How to Configure Employees in Maryland

Explanation

Employees who reside or work in Maryland need additional configuration to properly calculate state tax withholdings. Reference the withholding information instructions on https://www.maryladtaxes.gov.

Per section 4 of the Maryland Employe Withholding guide:

For employees who are residents of Maryland, use the rate corresponding to the area where the employee lives. Since each county sets its local income tax rate, there is the possibility of having 24 different local income tax rates. To reduce the number of local income tax rates, we have established 14 local income tax rates. Use the rate that equals or slightly exceeds the actual local income tax rate to ensure that sufficient tax is withheld.

For employees who are not residents of Maryland, use the Nonresident rate, which includes no local tax; but does include the Special 2.25% Nonresident rate.

For employees who are residents of Maryland and are working and paying withholding taxes in Delaware or any other nonreciprocal state, use the Delaware/Nonreciprocal state rate, which includes local tax and credit for taxes paid to another state or locality.

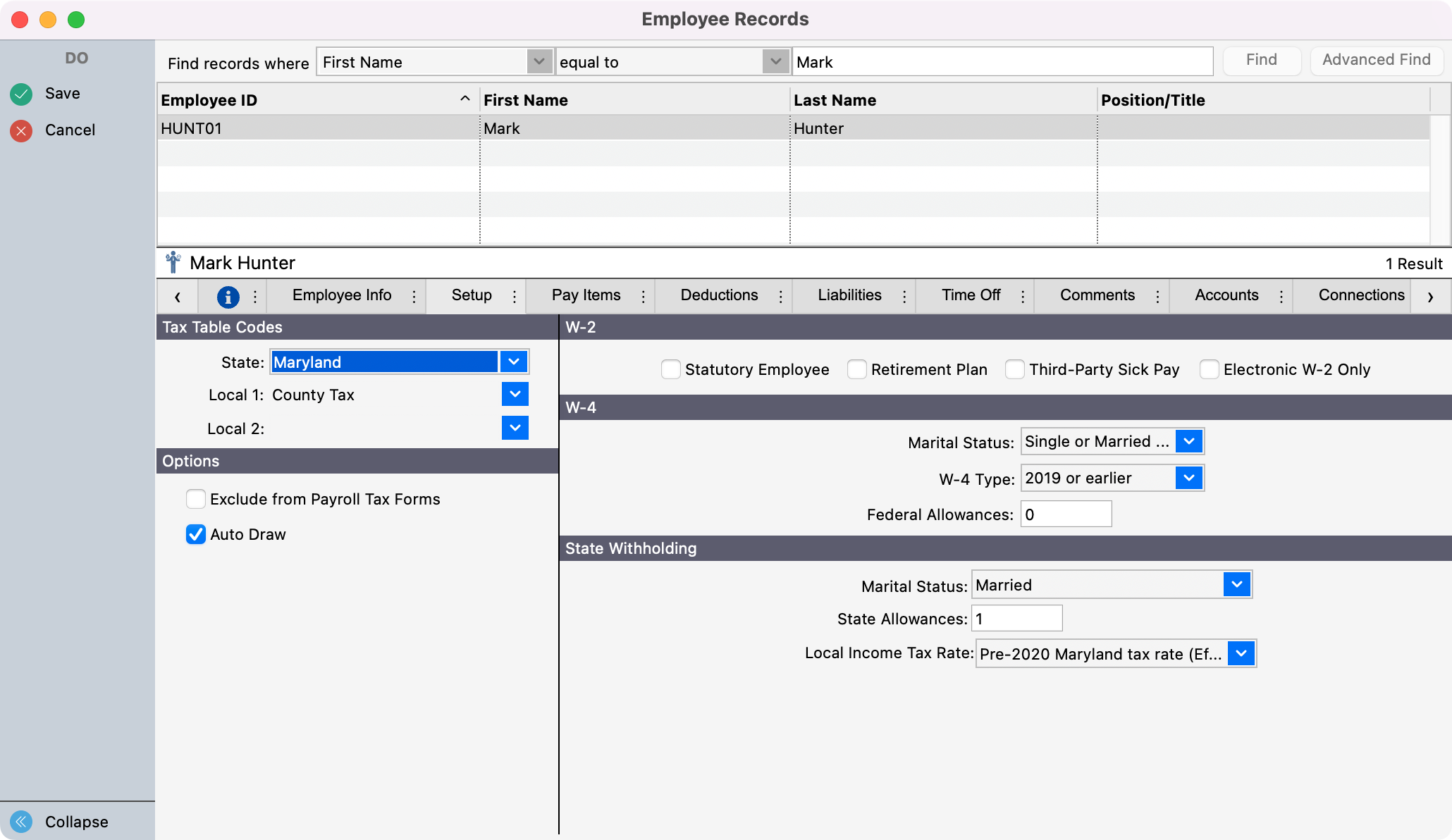

CDM+ allows selecting the appropriate local income tax rate for each employee. It is up to the employer to determine the correct rate—CDM+ does not provide any mapping between the employee's address and a tax rate.

Process

To set the local tax rate in CDM+ 11.1.4 and later:

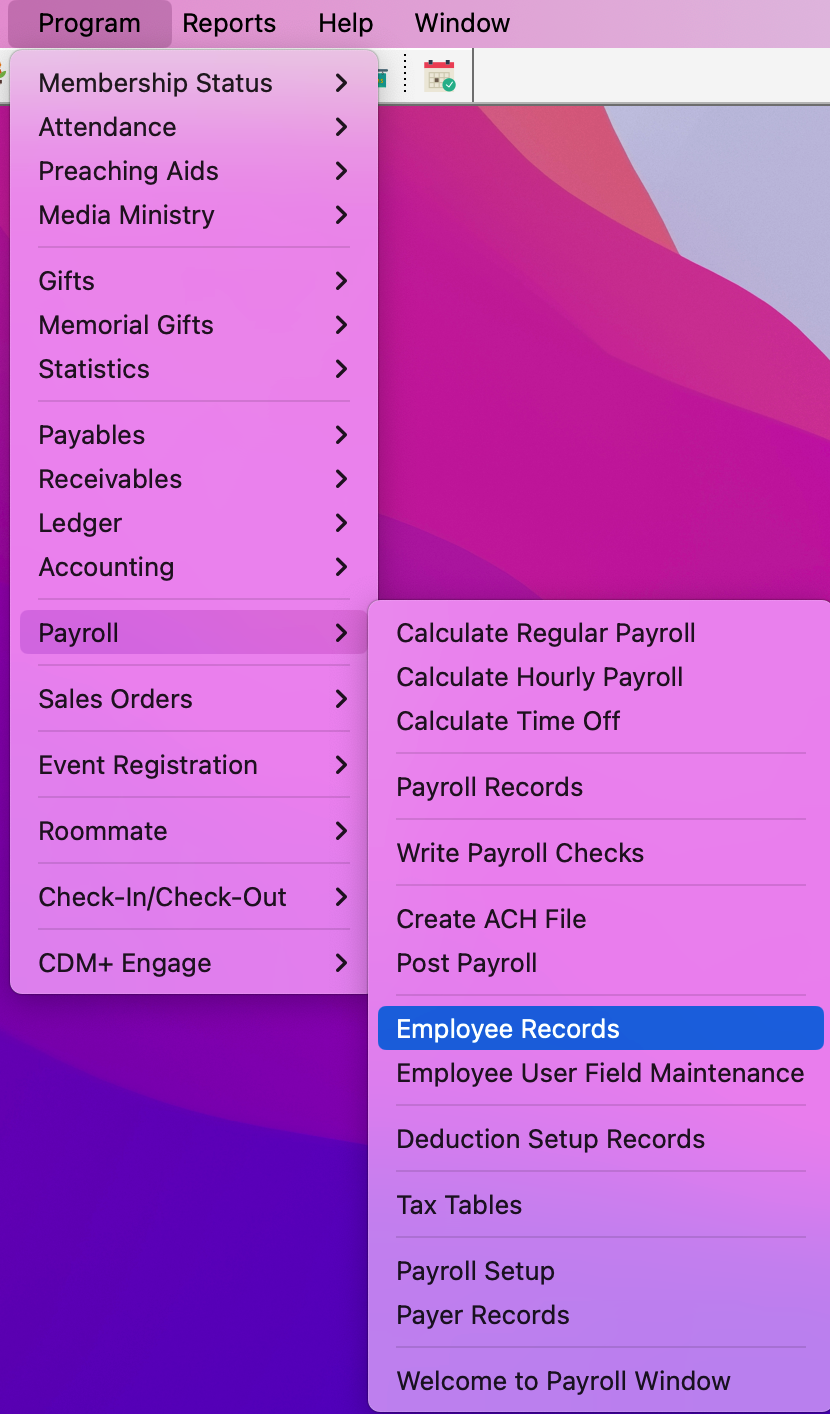

Go to Program → Payroll → Employee Records

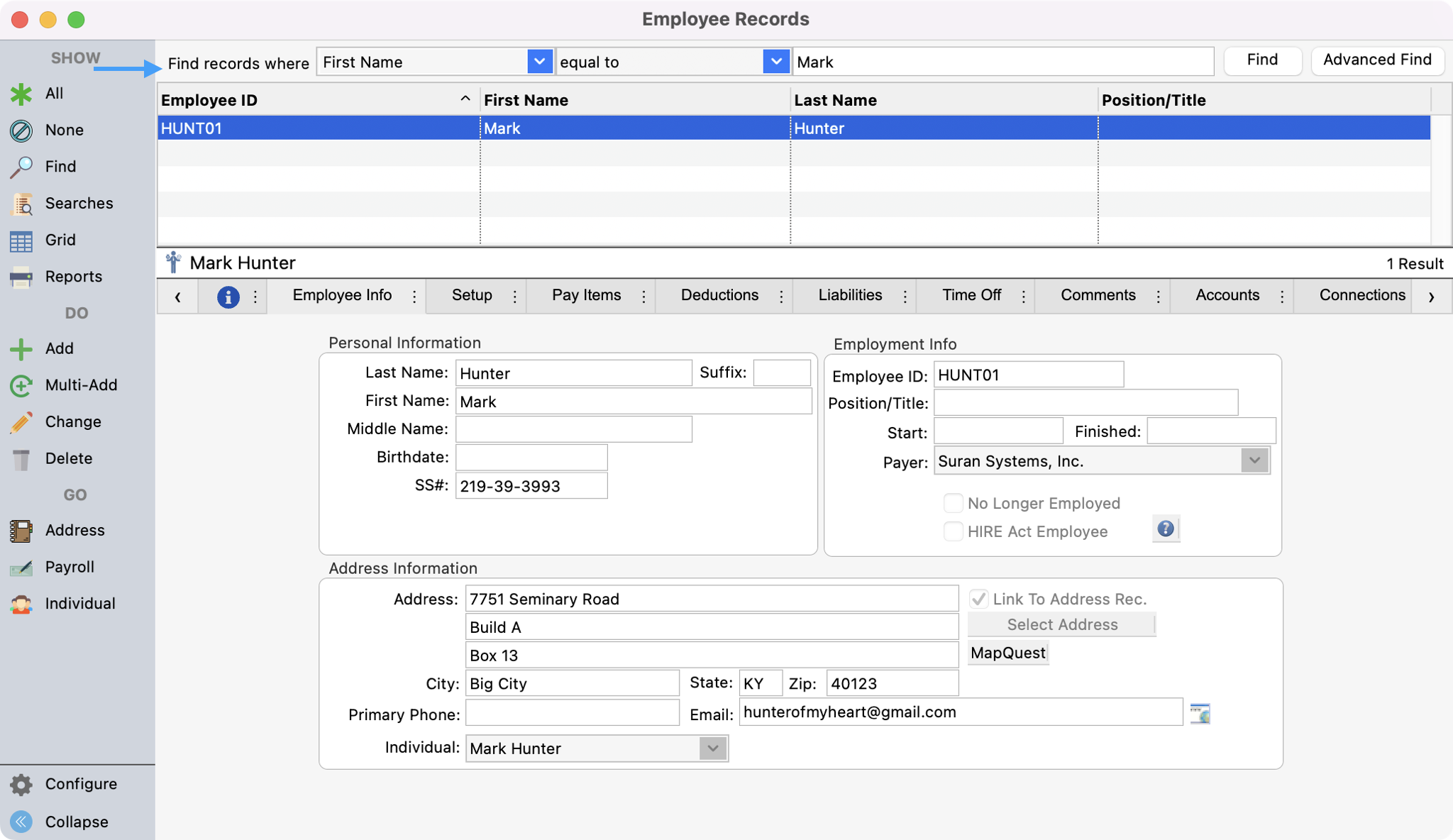

Find the employee to update

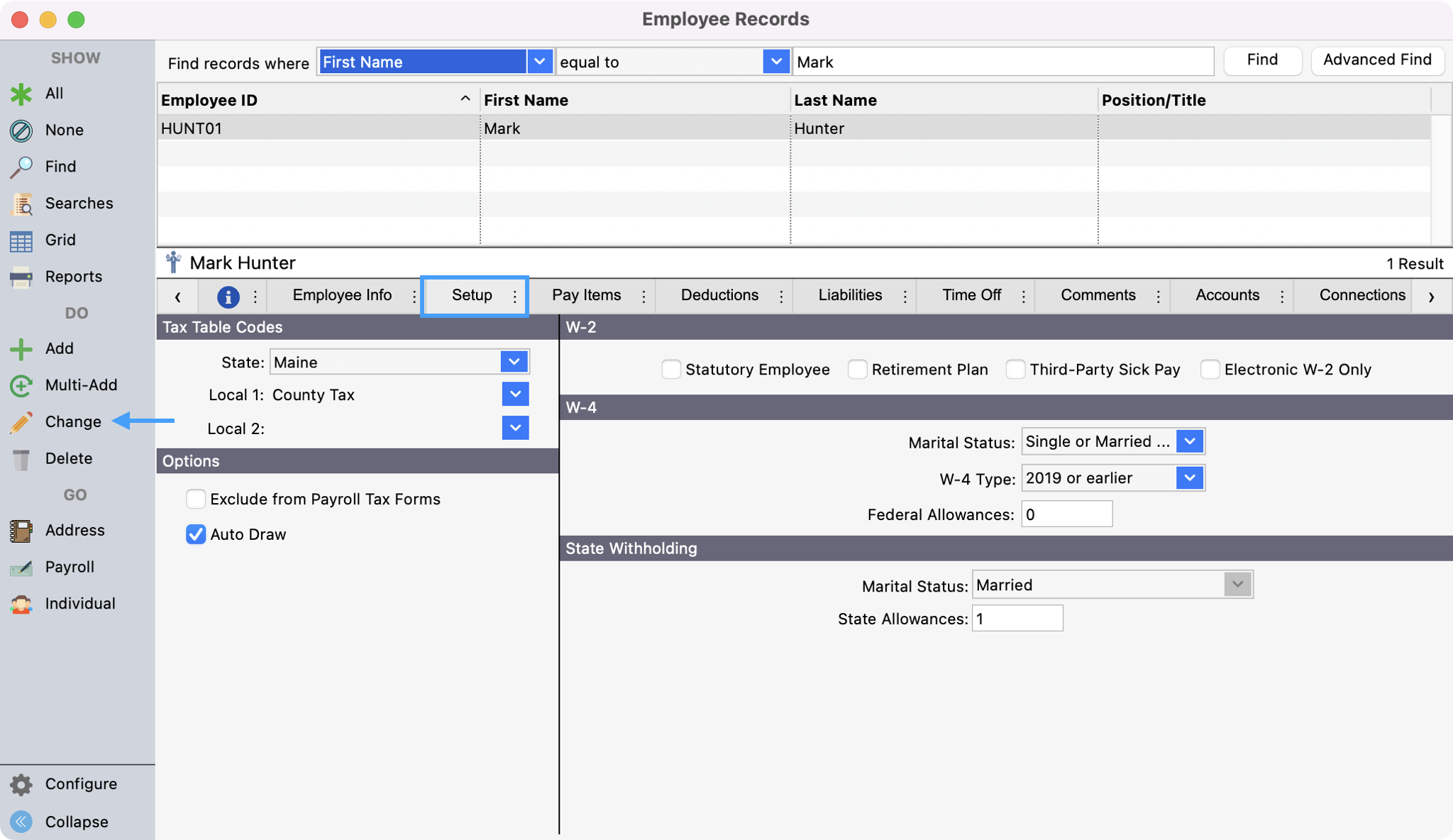

Click the Setup tab and then click on Change from the left sidebar.

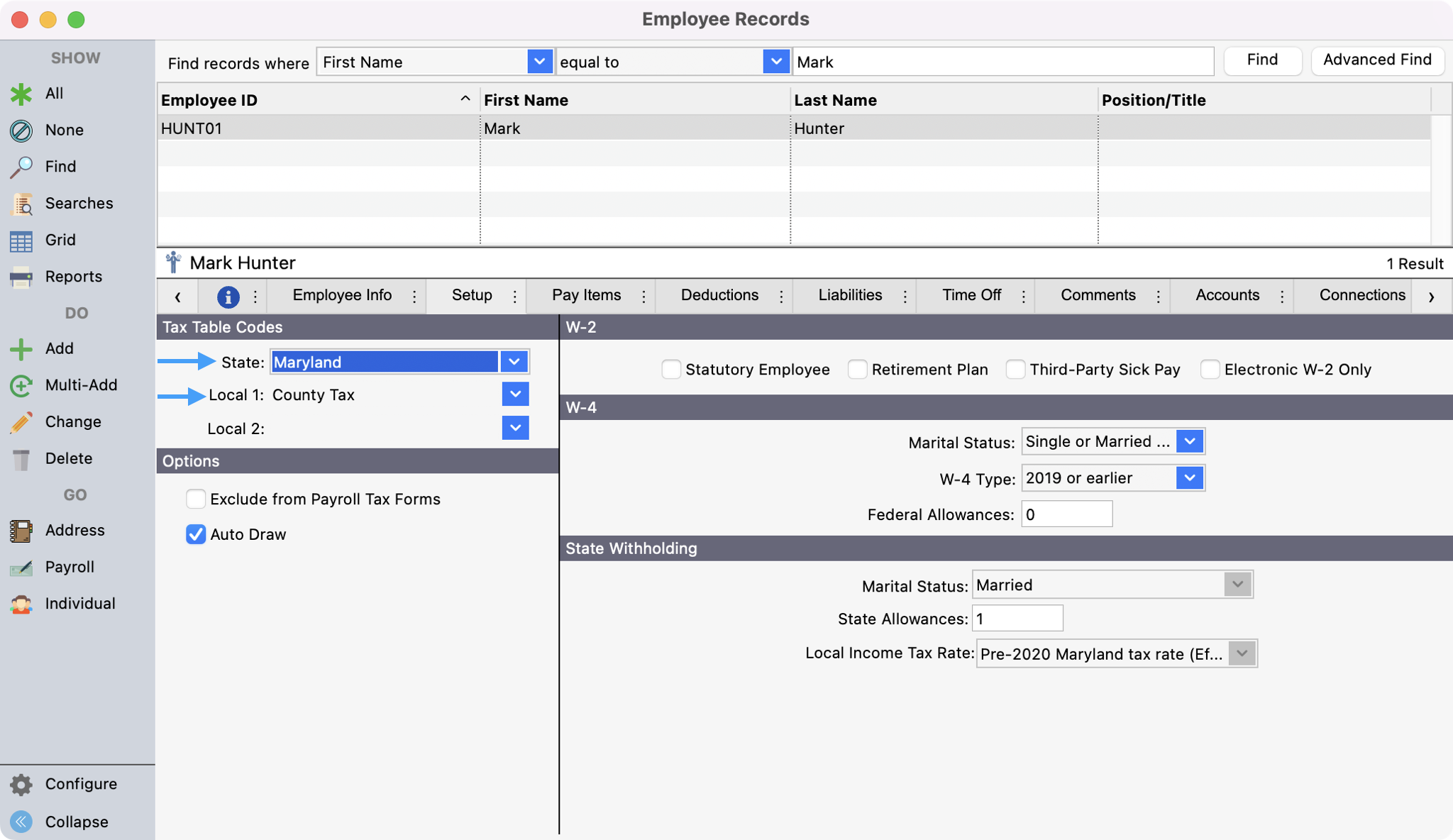

Ensure the state is set to Maryland and choose the appropriate Local Income Tax Rate

Click Save and repeat for any other employees residing in Maryland

If the local income tax rate is not correctly set on the employee record, state tax withholdings may be incorrect and can result in under or over-withholding state taxes.