How to put in imputed income for end of year taxes

There are times users need to add imputed income onto their payroll record, so it shows up on the W2 properly. This would be things such as insurance or fair rental value of parsonage lived in. They do not get a check for it, and it does not post to the user's ledger. It is just for reporting purposes.

Please seek the assistance of a CPA if you have any questions about adding imputed income to your W-2/W-3 forms.

Steps to Add Imputed Income

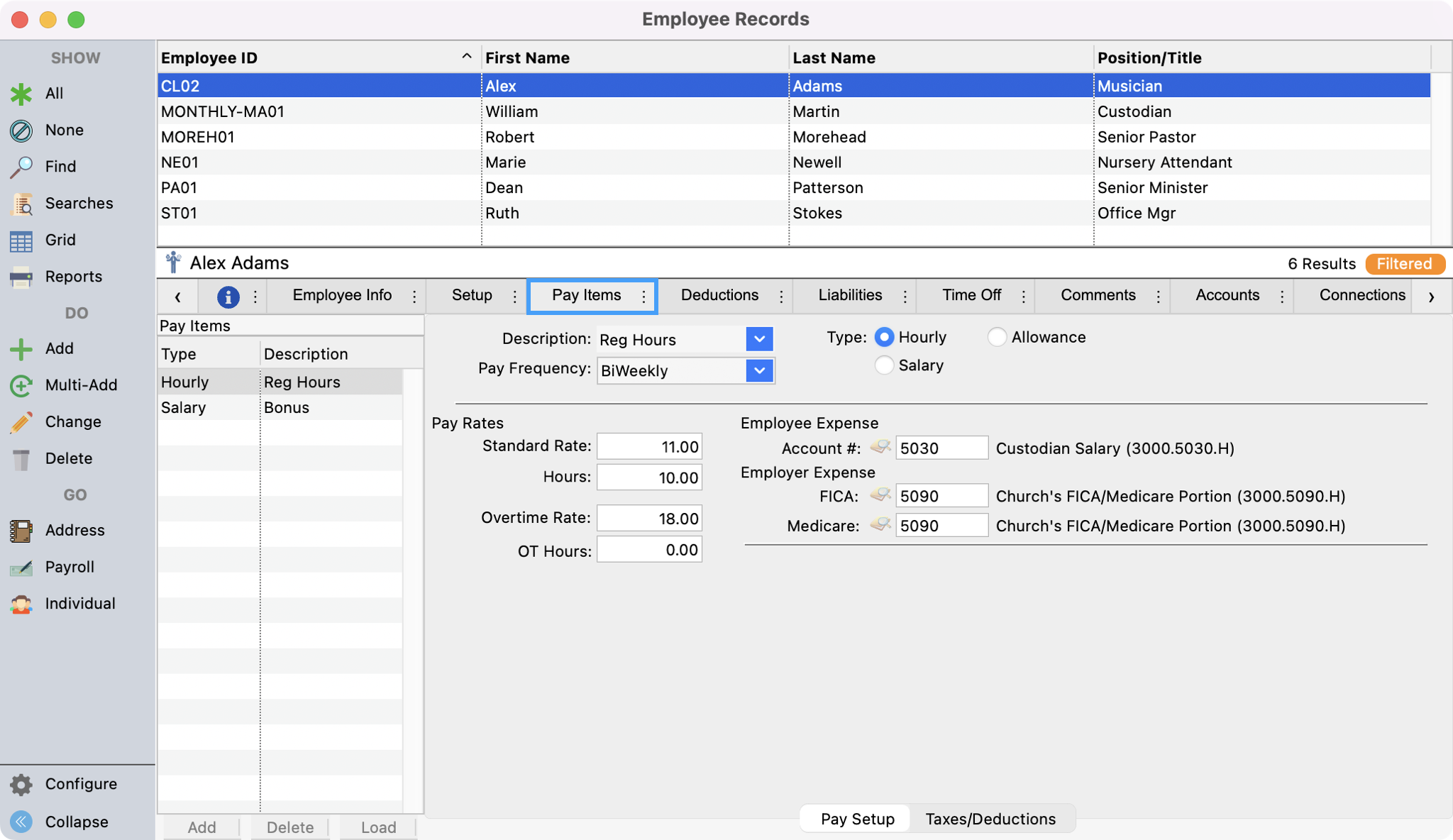

Open Employee Records (Program → Payroll → Employee Records)

Find the employee's record, click to highlight their record, and click Pay Items.

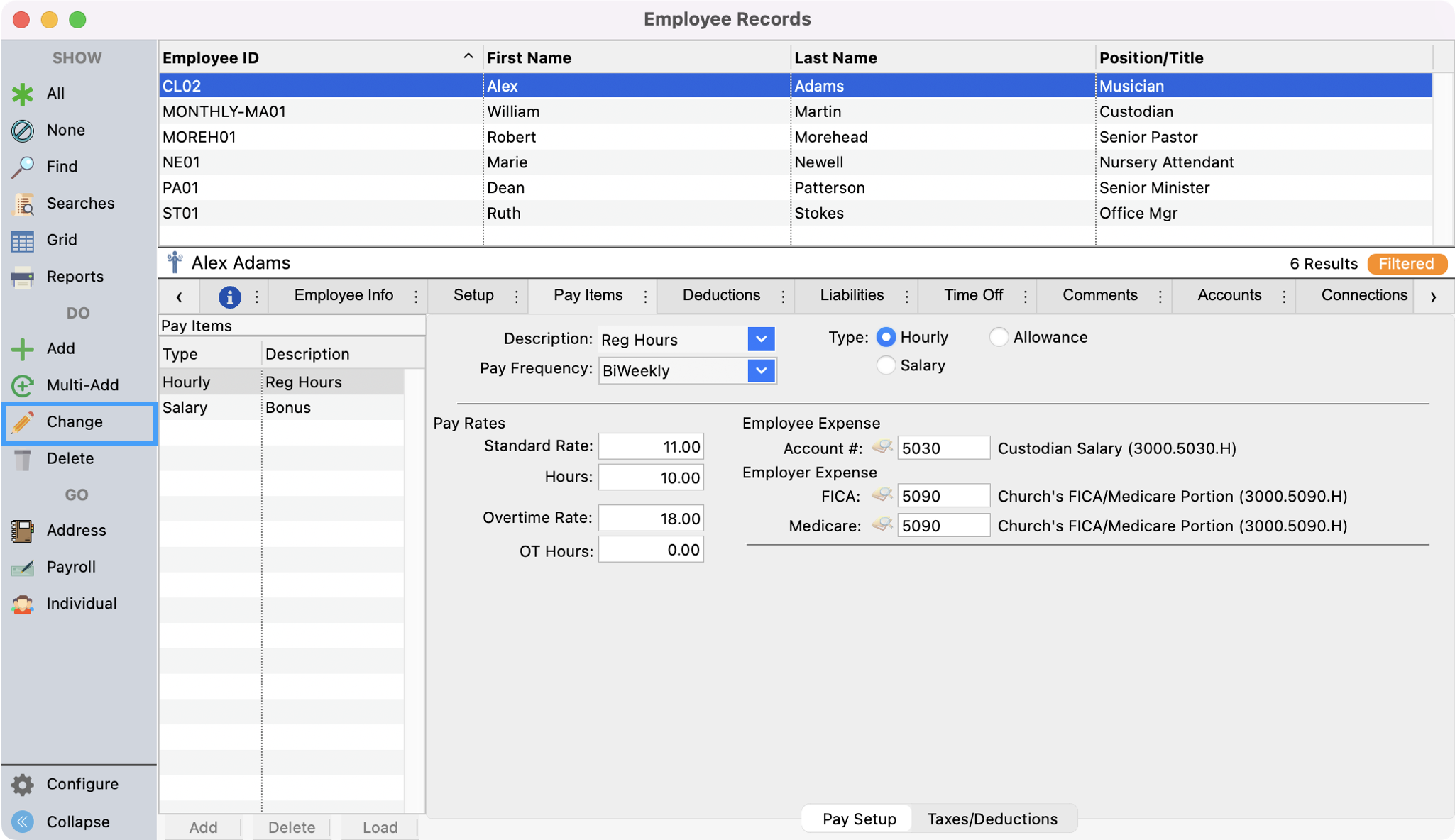

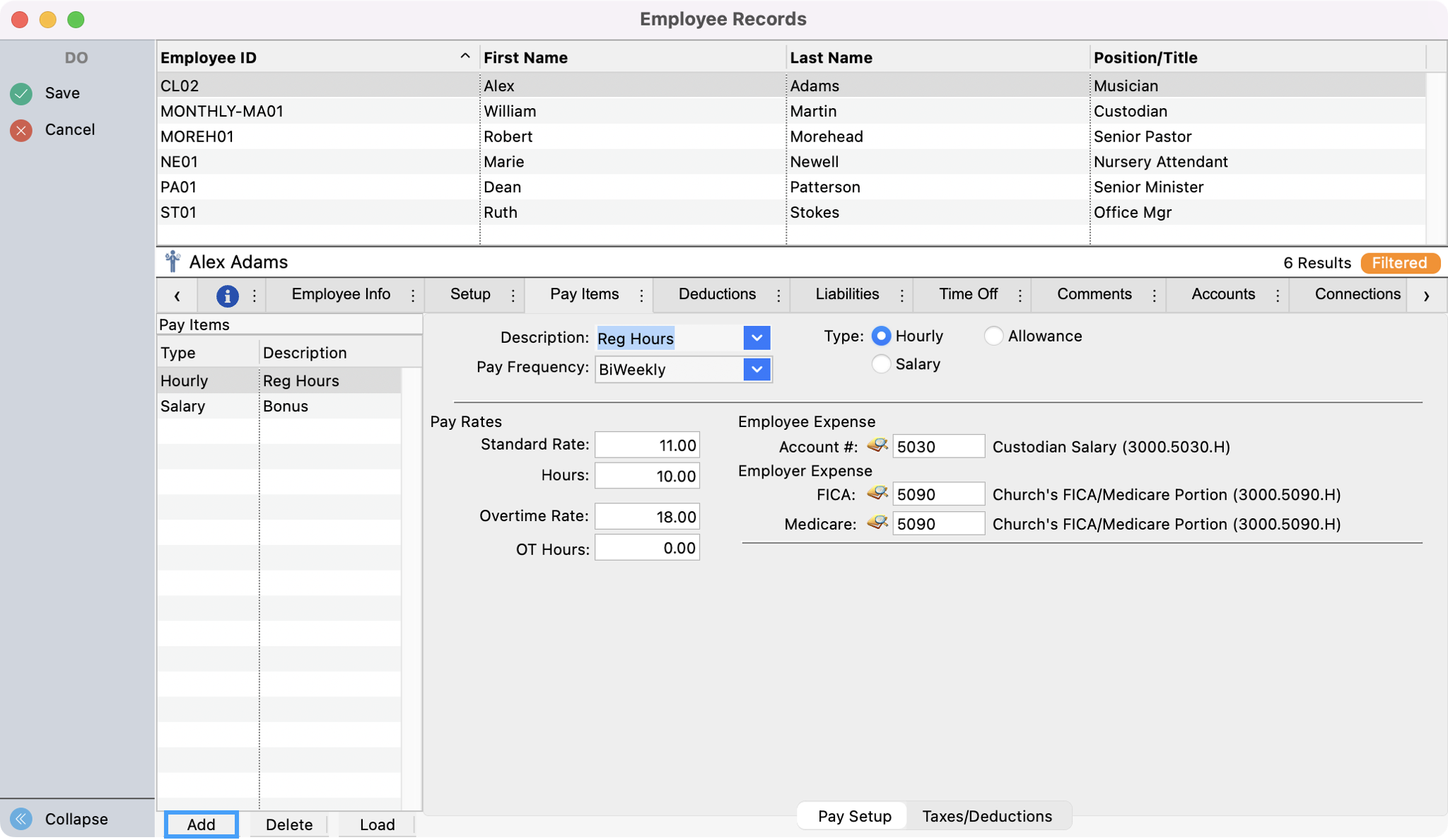

Click Change from the left sidebar and then Add in the bottom left of the Pay Items tab window.

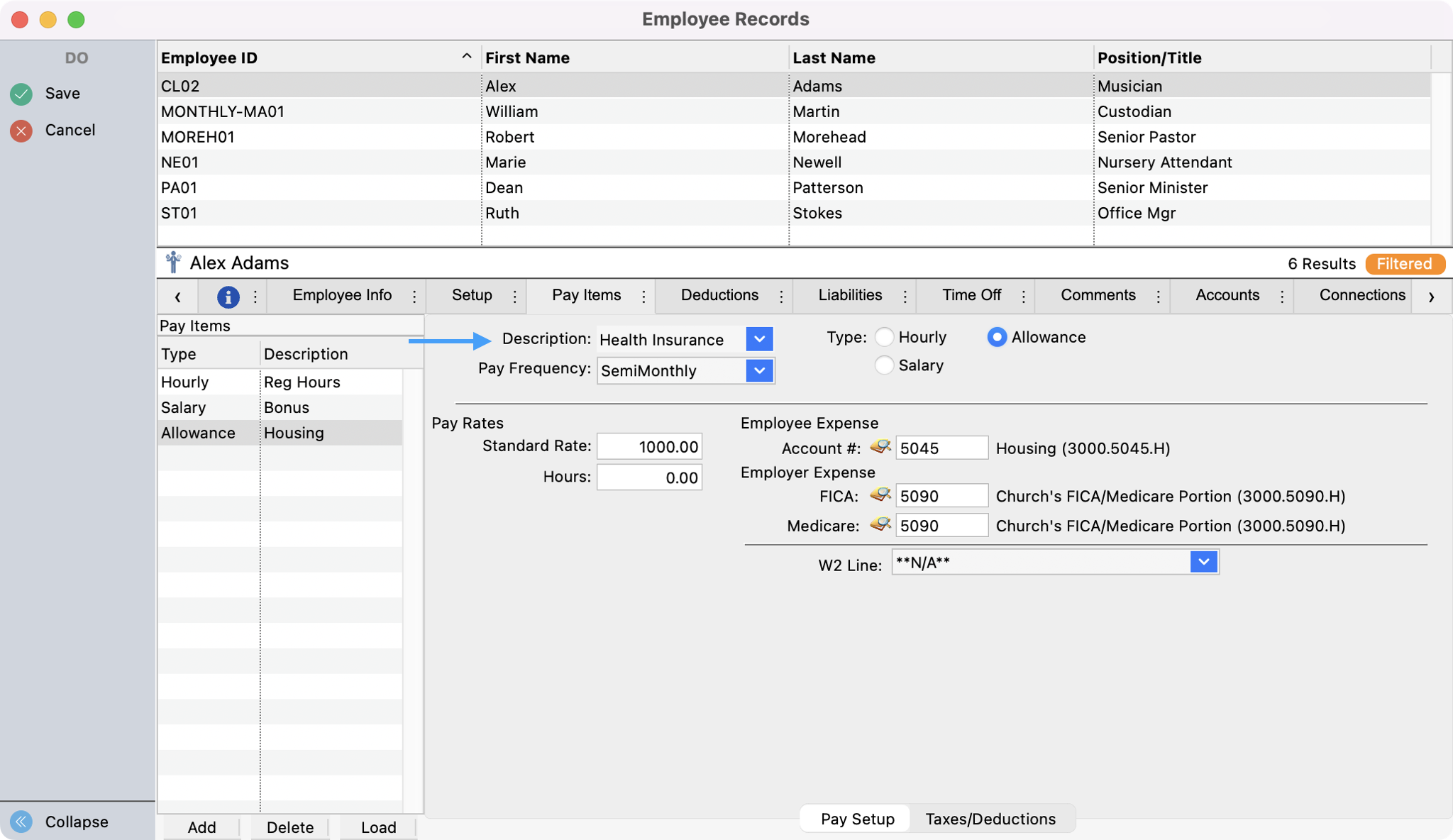

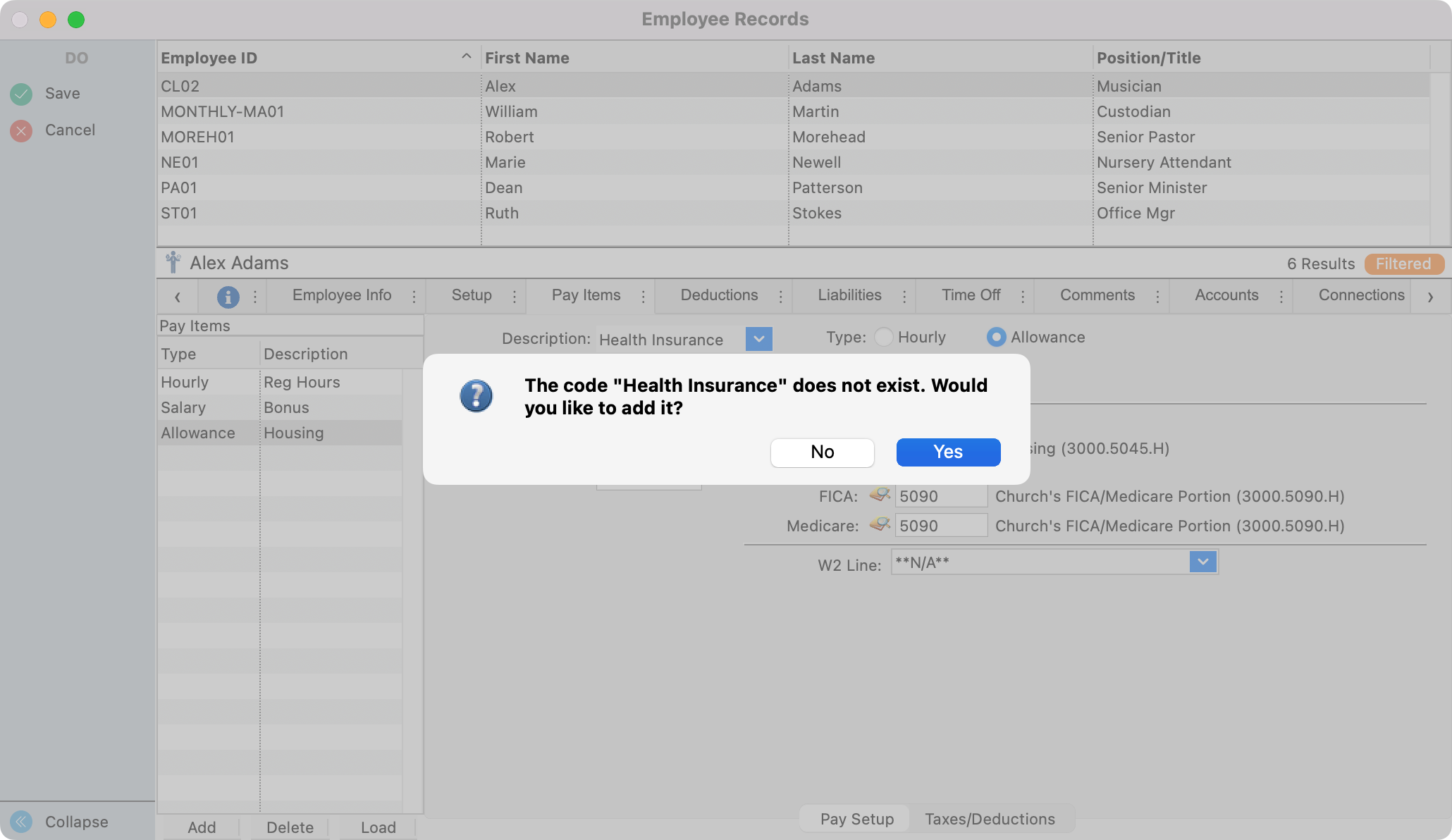

In the Description field select 'Health Insurance' or add it by entering the text Health Insurance, clicking tab, and selecting Yes.

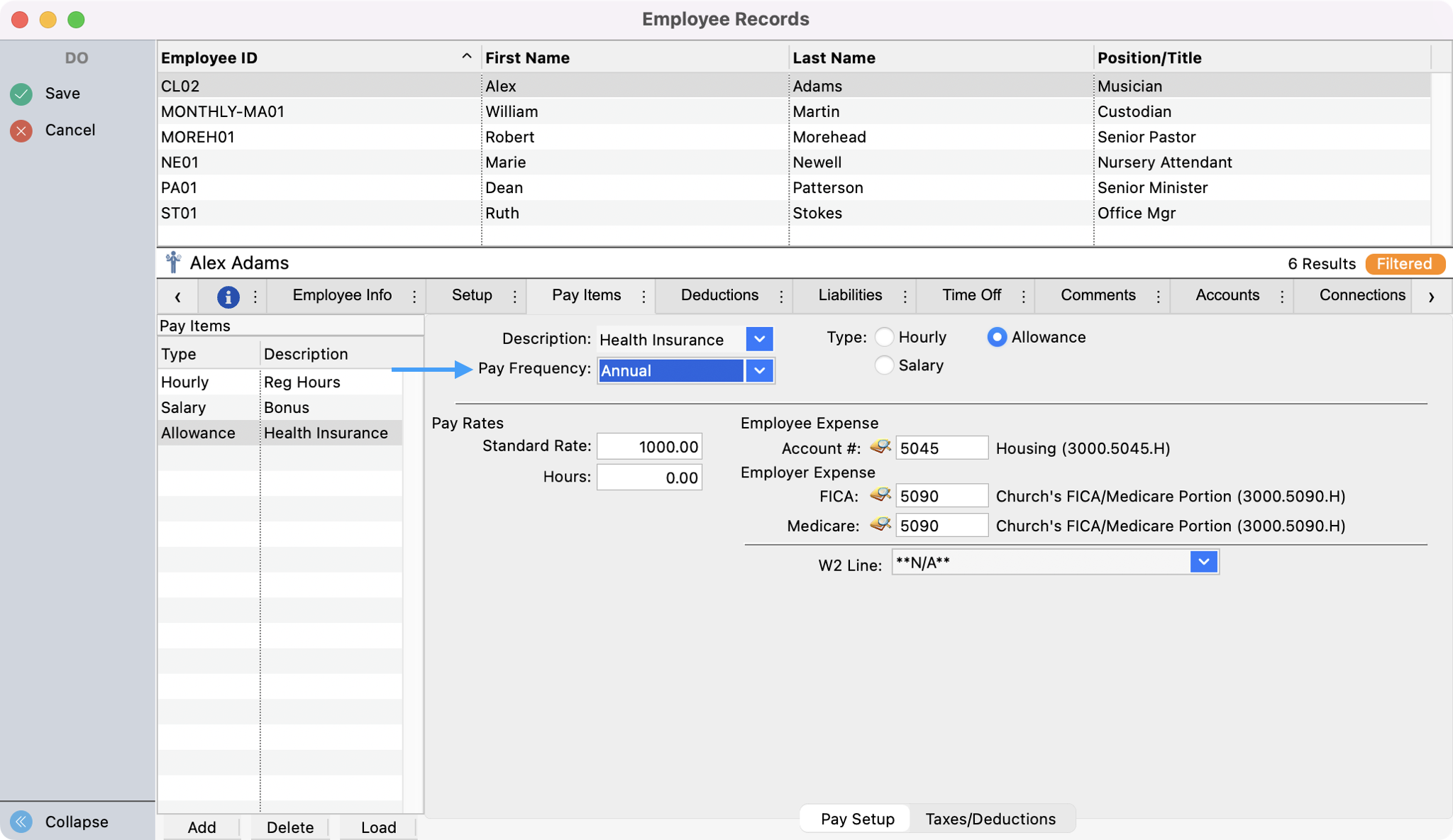

Select a Pay Frequency of Annual.

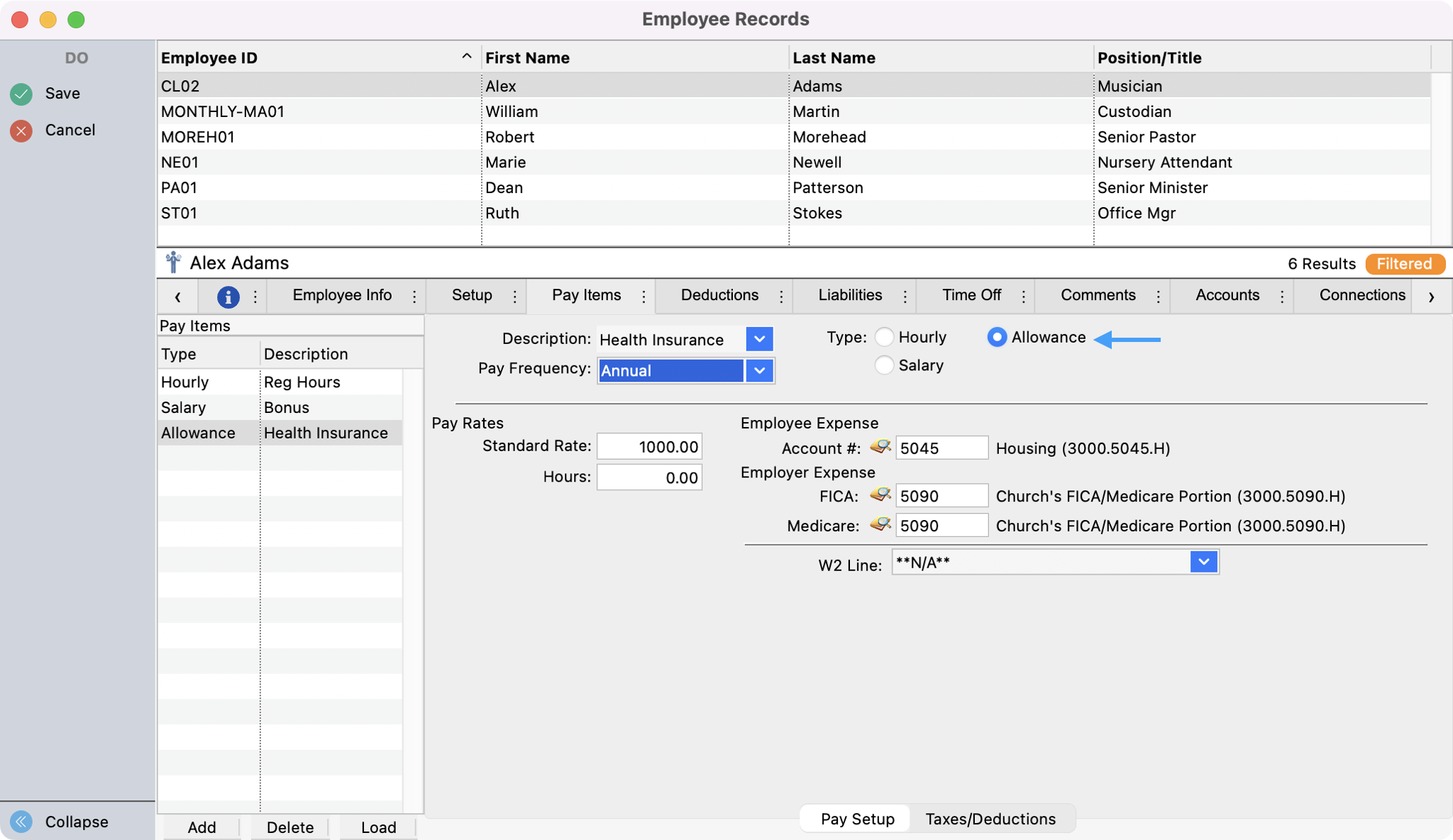

Select the Type, Allowance.

Under Pay Rates, enter in the total amount for the health insurance for the year.

Select the appropriate code for the imputed income (in our case we are showing employer sponsored health coverage with is Box 12 - Code DD1 )

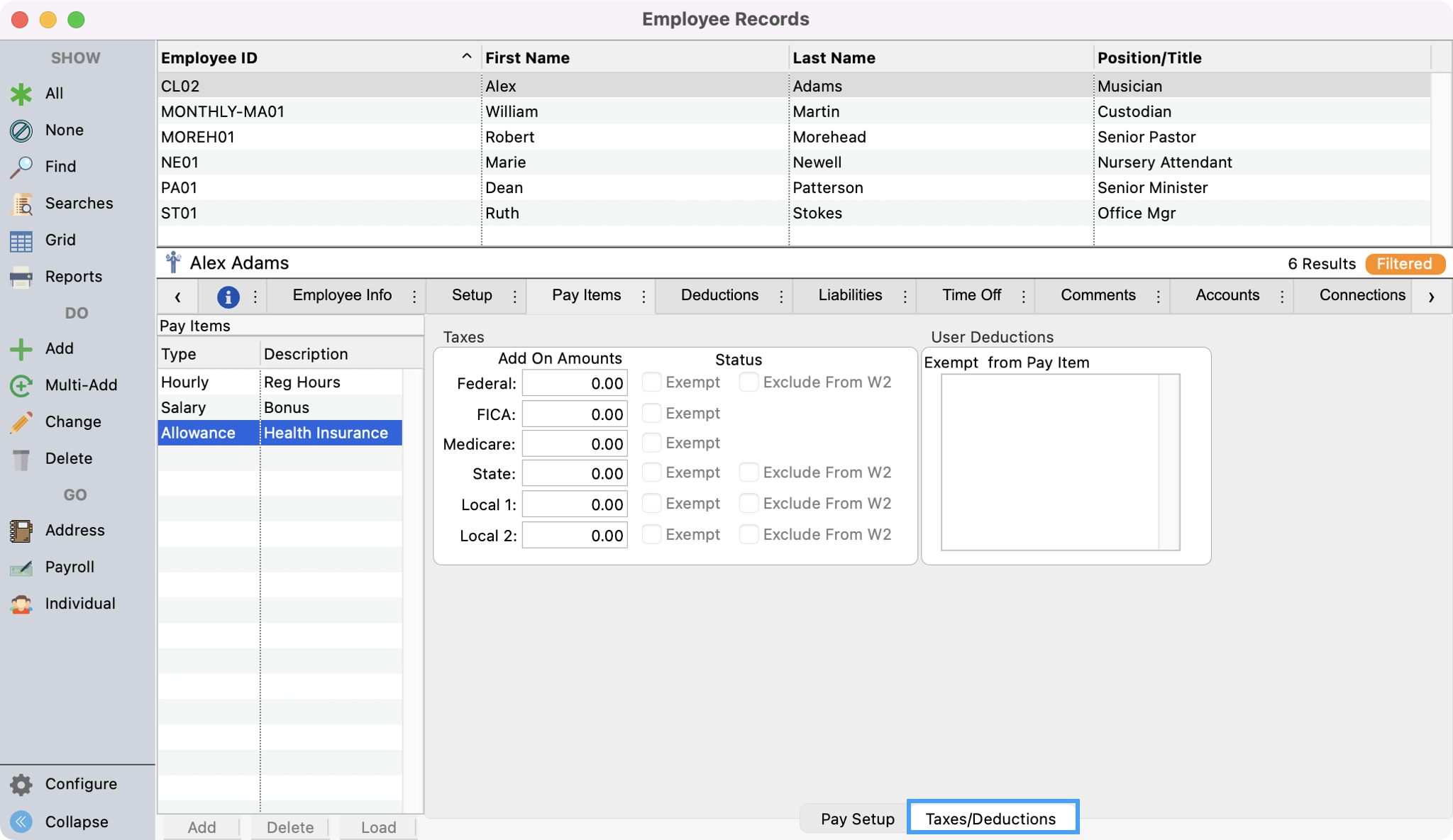

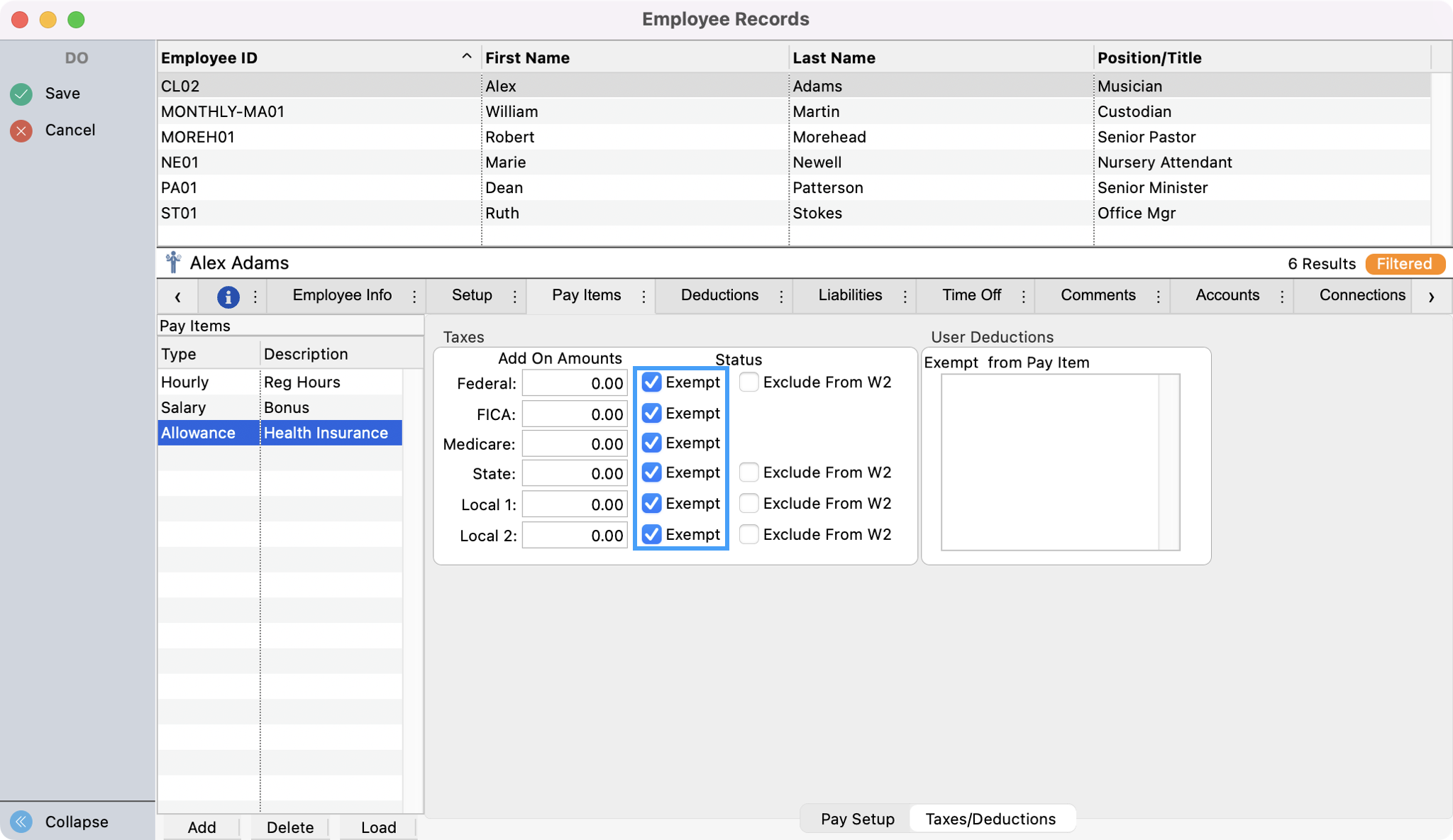

Select the Taxes/Deductions tab at the bottom of the Pay Items window.

Place checks in all Exempt checkboxes.

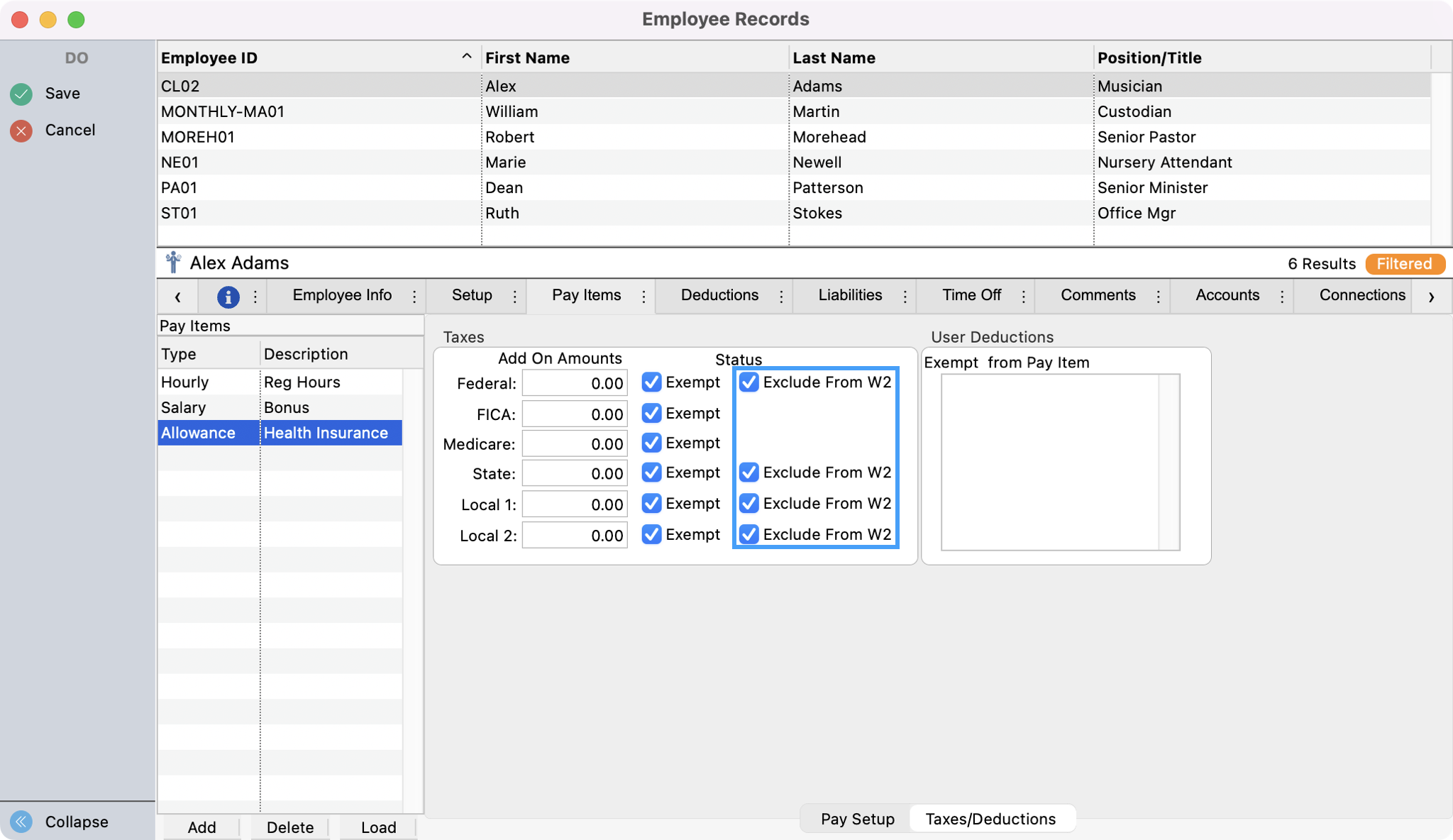

Place checks in all Exclude from W2 checkboxes (this will exclude this pay item from displaying in Box 1 of the W-2).

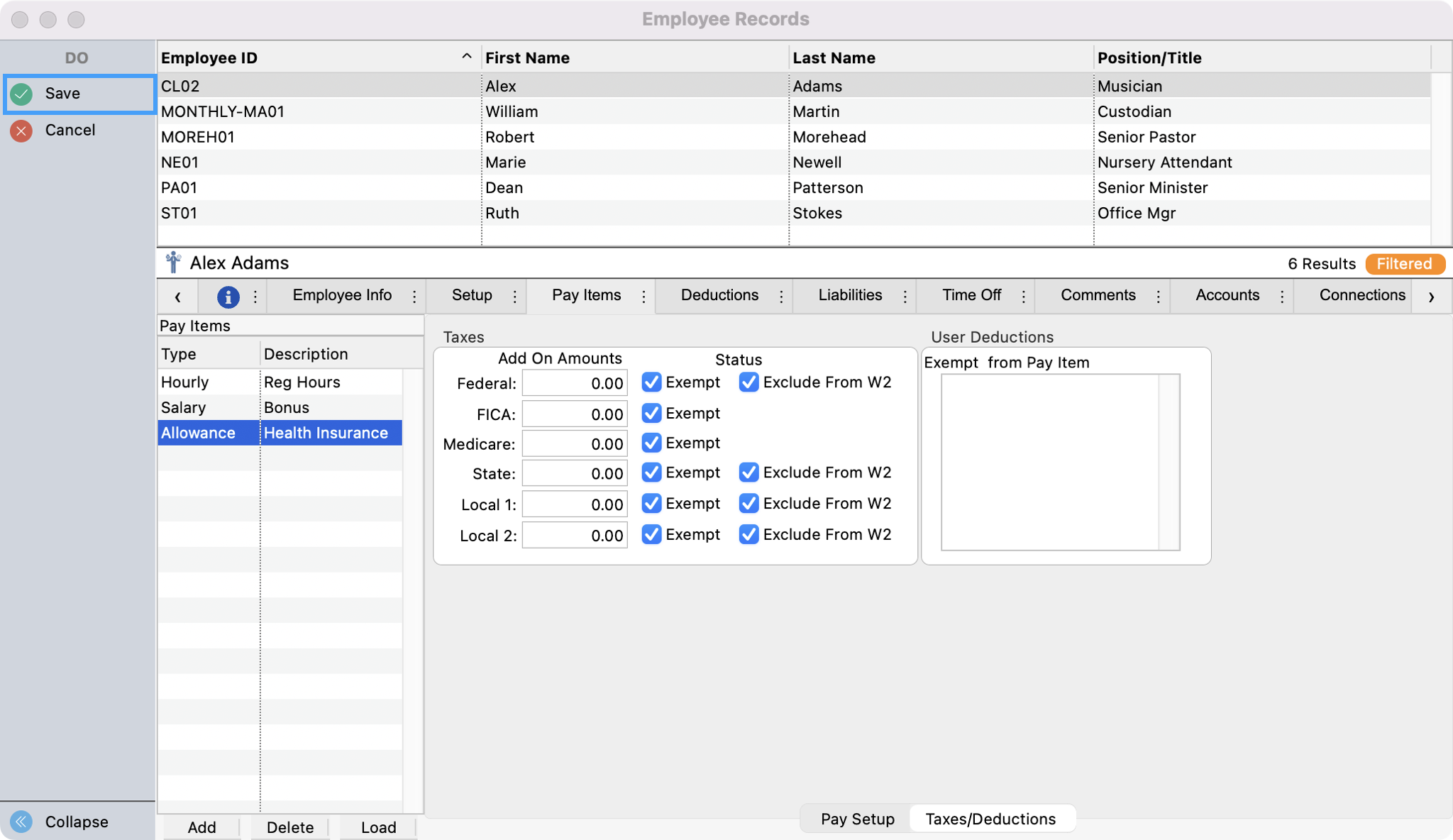

Click Save in the upper left sidebar.

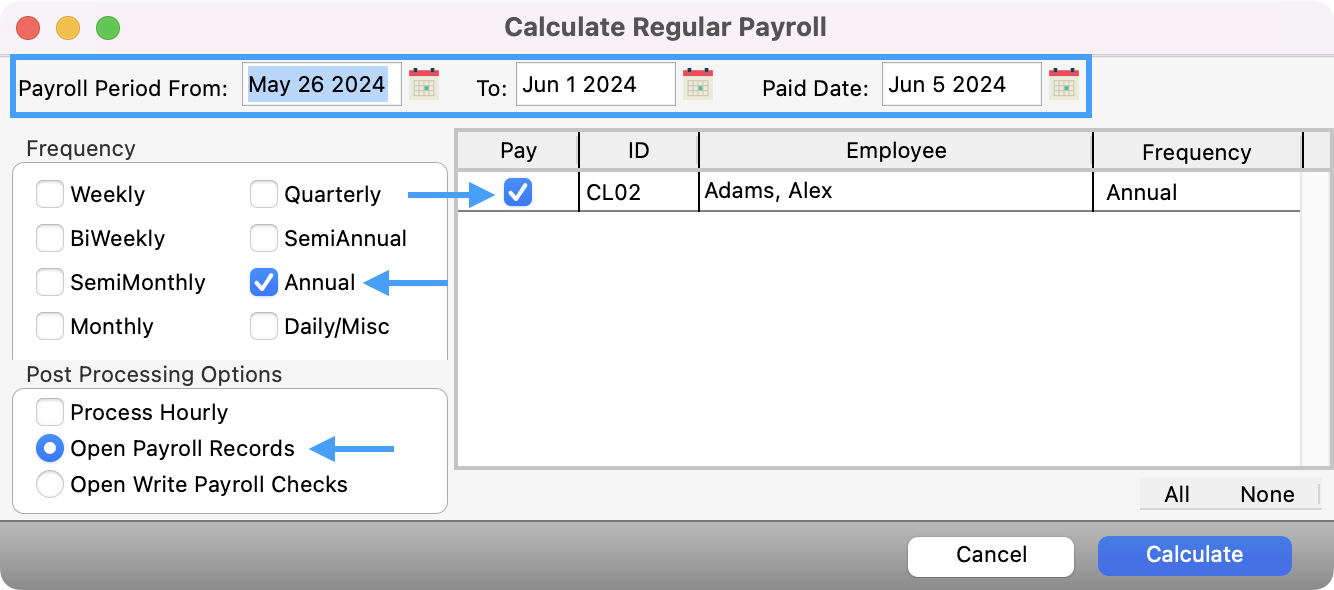

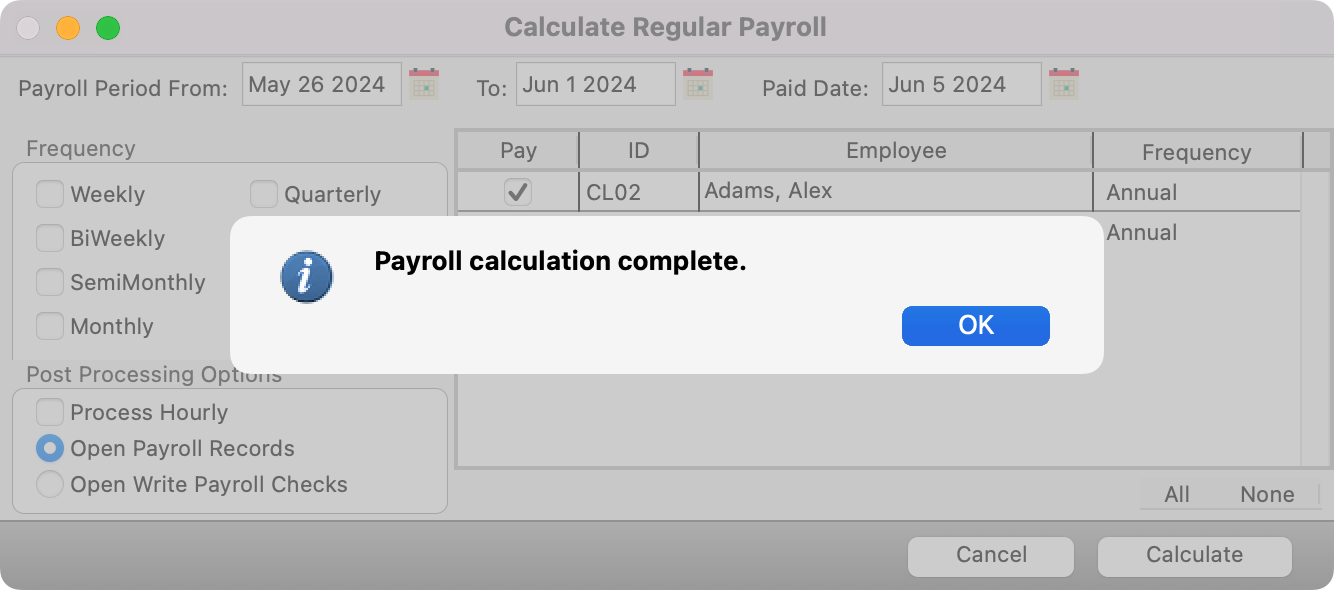

Open Calculate Payroll window (Program → Payroll → Calculate Regular Payroll).

Set the Payroll Period date range and Paid Date to dates not previously used. Then, set Frequency to Annual, put a check in the Pay checkbox next to the employee’s name (this will calculate the employee’s imputed income , and choose the Post Processing Option of Open Payroll Records. Click Calculate.

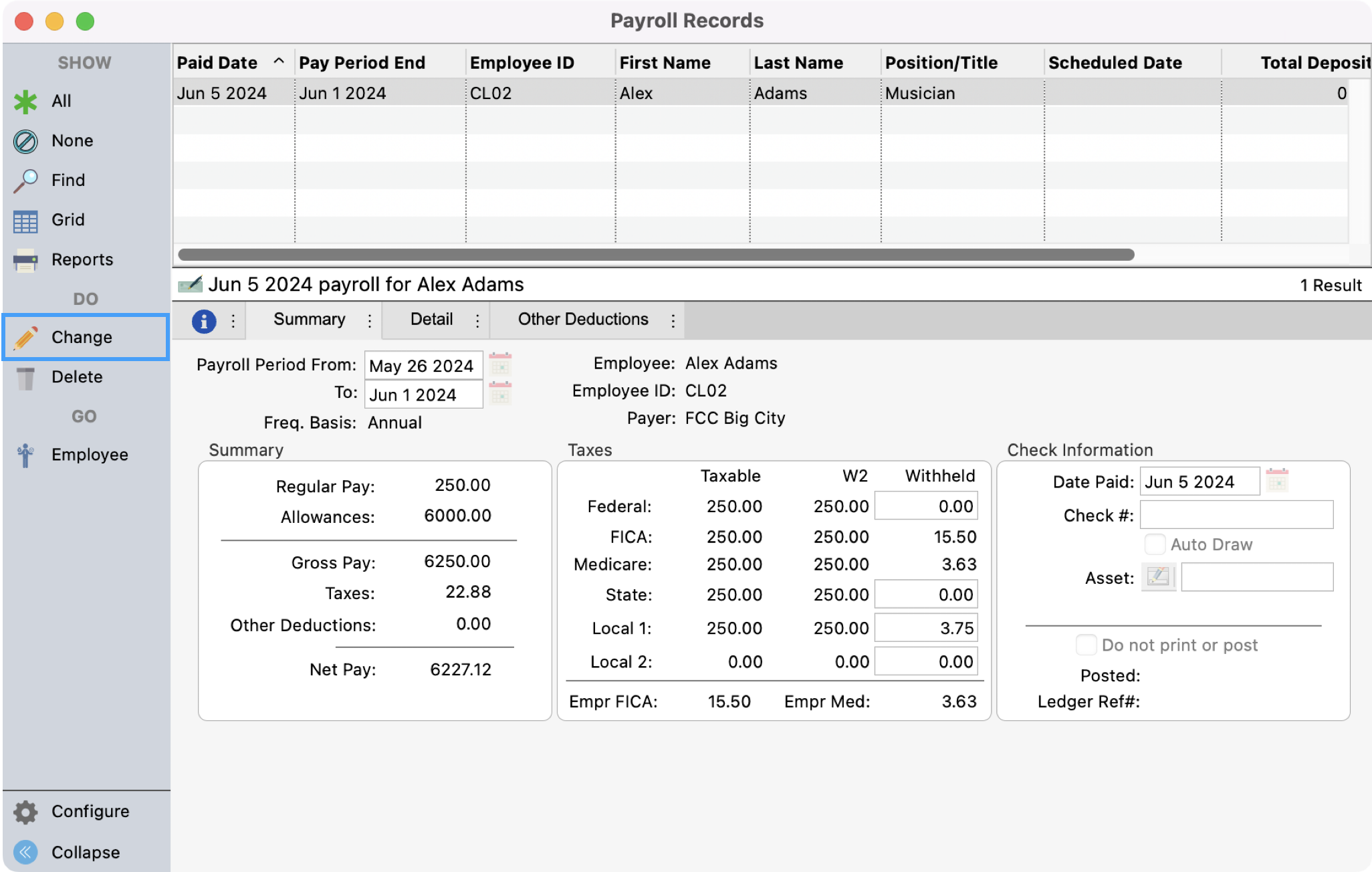

When calculation is complete and click OK. This opens the Payroll Records window. Click Change in this window.

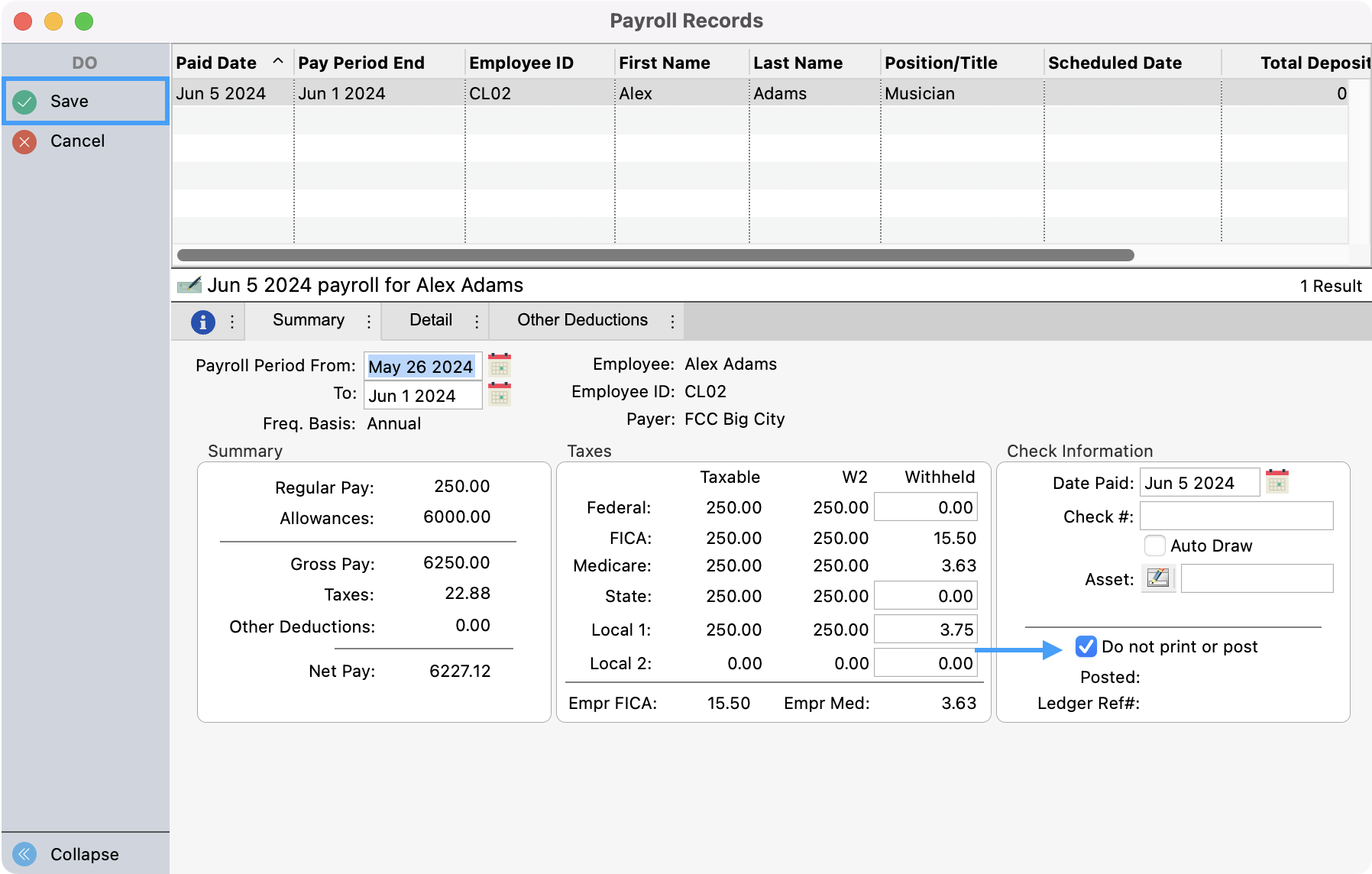

Place a check in the Do not print or post checkbox and click Save.

Now, the imputed income will show in your printed/e-Filed W-2/W-3 forms.

1 https://www.irs.gov/affordable-care-act/form-w-2-reporting-of-employer-sponsored-health-coverage