Verifying Balance Sheet Payroll Liabilities

Payroll is done on an accrual basis of accounting. What this means is that at the time payroll is calculated, the Gross amount of pay is expensed, but the reduction in cash only reflects the Net amount of the pay. The total amount of each deduction or tax that is withheld is held in the corresponding liability account. When taxes and other withholding items are paid, then the liability account is debited and cash is credited.

You can use the Trial Balance Report to see this.

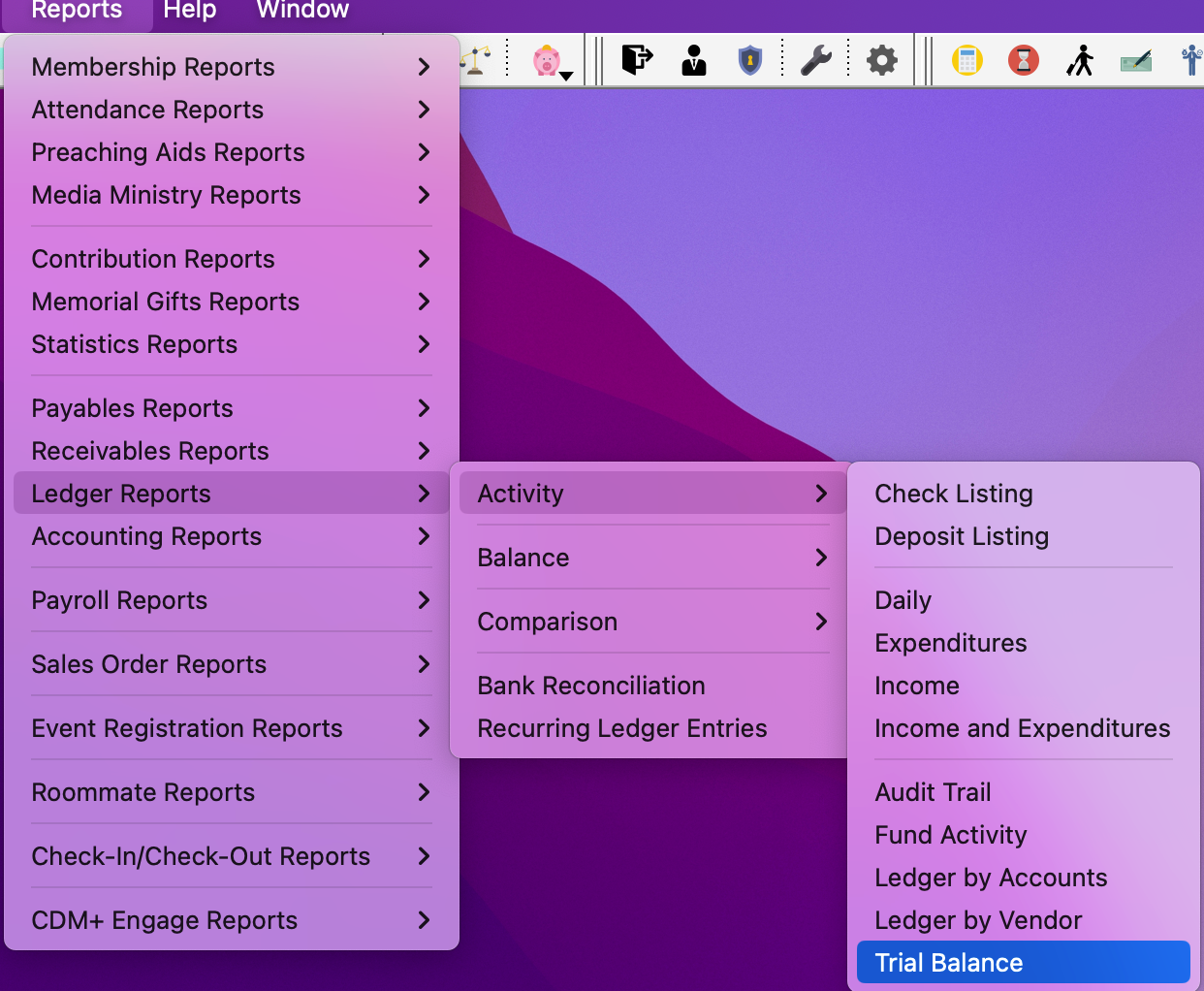

Go to Reports → Ledger Reports → Activity → Trial Balance

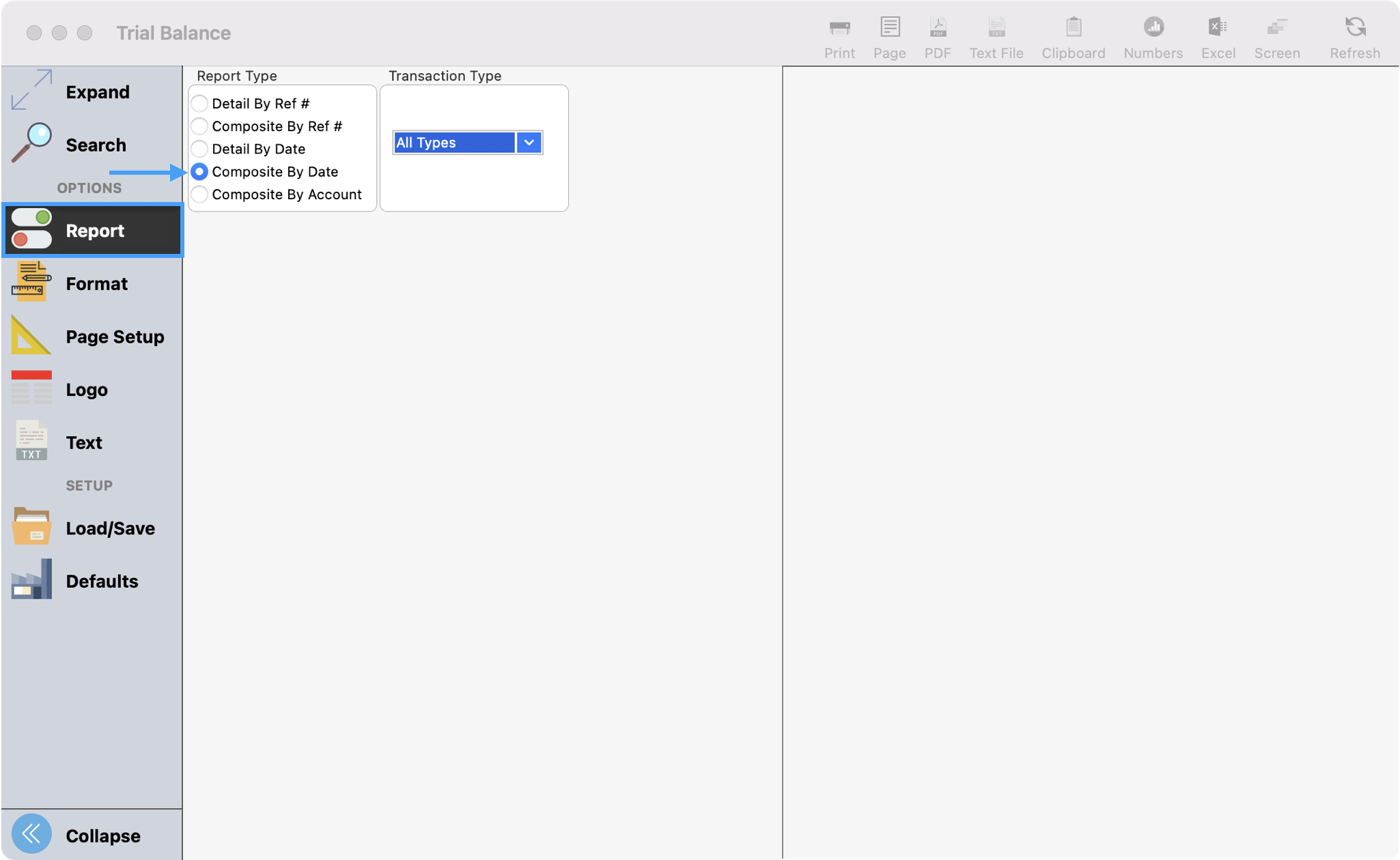

Click Report from the left sidebar and choose Composite By Date under Report Type.

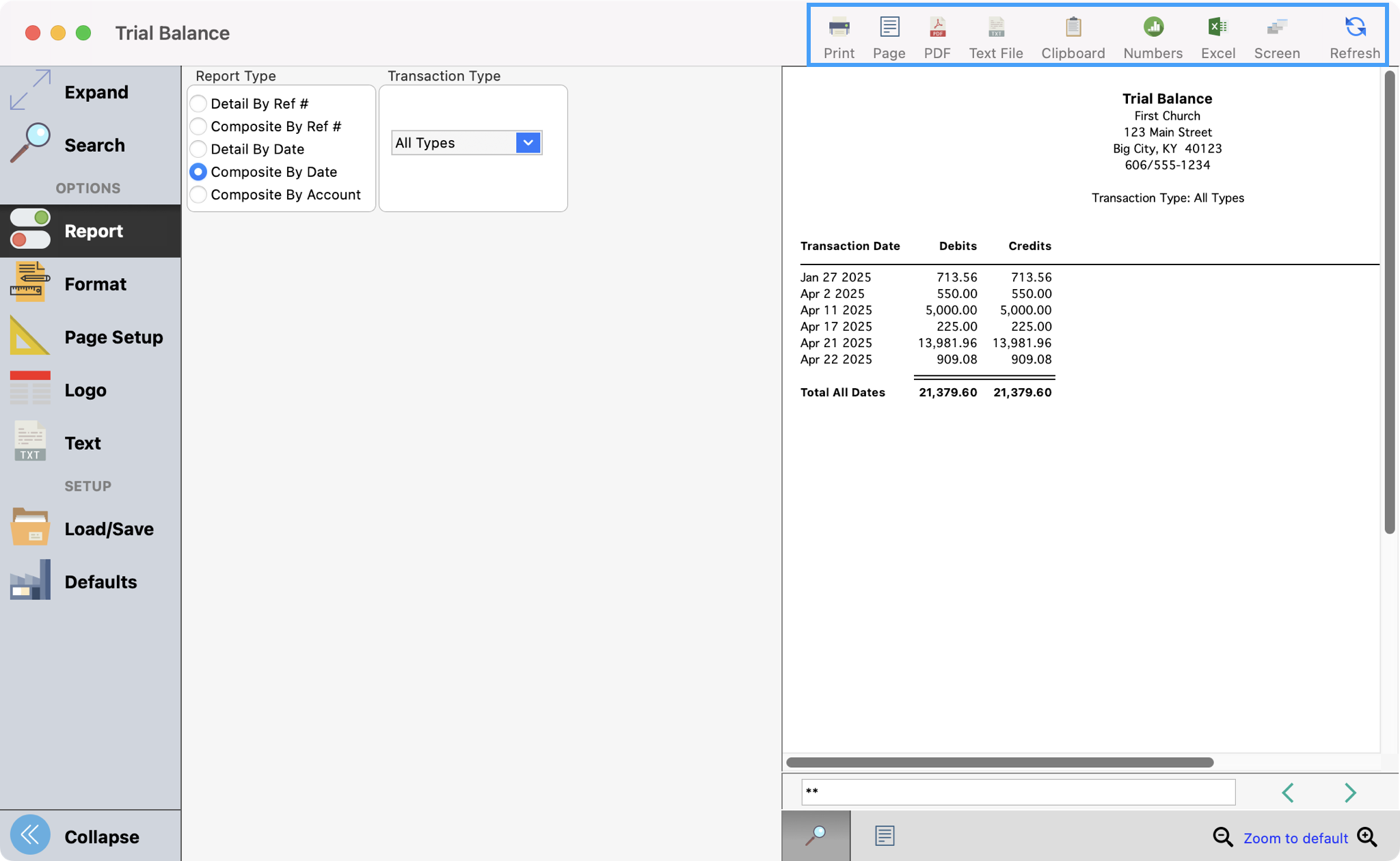

Click Refresh to see a preview of the report and then print or export as desired.

The balance sheet should always reflect the actual amount of taxes and withholding that is outstanding. If all taxes are paid up-to-date, the liabilities on the balance sheet should be zero. If this is not the case, do the following:

Check that the beginning balance of the liability account was entered correctly.

Run the Ledger by Accounts report for the liability account to see where the mistake occurs.