Closing a Year

A regular and important year-end procedure is closing out your books for the year. This procedure will update the Period Ending Balance for December of the year you are closing and make this period balance the new Fiscal Ending Balance, replacing the fiscal ending balance of the previous December.

If you are on a different fiscal period than one ending December 31, you can follow this same procedure, using your fiscal ending date.

Before running the Close this Year procedure, run your normal monthly Close Period procedure for the month of December. This will close December and any other prior months that have not been closed.

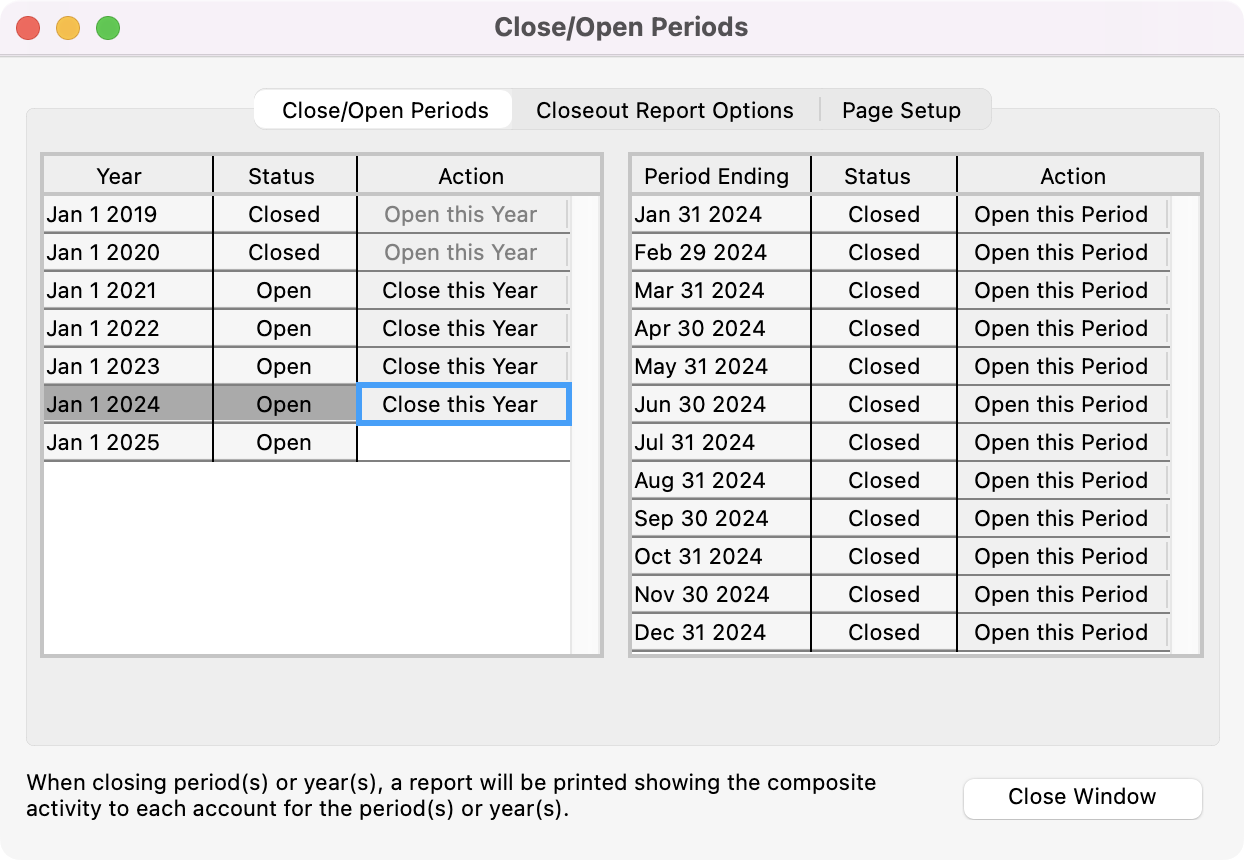

Then, from the Close/Open Periods window, click Close this Year next to the year you want to close.

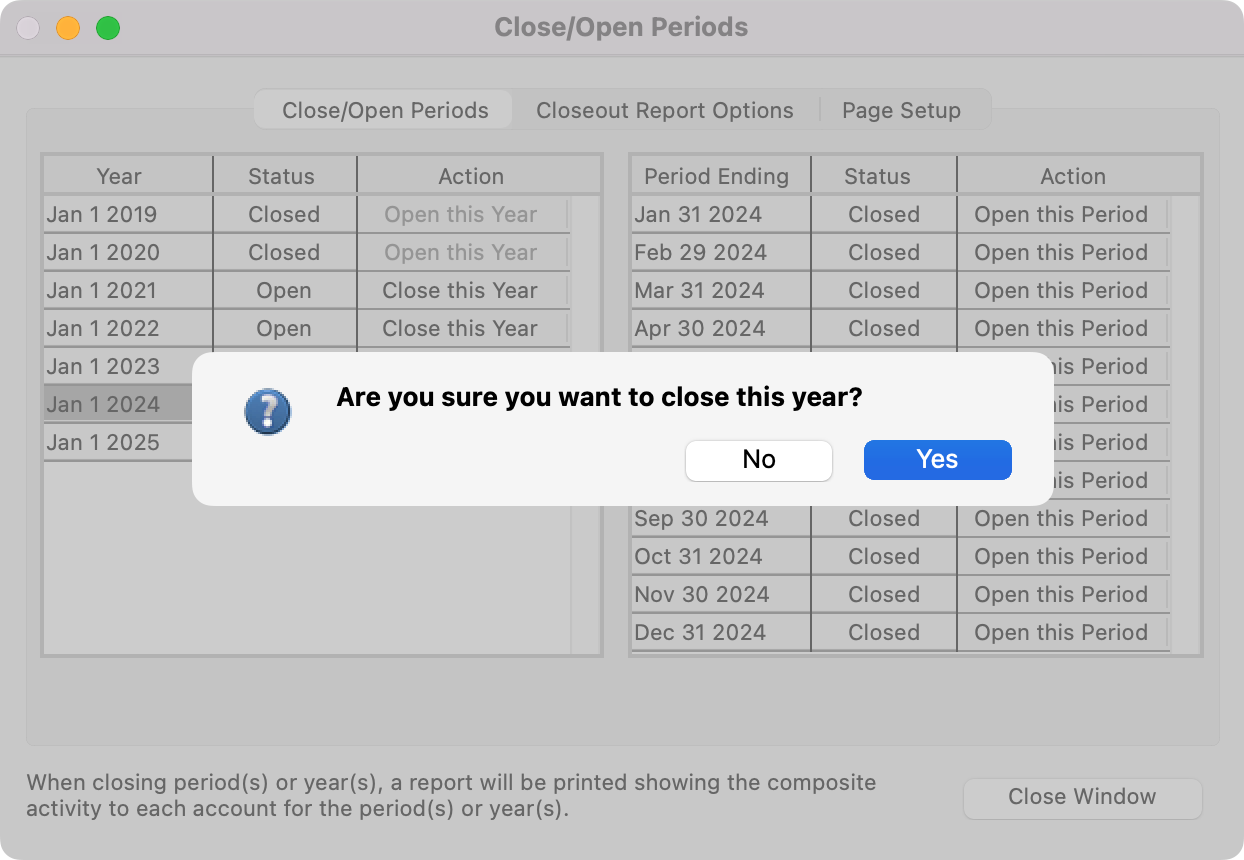

You’ll see a pop-up box asking you to confirm if you want to close this year. Click Yes to continue or No to terminate close-out functions.

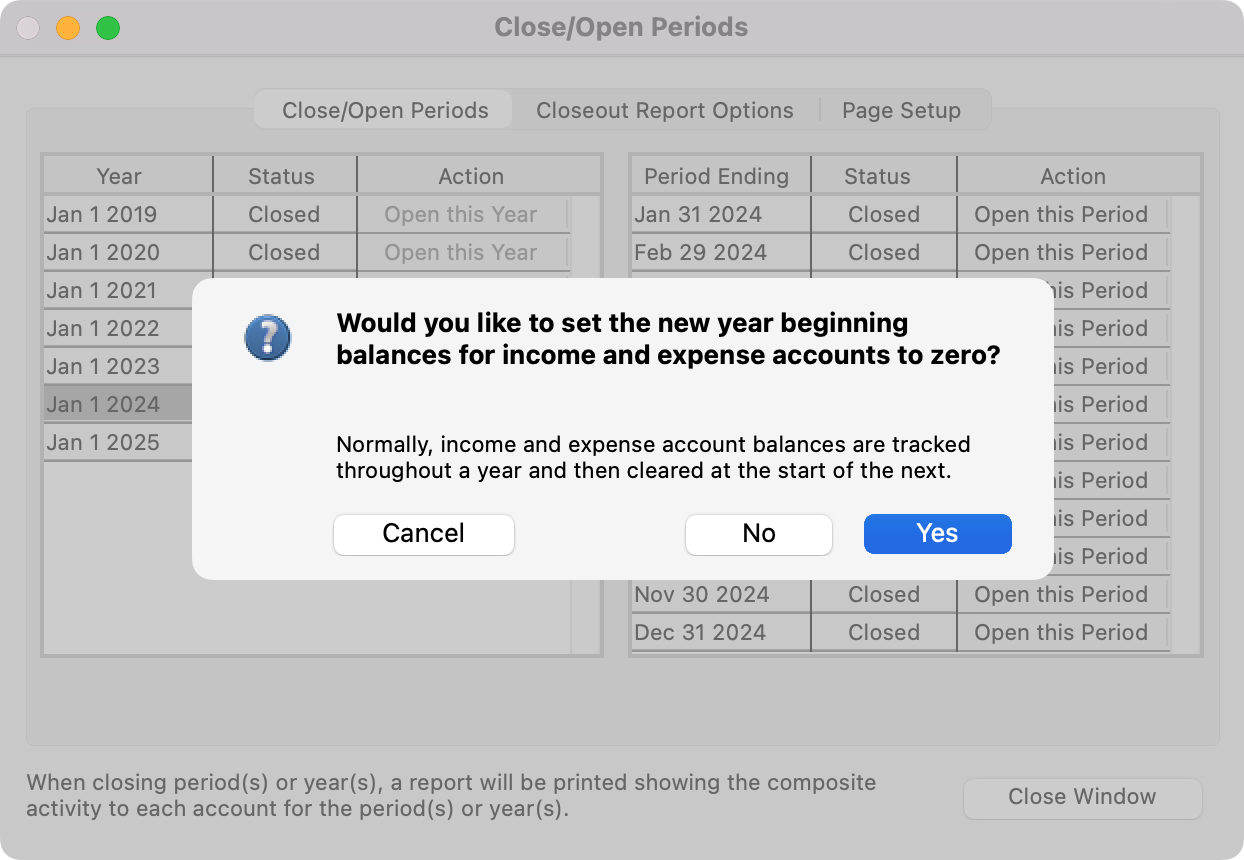

You will be asked if you wish to the beginning balances for the income and expense accounts to zero. Click Yes.

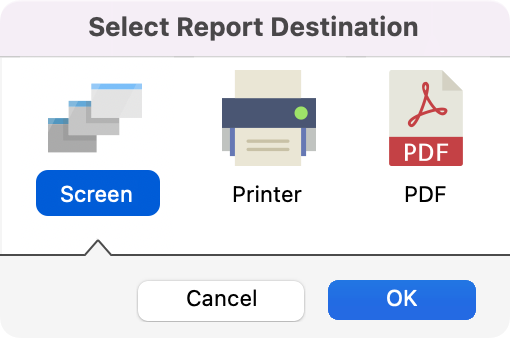

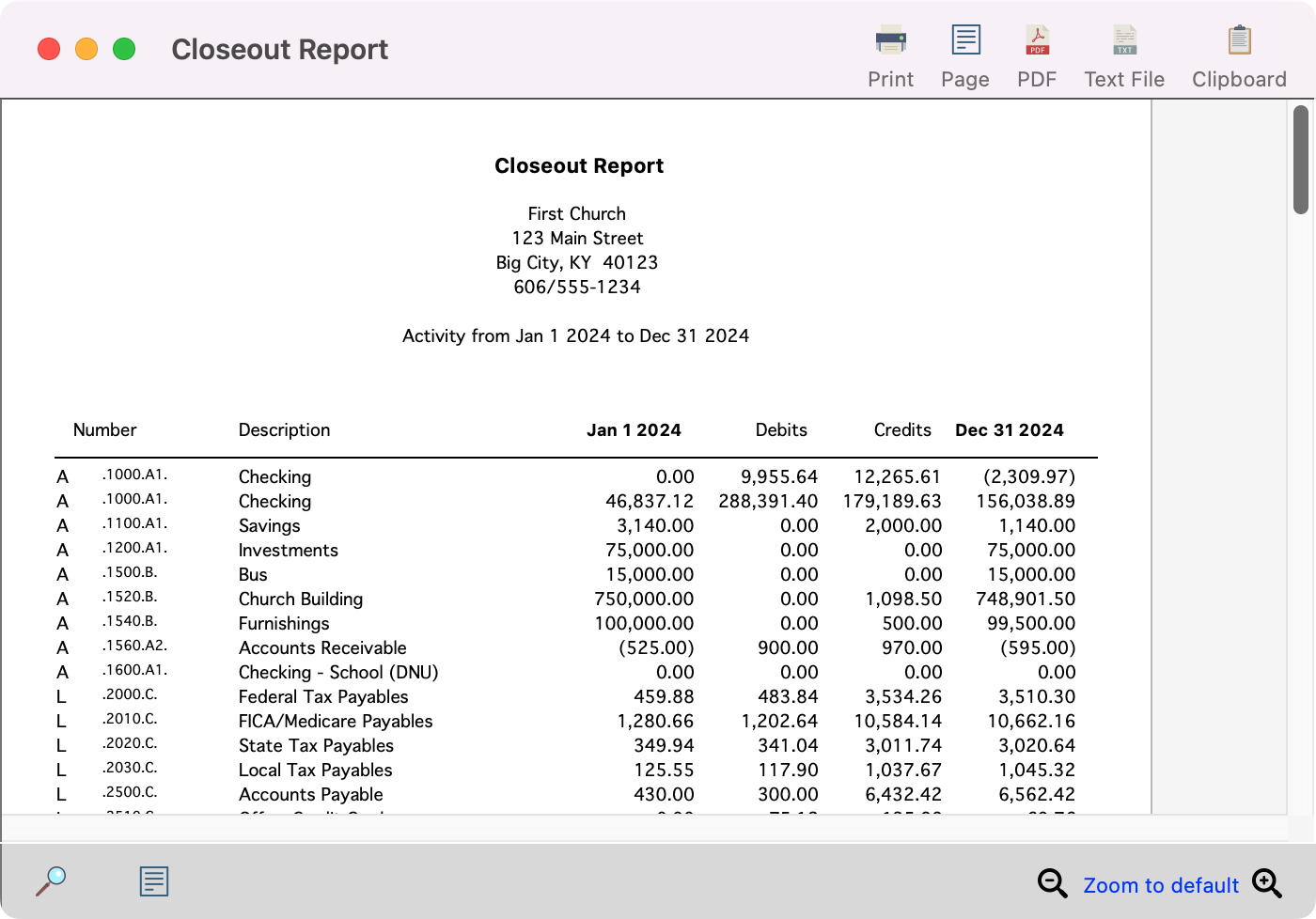

Next, select a destination for your Closeout report.

A Closeout report is then printed. You may format this report by making selections on the Closeout Report Options tab of the Open/Close Period window.

After the report has printed, you will be asked to verify if the information on the report is correct. If the information is correct, click on Yes to continue. Respond Yes ONLY if you are sure the balances are correct and that all information has been entered for the year you are closing.