Correcting Taxable or W-2 Information Not Set Up Correctly

With un-posted payrolls, on the detail tab ,the W-2 information can be changed. For example, a Minister’s Housing was not marked as being exempt from Box 1 of the W-2. This change can be made on the payroll record if it has not been posted to the ledger.

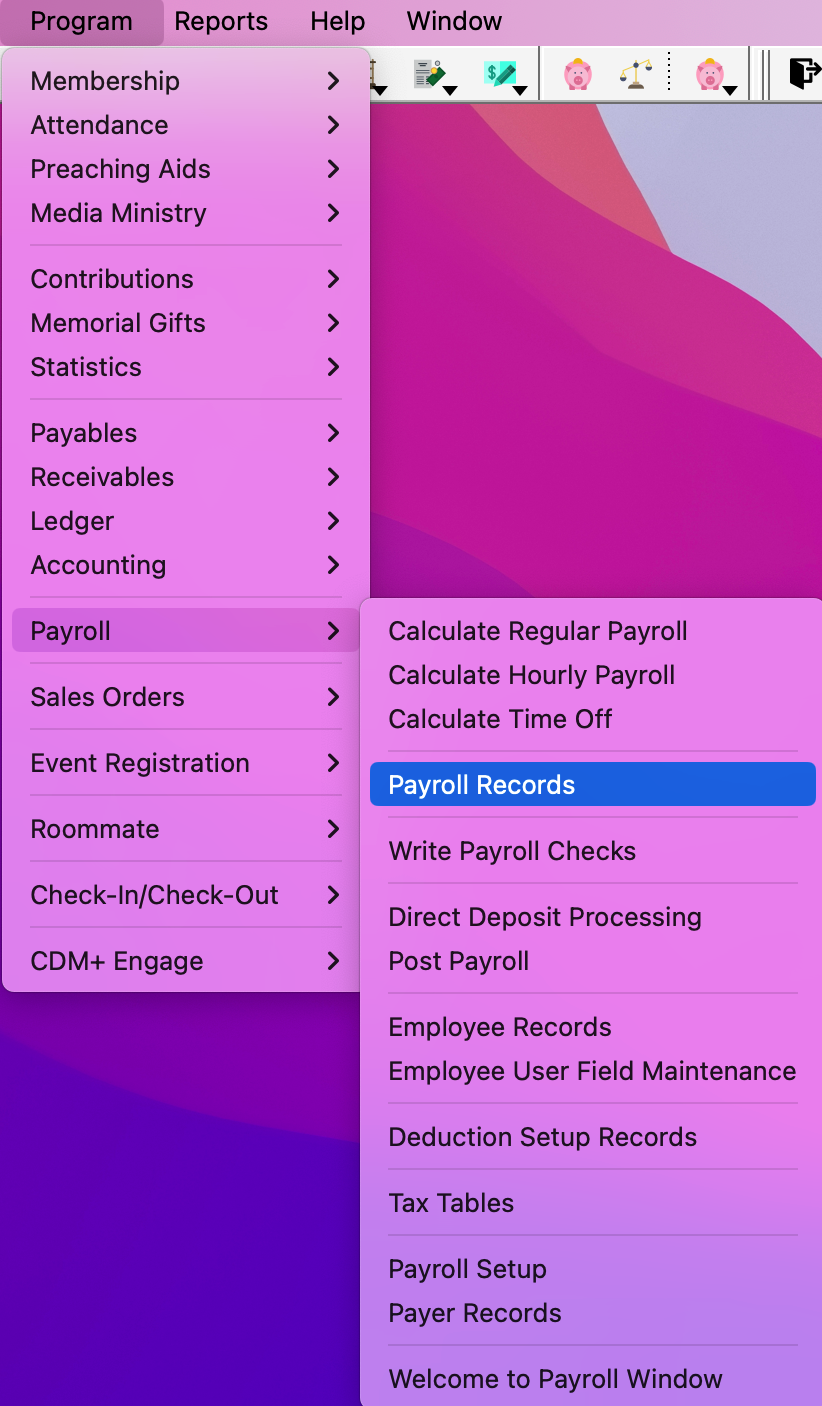

To make a change on a payroll record, go to Program → Payroll → Payroll Records.

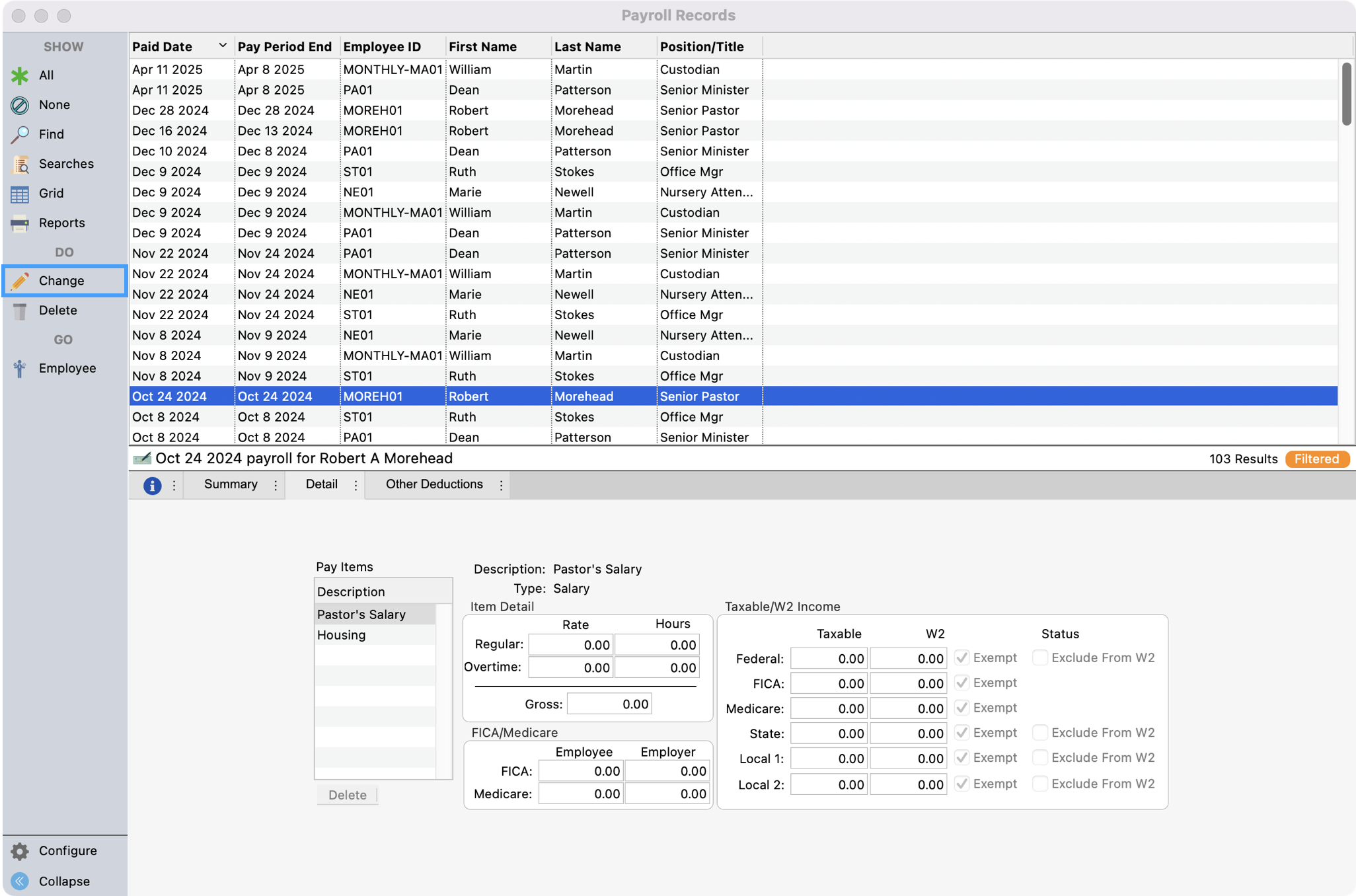

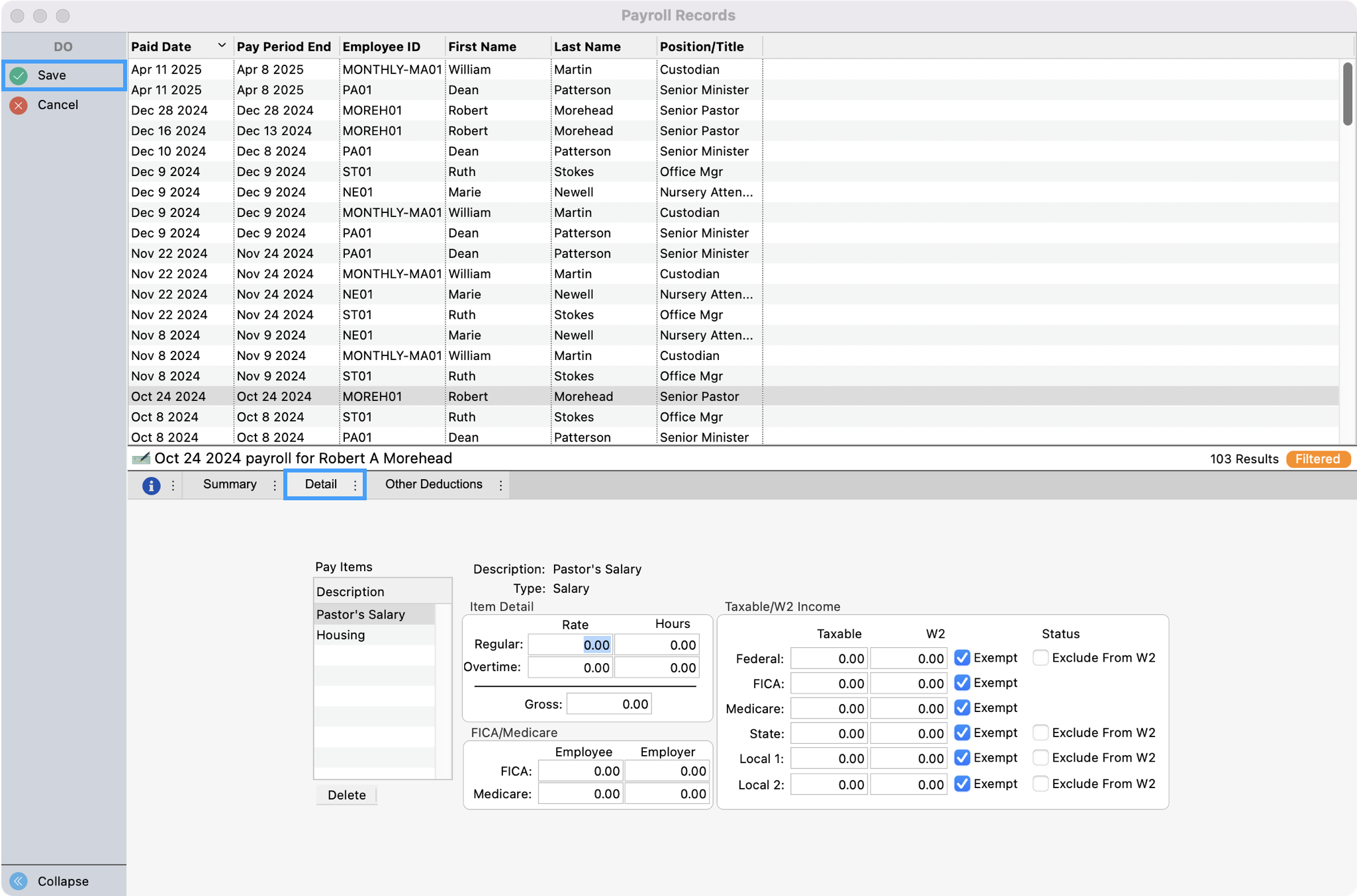

Find and select the payroll record you need and click Change from the left sidebar.

Click the Details tab and make any necessary changes. Save all your changes.

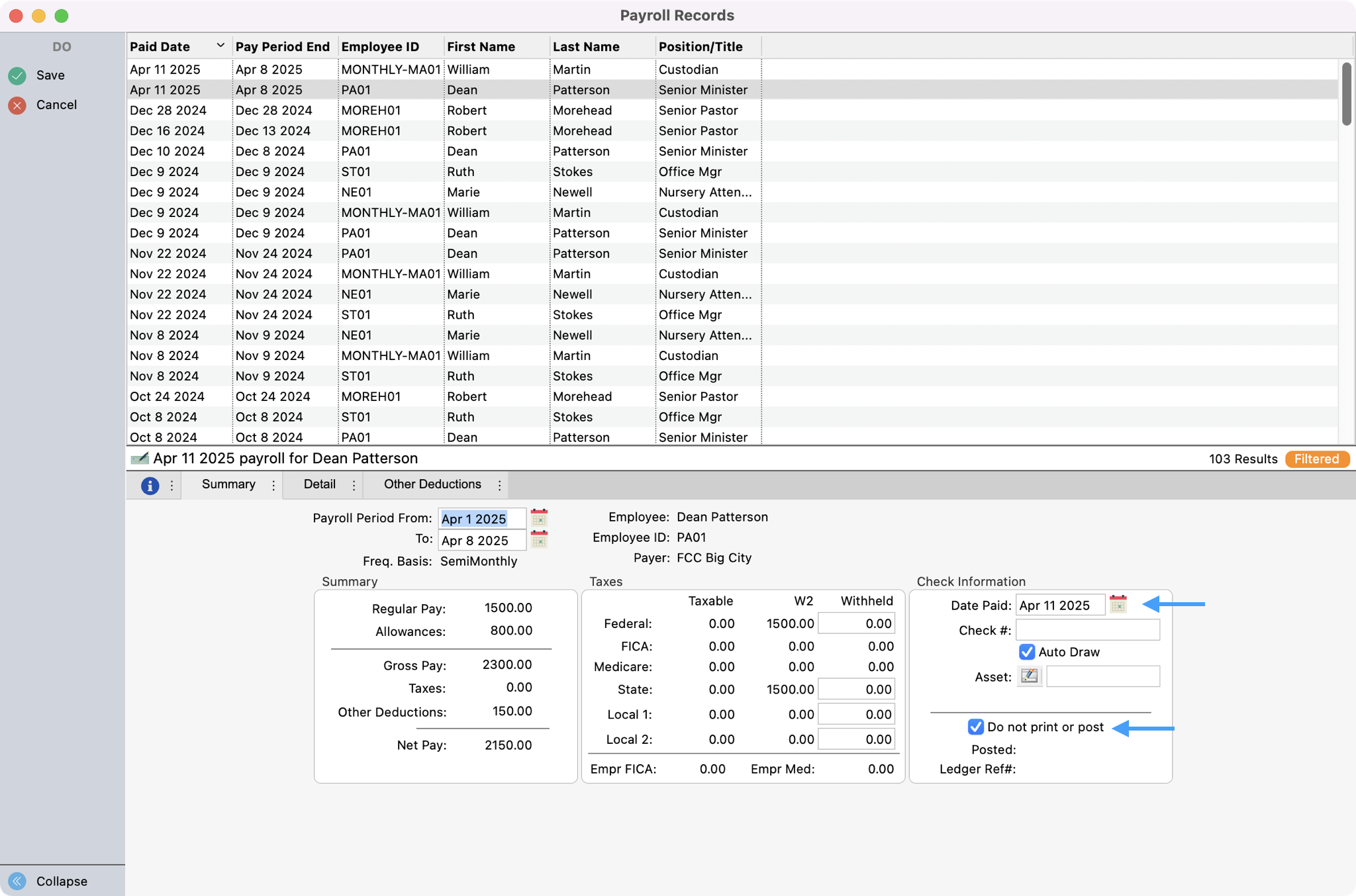

Another option is to enter a payroll record to adjust the W-2 totals. If an adjusting record is entered, the Date Paid must be filled in, and the Do not print or post checkbox would be checked.