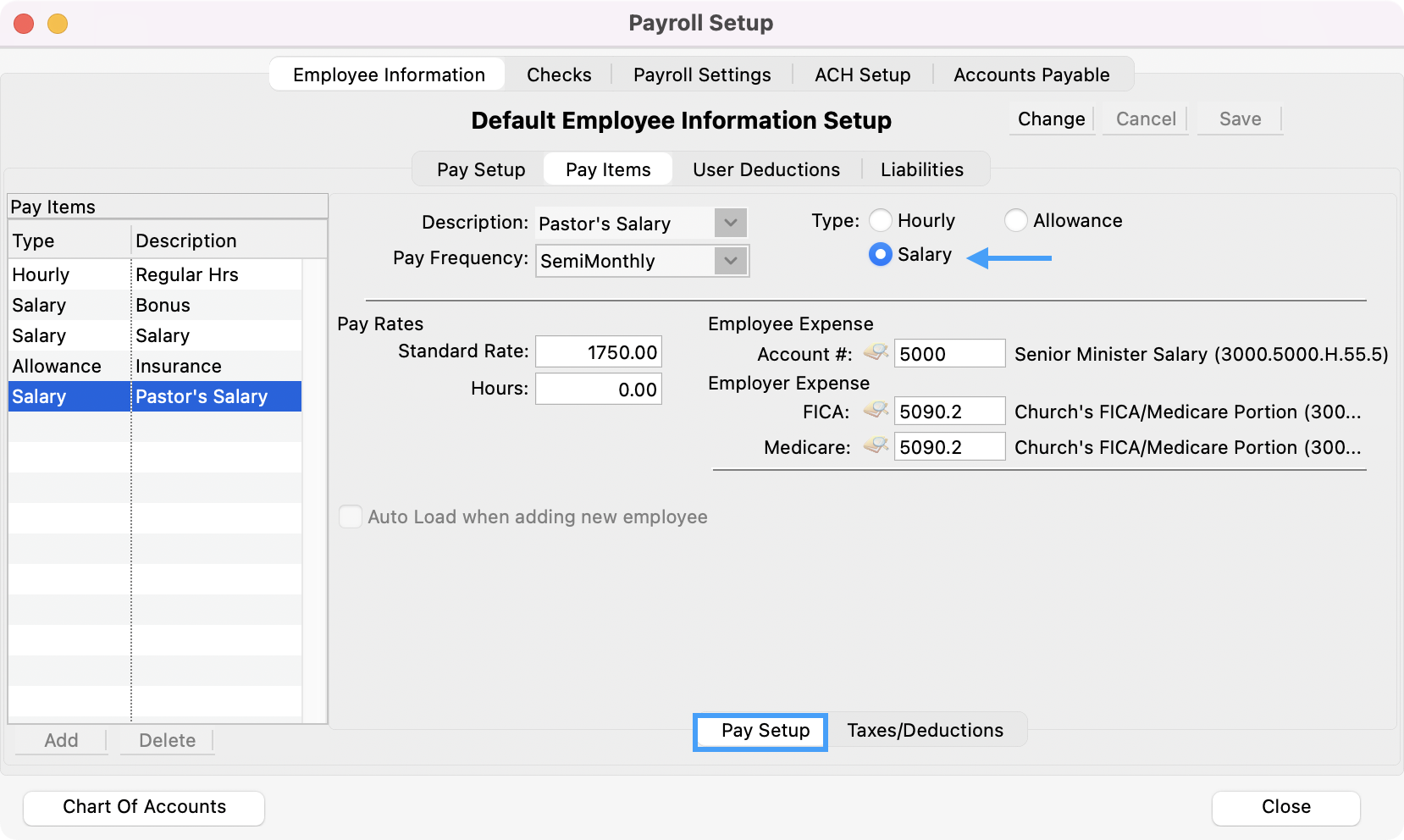

On the Pay Items tab of the Employee Information record for the minister, under Pay Setup create a pay item with the type Salary. Use the appropriate pay frequency, and set the standard rate according to the pay frequency.

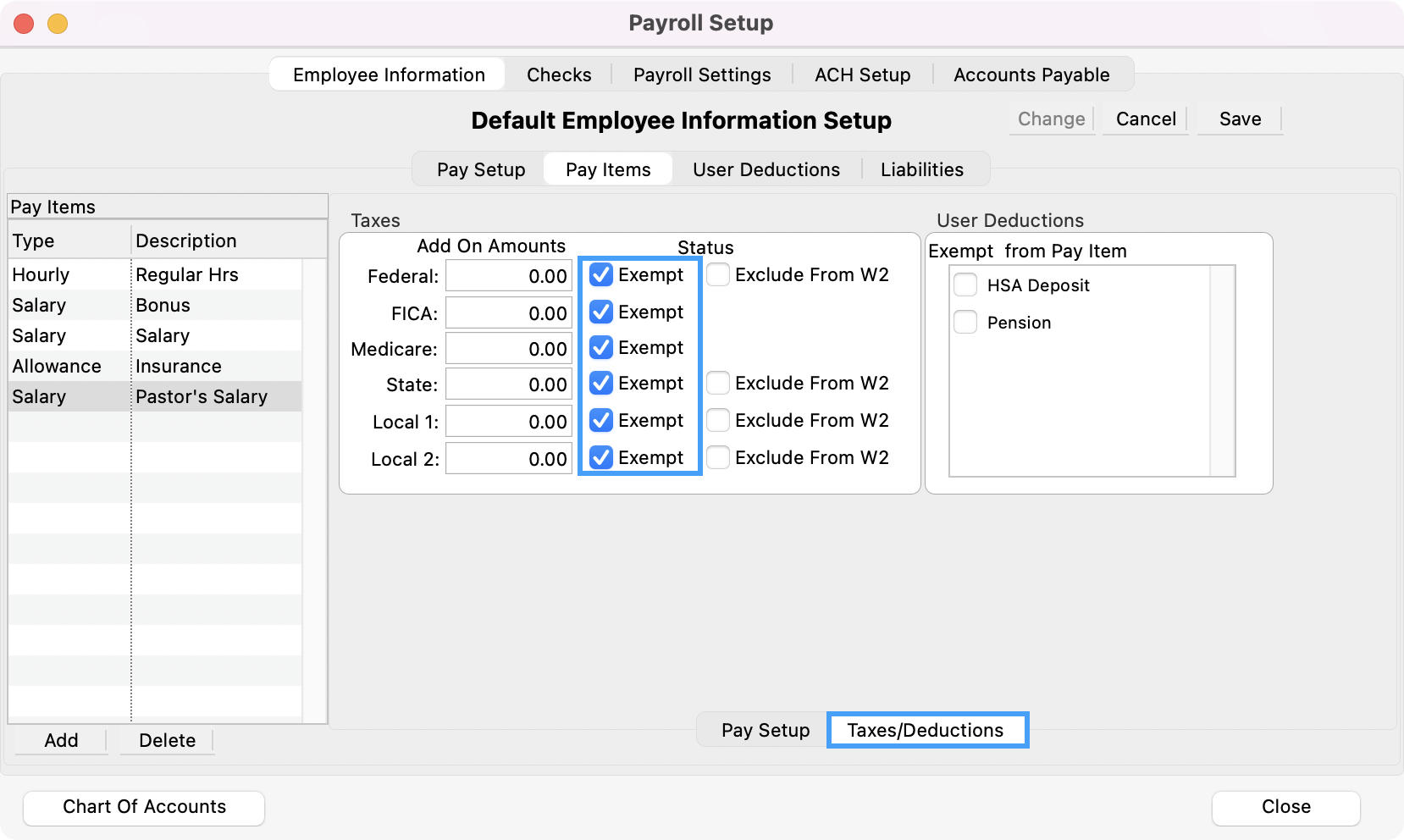

Then, on the Taxes/Deductions section, mark the salary pay item exempt from all taxes. This will prevent federal, state, and local income tax withholding as well as preventing withholding for FICA and Medicare taxes.

How to Set Up the Housing Allowance in CDM+

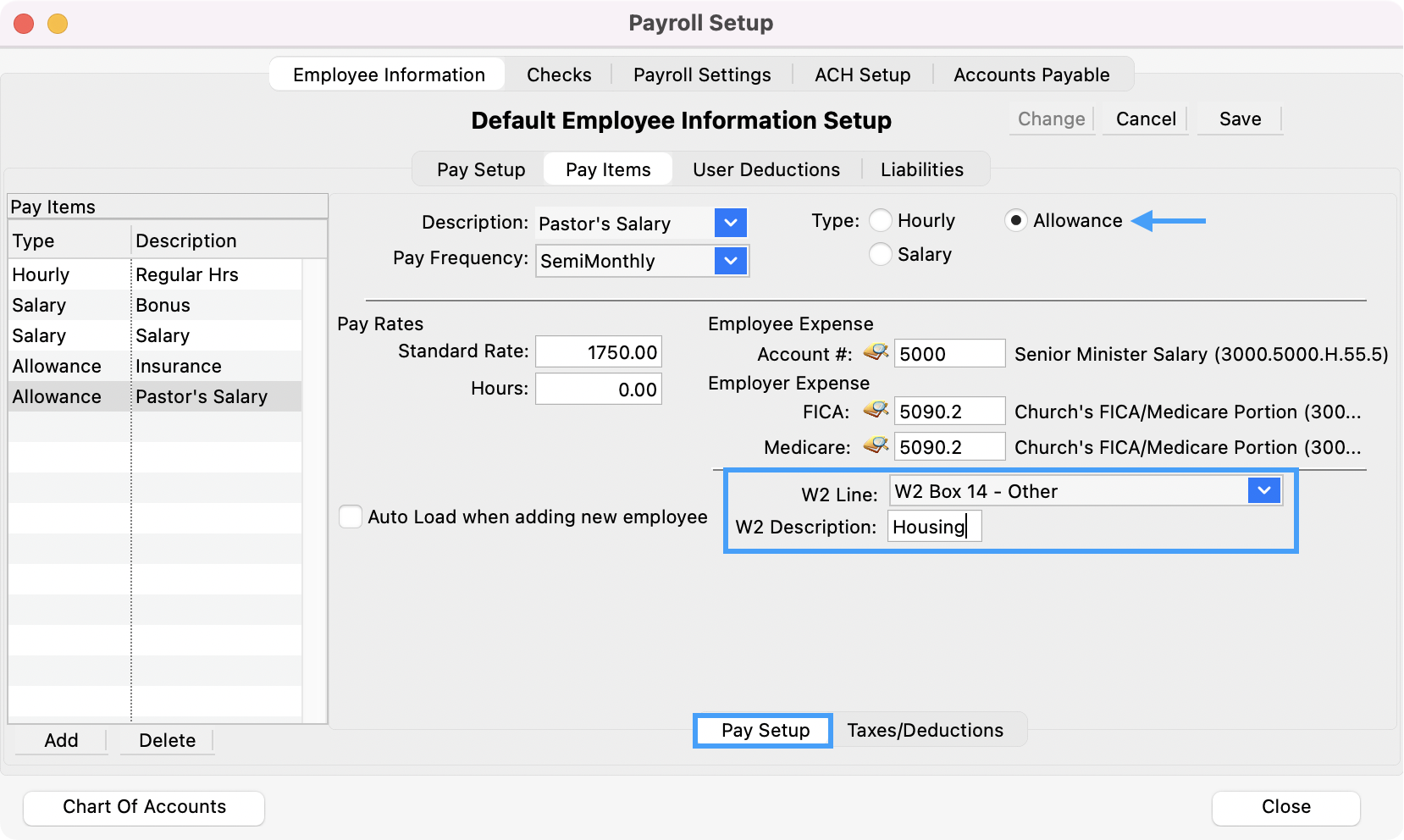

On the Pay Items tab, add a pay item with type Allowance. When selecting Allowance as the type, CDM+ offers the options to specify the W-2 Line and W-2 Description. Use W-2 Line to specify that this pay item is reported in W-2 box 14. Use W-2 Description to specify a short description for the allowance that will be included in Box 14.

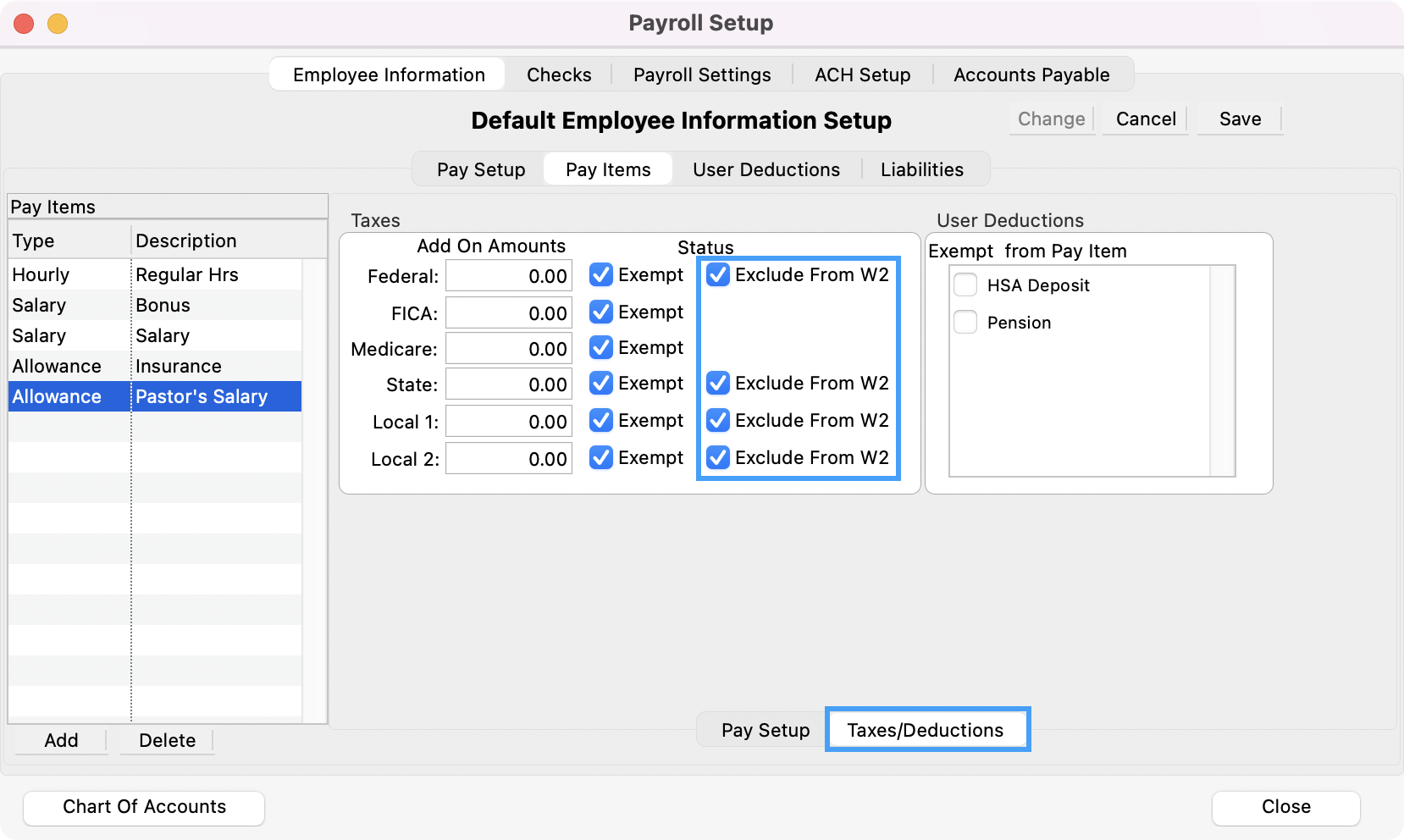

Then, on the Taxes/Deductions section for the housing allowance, mark the pay item as Exempt from all tax withholdings. In addition, mark the pay item to be excluded from W-2 for all federal state and local taxes. This will prevent the housing allowance from being included in boxes 1 and 16 because it will be reported in box 14.