Setting Up Additional or Fixed Withholding

When completing Form W-4, Employee's Withholding Allowance Certificate, an employee may request that an extra amount be withheld in addition to the calculated withholding. On the 2019 form , this is requested on line 6. In the case of clergy, whose compensation is not subject to federal withholding, this amount will represent a fixed amount to be withheld each pay period.

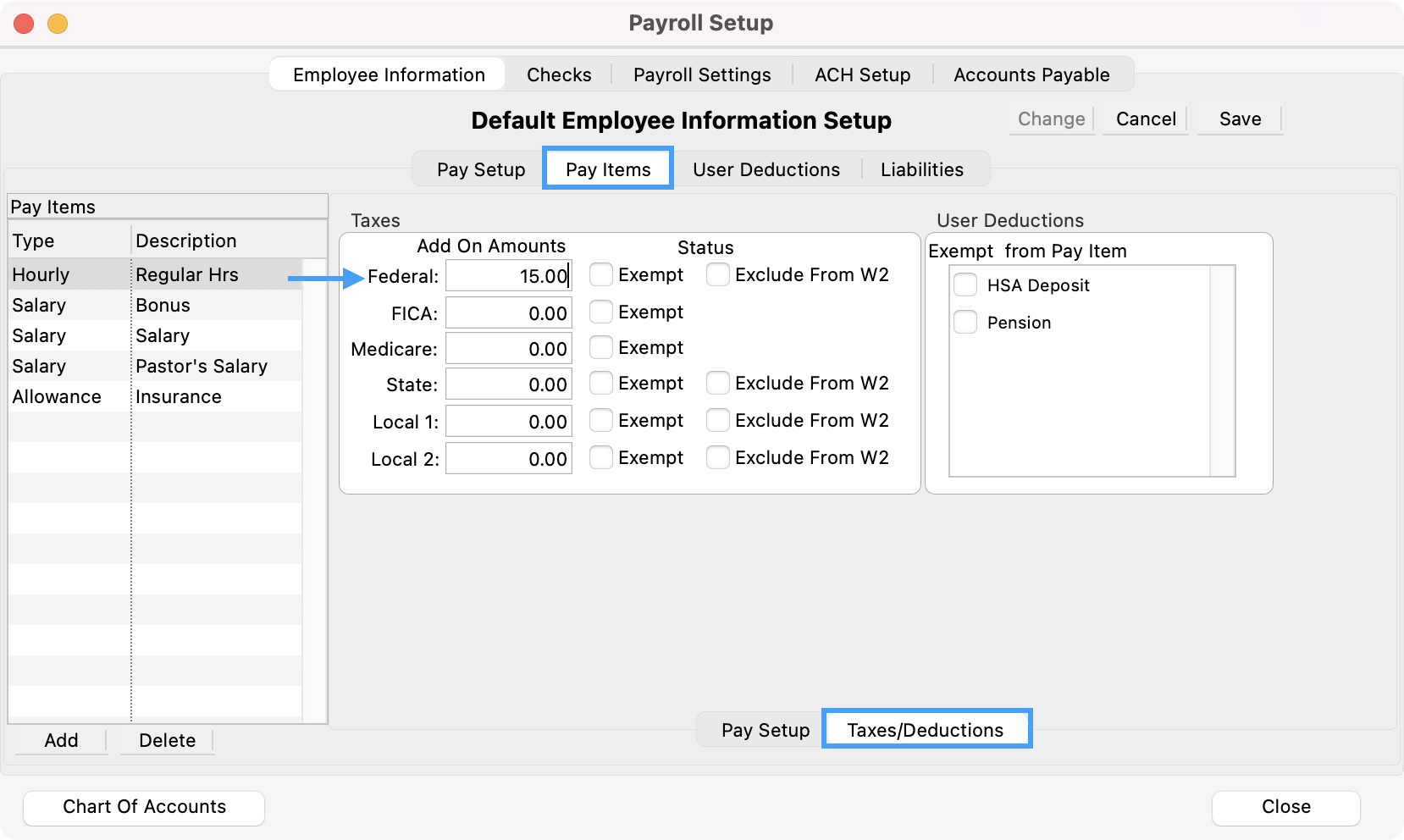

Both of these are set up using the Taxes/Deductions section of the Pay Items tab of the Employee Information record.

Additional Withholding

In the case of a non-clergy employee who requests an additional withholding, include the amount from line 6 in the Add On Amounts column next to Federal, as shown below.

In this example, when payroll is calculated, the federal withholding will be calculated per the tax table, and the calculated withholding will be increased by $15. It is important to note that this setup causes CDM+ to calculate the withholding and then to increase that by the specified amount.

Fixed Withholding

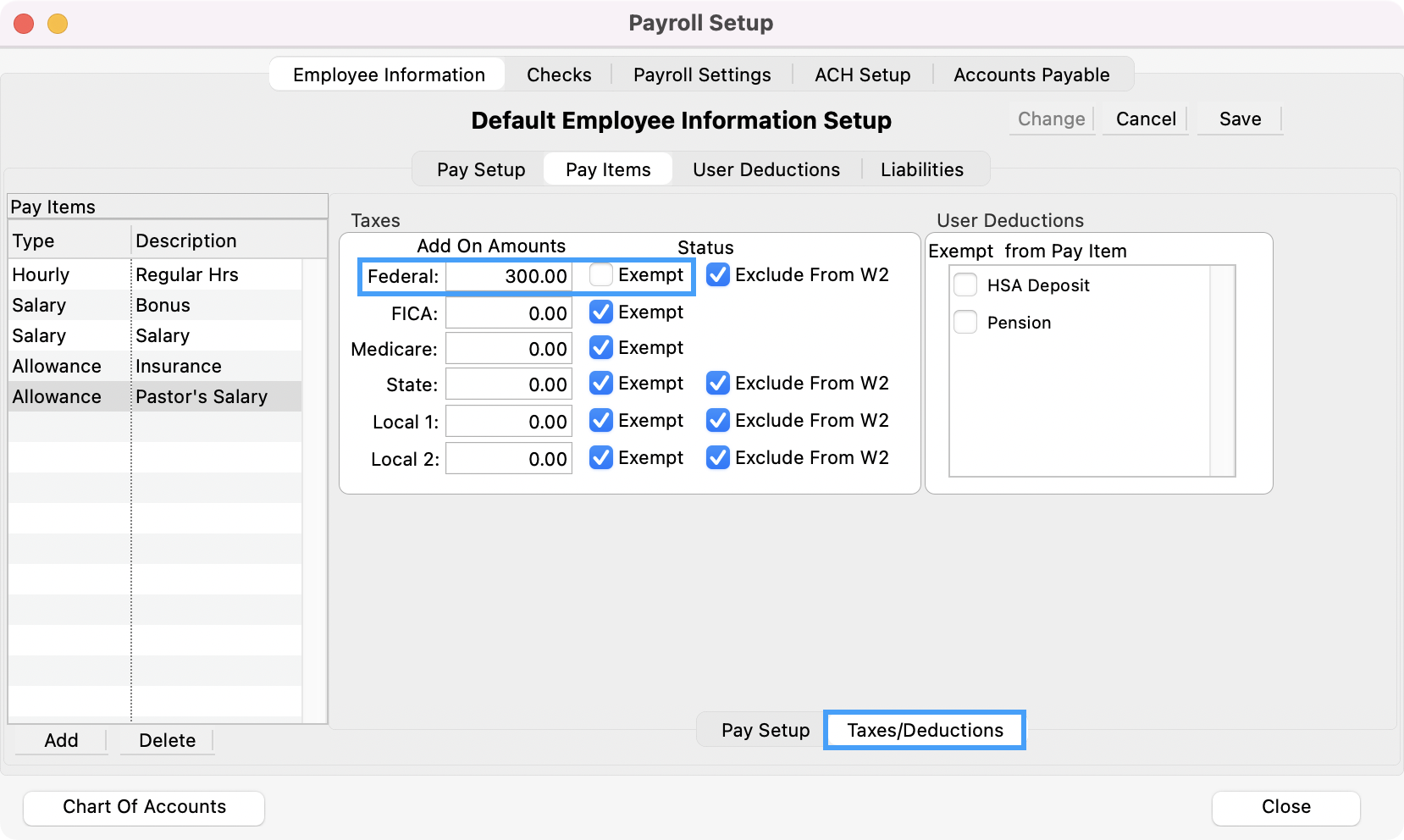

Sometimes clergy, because their salary is not subject to federal withholding and because they pay Social Security and Medicare taxes by filing Form SE, will request a fixed federal withholding to help them set aside money to meet their tax liability. This is set up much like the additional withholding but with one additional step.

Example: Pastor Patterson wants only a fixed $300 withheld each pay period.

First, on the Taxes/Deductions section of the Pay Items tab, on the Federal line, make sure the Exempt box is unchecked. Then enter $300 in the Add On Amounts column as shown below.

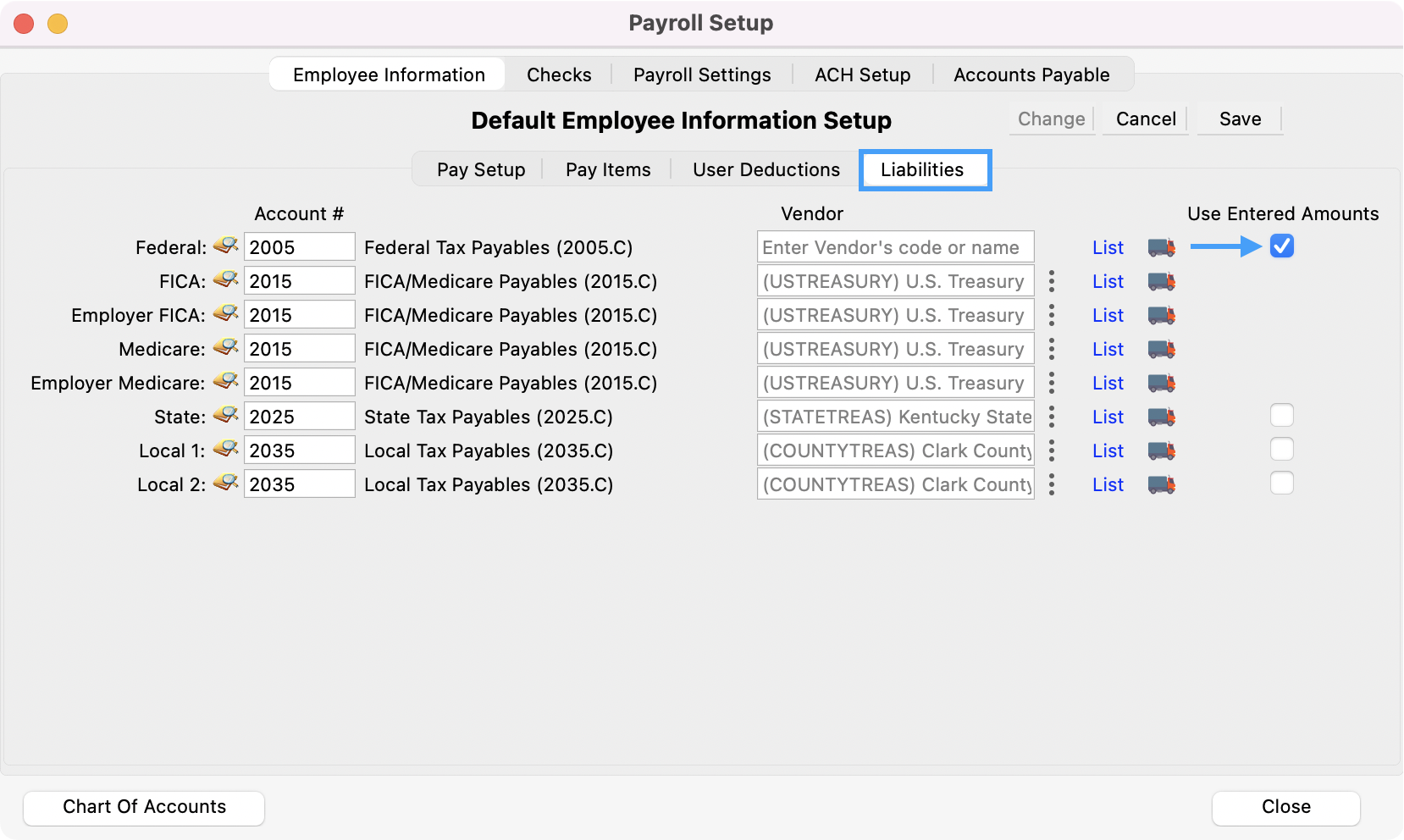

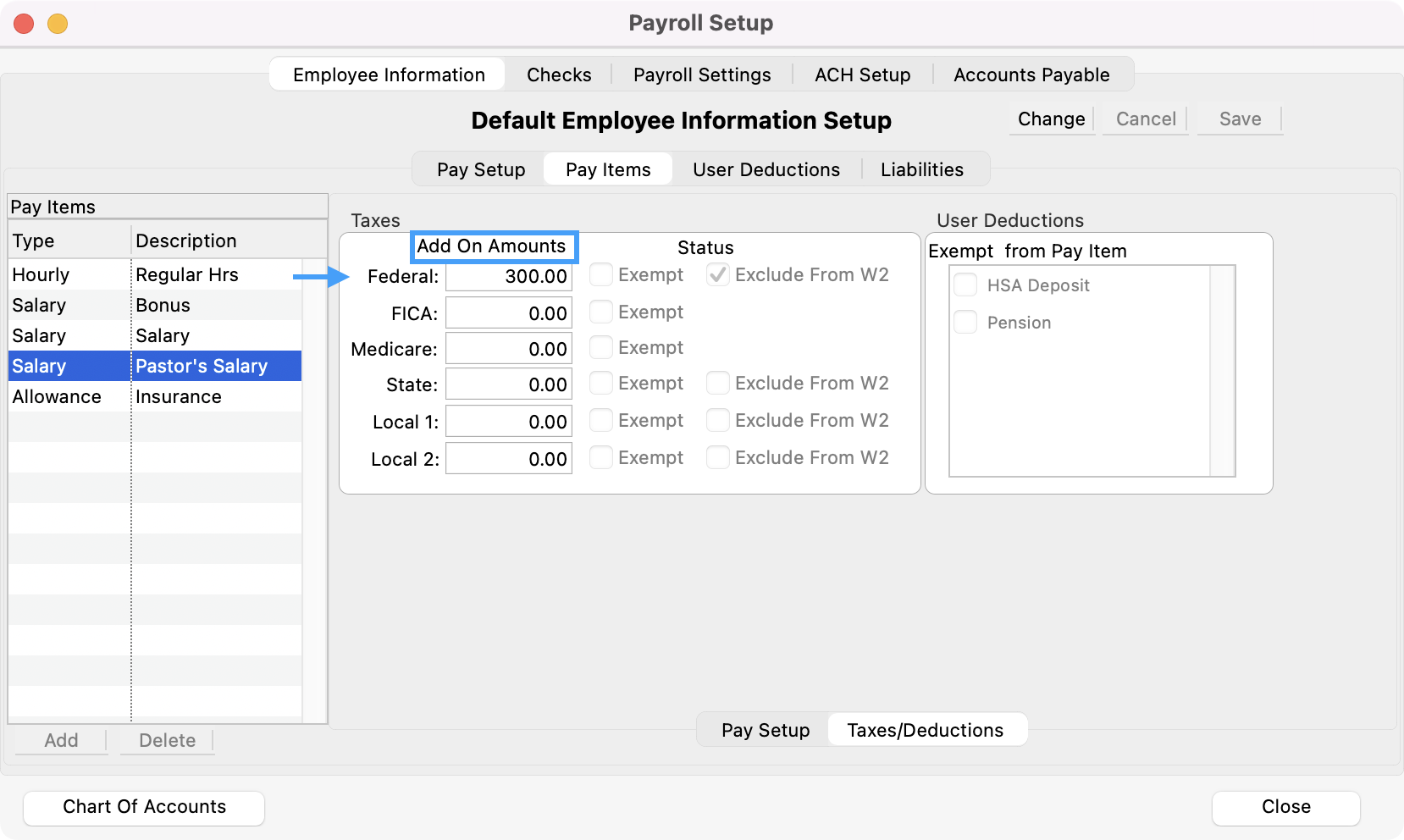

If left like this, payroll calculation will calculate withholding according to the tax table, then add $300. However, Pastor Patterson just wants the $300 withheld. To accomplish the fixed withholding, go to the Liabilities tab, and check the box for Use Entered Amounts Only as shown below.

3. This causes CDM+ to bypass the tax table calculation and withhold only the amount shown in the Add On Amounts column.

This same process can be used to create an additional or fixed withholding for state and local taxes.