How to remove housing out of box 1 of a W-2

PROBLEM

Housing is an allowance that is to only be reflected in Box 14 of the W-2s. There are times when a user goes to print the W-2 they find the housing amount is showing on Box 1 and/or 14 and need it removed from Box 1.

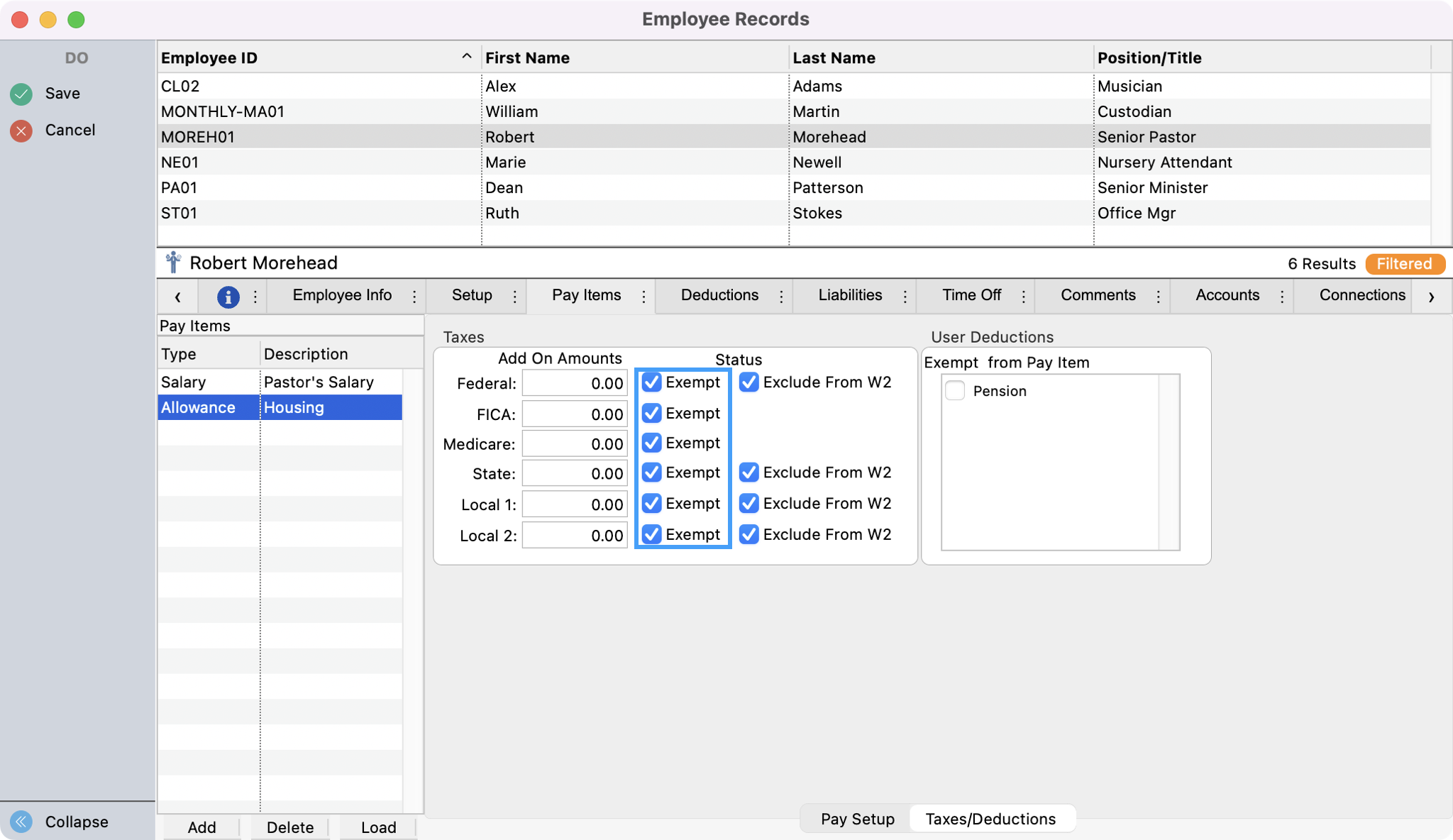

This happens when the user does not mark the 'Exclude from W2' check box when setting up the Housing allowance.

Go to the Employee's Record and mark the 'Exclude from W2' check boxes so it is set correctly for the new year.

You will also need to make sure the allowance is set to go in Box 14 under the Pay Item tab.

SOLUTION

There are two ways you can remove the housing amount out of Box 1.

Option A

Figure up the amount you need to reduce Box 1 by:

Calculate payroll for the housing allowance dated for some time in the tax year you are working with.

Go to that payroll record and change the gross amount on the housing pay item reducing the amount you need to lower box 1 by. (you will need to do a negative amount to lower it.)

If other Pay Items were calculated, click on them and zero them out.

Mark the Do No Print or Post box on the Summary tab so this does not ever try to post to the ledger.

Save

Option B

Open Payroll Tax Forms (Reports → Payroll Reports → Payroll Tax Forms

Select W-2/W-3 Forms

Set to the appropriate tax year

Click Show Forms

Go through the W-2/W-3 setup process

When you are in the Aatrix spreadsheet like grid (for Windows) or the W-2 form (for Mac), find the Box 1 amount

Lower the Box 1 amount by the amount of the Housing Allowance

Add an additional column to the Aatrix Grid (Windows) or add the work 'Housing' and the amount for Housing in Box 14 (macOS)

Then, continue on through the process of generating W-2/W-3 Forms

Note: If you do it this way, there is no record of it being lowered in CDM+. It is not taxable income so it will not affect the 941s but you will not see it on the payroll reports you print. This option will only affect the printing of W-2s in Aatrix.