Search Transactions by Date

Search Transactions allows you to:

- Locate electronic payments

- Check their status (processing/cleared/returned/refunded)

- View information about the transaction

- Refund the transaction

- Print a transaction receipt

Searching Transactions

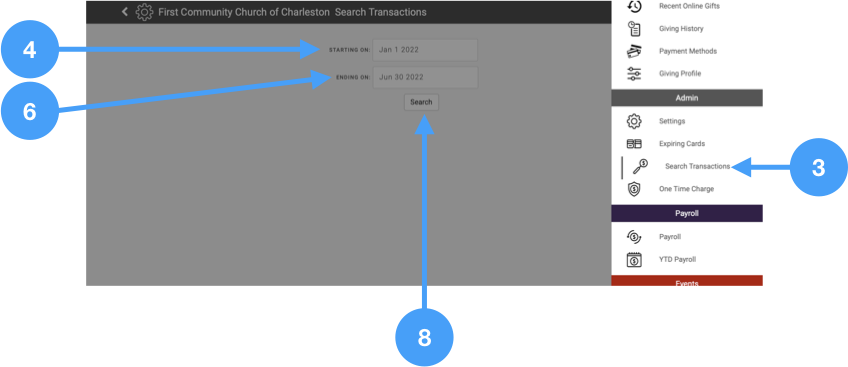

Provide a date or date range during which the transaction was made to locate transactions.

- Log into Engage as an Administrator

- Go the navigation menu and choose Admin

- Go to the navigation menu and choose Search Transactions

- Click Starting On

- Select a date

- Click Ending On

- Select a date

- Click Search

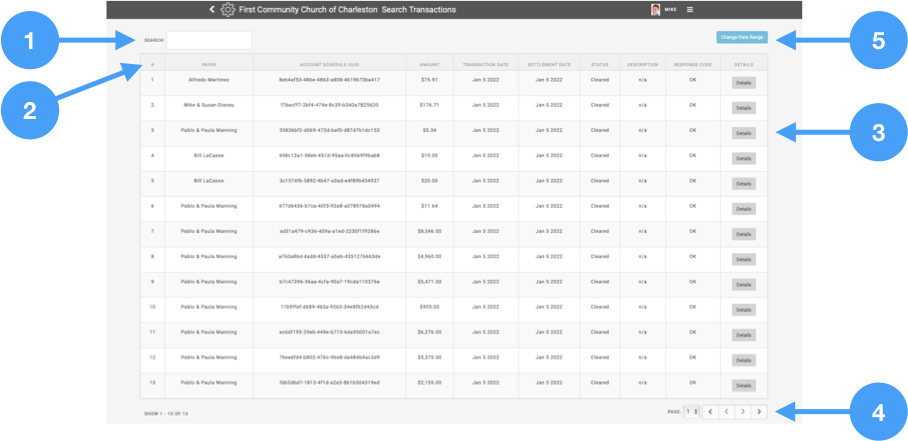

Viewing Transactions

A list of transactions made during the selected date range will appear. You will see:

- # Search result order

- Payer who made the payment

- Account Schedule GUID a unique identifier for this payment (see below)

- Amount total amount of the payment

- Transaction Date date the transaction was initiated

- Settlement Date date the transaction was settled into your organization's bank account

- Status

- Processing the transaction has been initiated by not yet confirmed

- Cleared the transaction was successfully processed by the payer's financial institution

- Returned the transaction failed

- Risk Hold the transaction has been placed on hold

- Description the reason for the transaction (gift, event payment, etc.)

- Response Code

- OK for a successful transaction

- A1 for a refunded transaction

- Another value for a returned transaction

- Details view more details about the transaction

You can:

- Search within the list against any column

- Click a column header to sort the list

- Click Details to view more information abut the transaction

- Navigate between pages of results

- Change the date range to search different dates

Transaction Details

Click Details to view more details about a transaction.

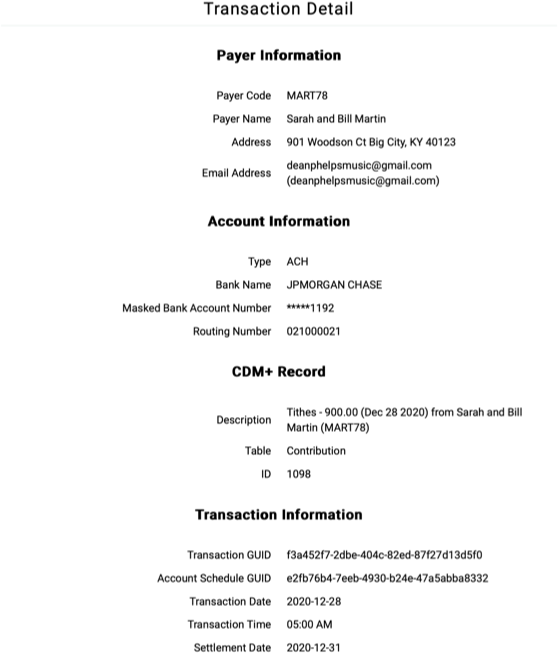

Payer Information

- Payer Code the giving unit or customer code

- Payer Name the name of the payer

- Address the street address associated with the payment

- Email Address the email address where the payer will be contacted regarding the payment

Account Information

- Type ACH for bank withdrawal (eCheck) or the credit/debit card type (VISA/MasterCard/American Express/Discover)

- Nickname the name the payer used for this payment method

Bank Accounts

- Bank Name the bank name

- Masked Bank Account Number the bank account number showing the last 4 digits only

- Routing Number the routing number for the bank

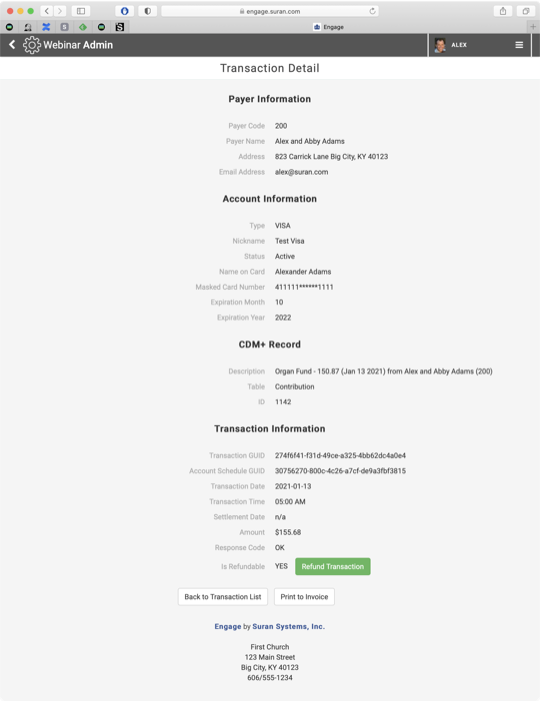

Credit/Debit Cards

- Status the current status of the payment method

- Active this payment method is valid

- Expired the payment method has expired

- Cancelled the payment method has been cancelled

- Name on Card the name associated with the payment method

- Masked Card Number the masked account number showing the BIN and the last four digits of the card number

- Expiration Month the expiration month of a credit/debit card

- Expiration Year the expiration year of a credit/debit card

CDM+ Record

- Description a description of the related record in CDM+ (gift, event payment, etc.)

- Type the type of related record

- ID/Reference the unique identifier for this record

Transaction Information

- Transaction GUID a unique identifier for the transaction (see below)

- Account Schedule GUID a unique identifier for the payment (see below)

- Transaction Date date the transaction was initiated

- Transaction Time the time the transaction was initiated

- Settlement Date date the transaction was settled into your bank account

- Amount the total amount of the transaction

- Response Code

- OK for a successful transaction

- A1 for a refunded transaction

- Another value for a returned transaction

- Is Refundable YES if the transaction can be refunded; NO if it can't be refunded

Account Schedule and Transaction GUIDs

A transaction can have two unique identifiers:

- Account Schedule GUID

- Transaction GUID

All transactions will immediately have an Account Schedule GUID. The Transaction GUID will be available once the financial transaction has occurred.

The following circumstances affect how and when these two identifiers apply.

Single vs. Multiple Payments

A payment that occurs once will have a unique Account Schedule GUID. A payment that occurs multiples times will:

- Have the same Account Schedule GUID for all payments

- Have a unique Transaction GUID for each payment

- Have a unique Transaction Date for each payment

Future Payments

A future payment will have an Account Schedule GUID immediately assigned, but a Transaction GUID will not appear until the payment occurs.

ACH Payments

ACH payments are processed in a daily batch. A Transaction GUID will not appear until the payment is processed.

Refunding a Transaction

Click Refund Transaction to return the payment to the payer's account. Note:

- Transaction fees will occur on the refund for the same amount as the original transaction

- Transactions made over 120 prior to today's date will not be refundable

Print Receipt

Click Print Receipt to print a receipt of the transaction.