How to Generate and Print Form 1099-NEC on macOS

There are four stages to print Forms 1099-NEC and 1096 on macOS:

- Prepare CDM+ Records

- Setup Aatrix

- Review Forms

- Print Forms

This guide will walk you through each of these stages.

Most stages include a video showing the instructions in action. You can follow either the written instructions or the video and will follow the same steps.

2023 Federal 1099 forms can be printed on plain white paper using Aatrix and CDM+. Pre-printed red ink forms are no longer required when printing from Aatrix.

Prepare CDM+ Records

Reviewing Vendor Records

Program → Payables → Vendor Record

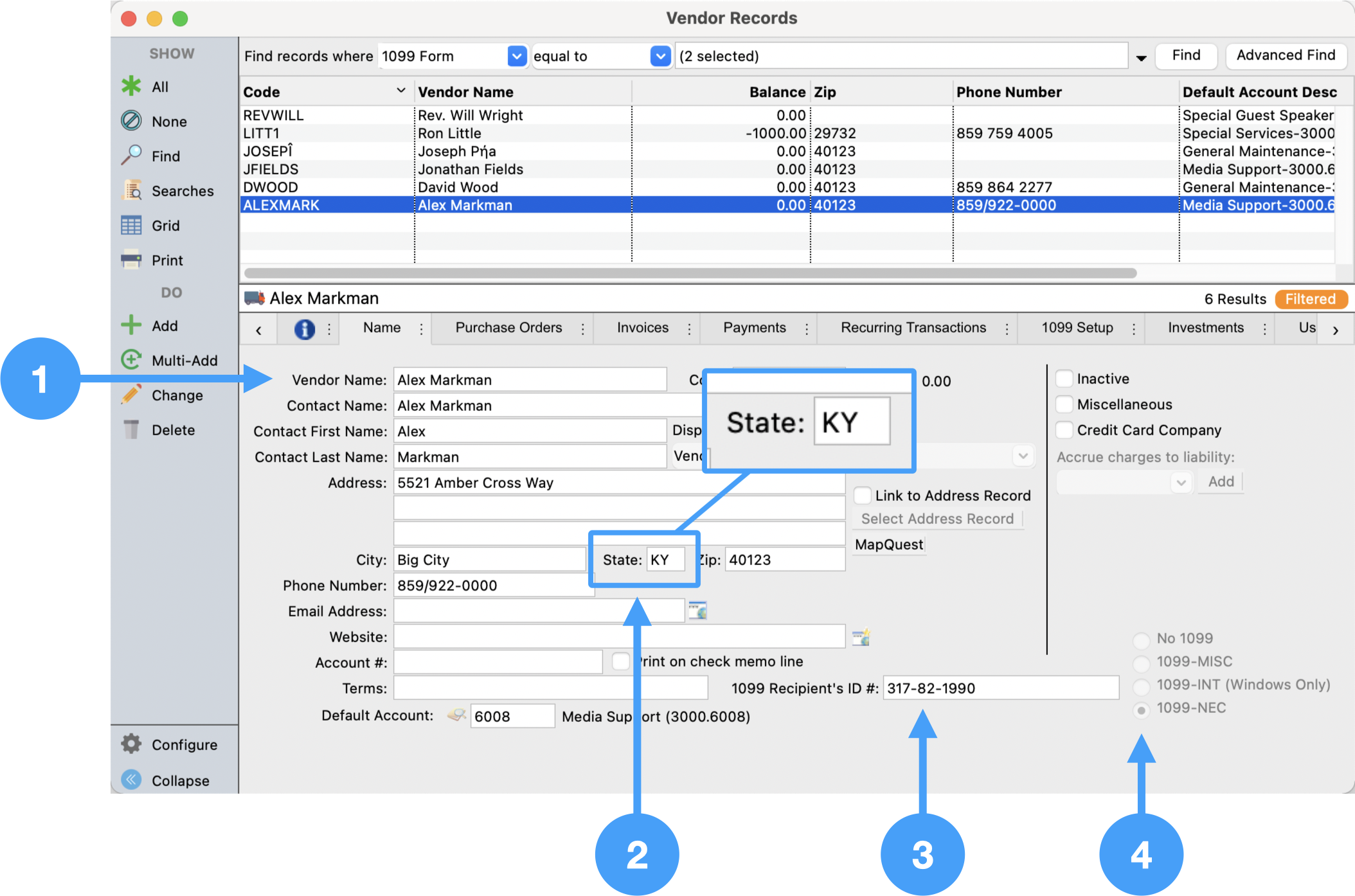

Ensure Name and Address are correct.

Ensure the state is exactly two characters.

Ensure 1099-NEC is selected.

Ensure 1099 Recipient's ID number is correct.

Prepping Your 1099

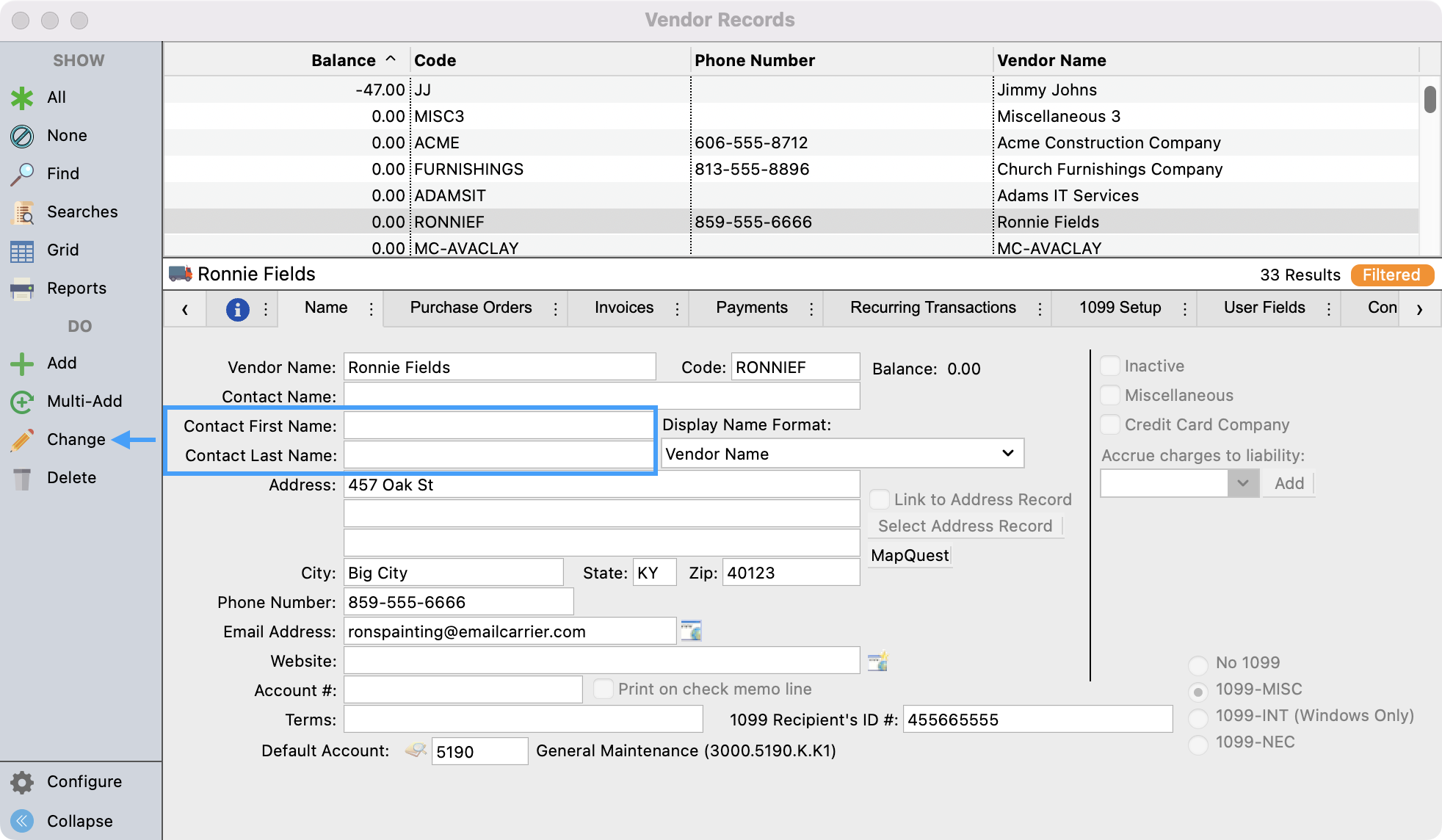

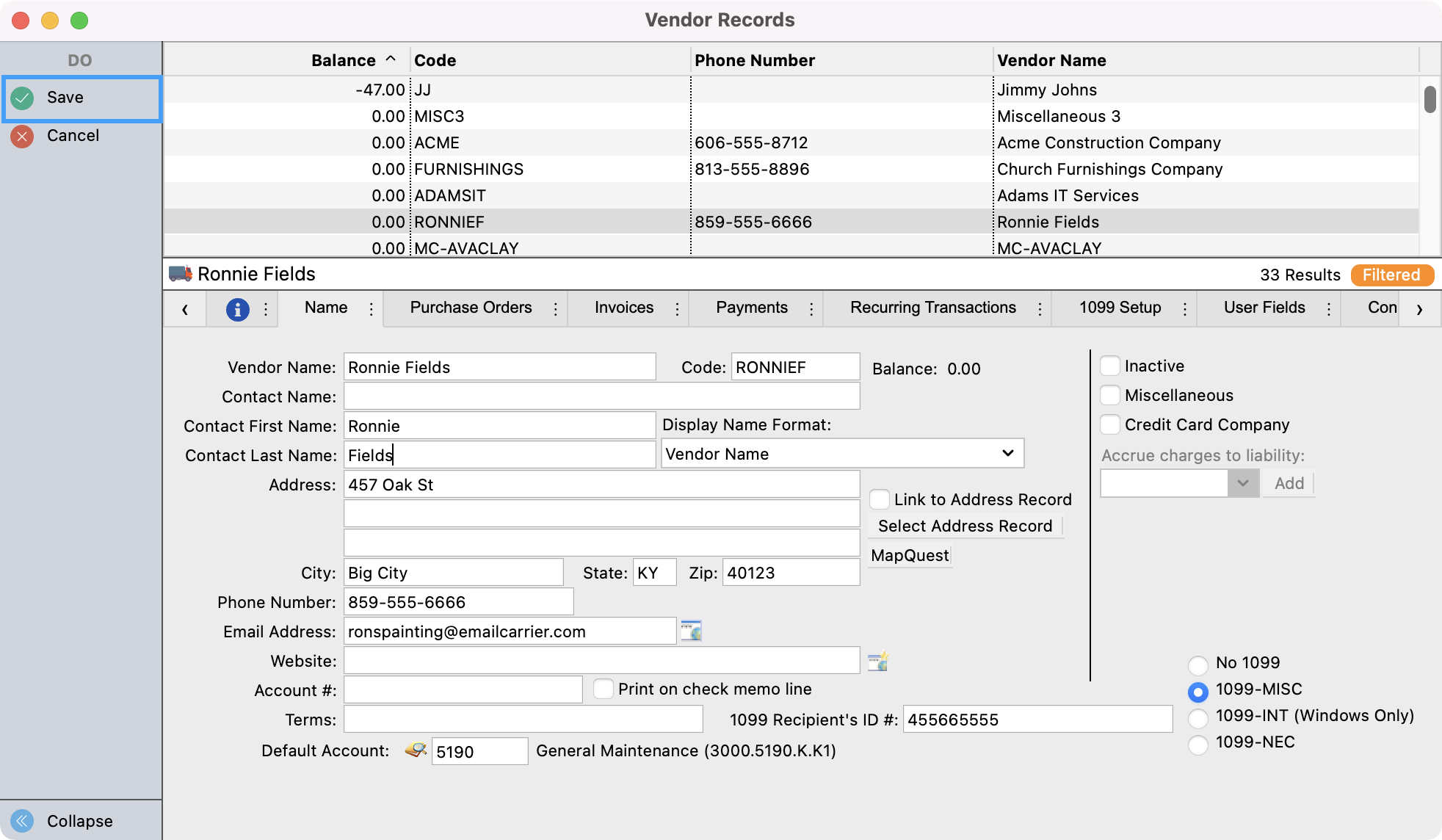

It is an IRS requirement that Vendors using a SSN must have the first and last name fields completed on the form.

If you notice the the Contact First Name and Contact Last Name fields are black, click Change from the left sidebar.

Fill in these required fields and then Save your changes.

Once this information is filled it you can run your 1099’s like normal.

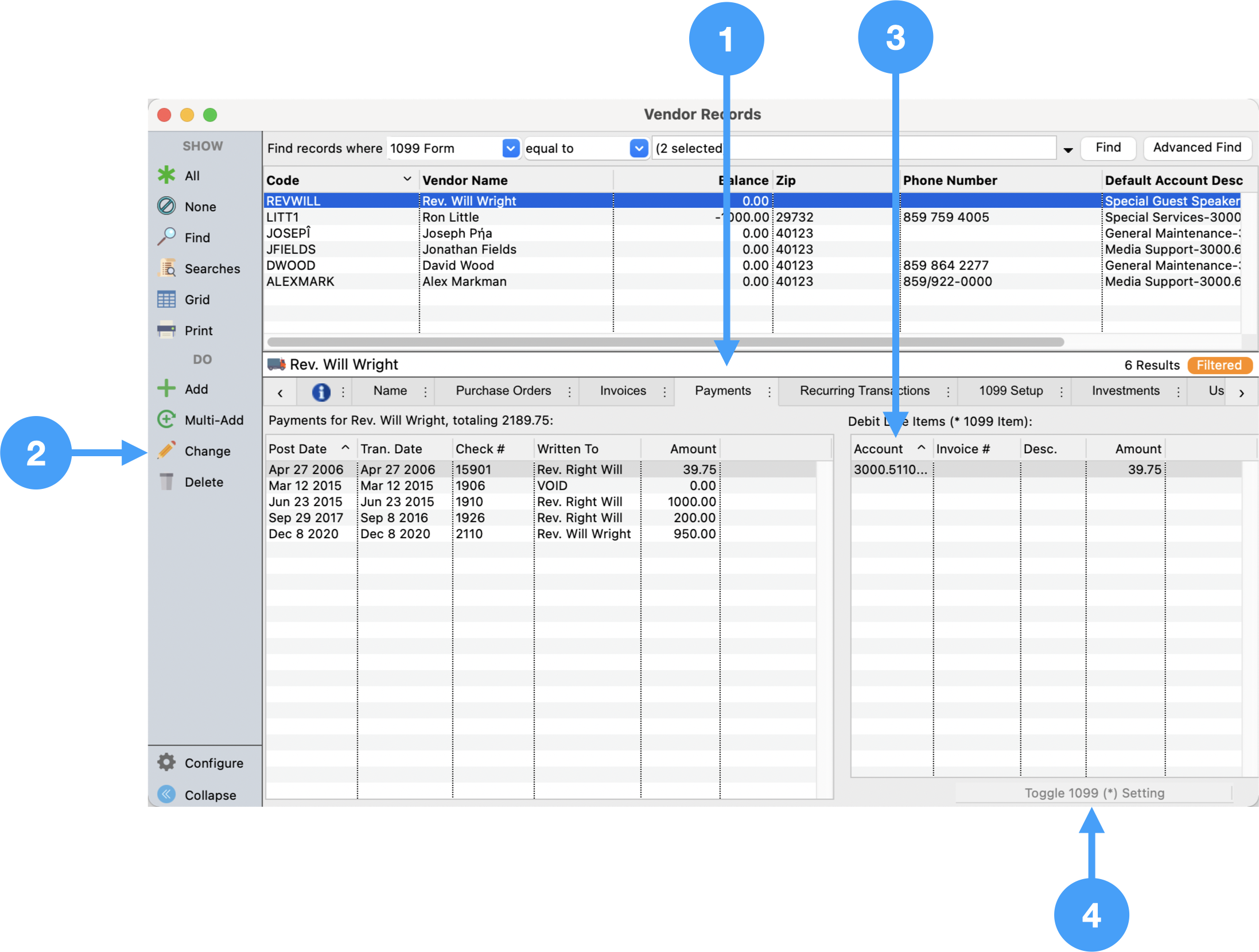

Vendor Records - Payments Tab

Ensure Expense accounts are tagged as 1099 showing an asterisk beside the account number. This is visible in the table on the right side of the Payments tab.

Select Payments tab

Click Change in Sidebar

Select the expense line you want to toggle.

Click Toggle 1099 ( * ) Setting

Click Save

Below is an animation of the process in action:

If a payment to the vendor does not appear on the Payments tab, find the payment under Program → Ledger → Ledger Entry Records and ensure the vendor is selected in the Vendor field.

Vendor Records - 1099 Setup Tab

There is no setup required under the 1099 Setup tab for 1099-NEC forms.

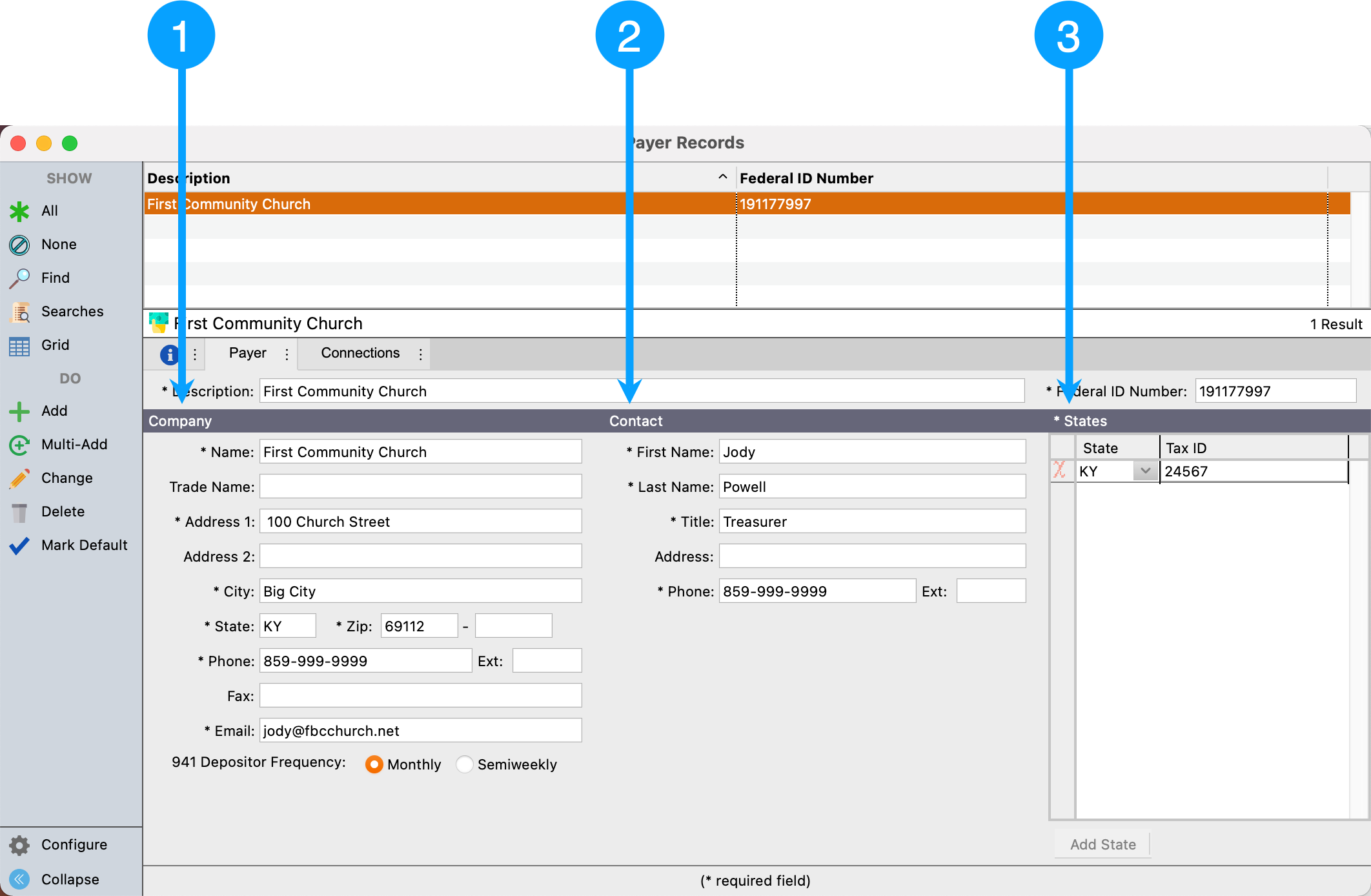

Payer Records

Program → Accounting → Payer Records

Ensure the Company information is correct.

Ensure the Contact information is correct.

Ensure State is selected.

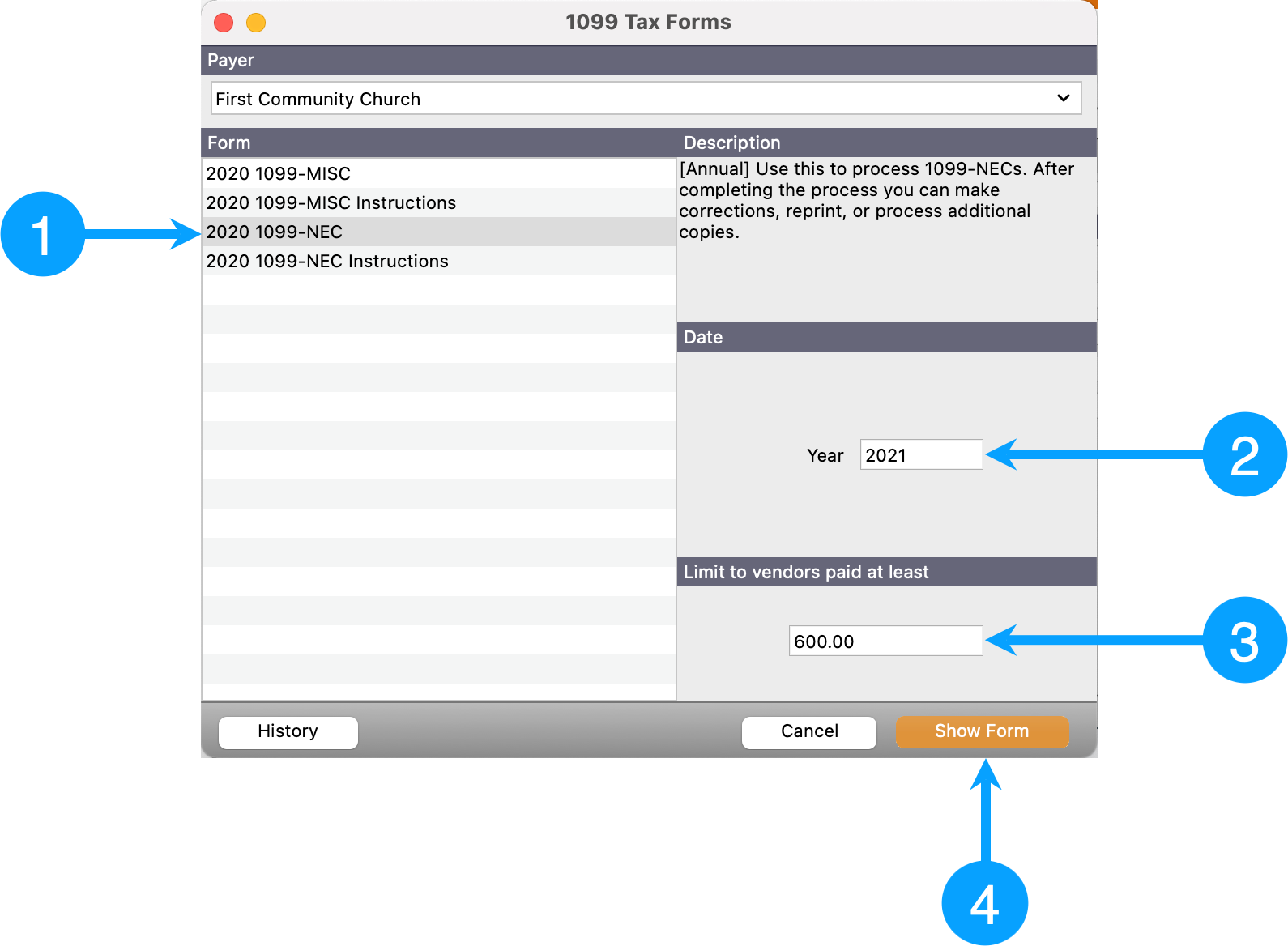

Processing 1099-NEC Forms

Reports → Payables → 1099 Forms

Select 1099-NEC

Enter 2020 for the Year field.

Ensure Vendor Limit is set to '600.00'

Click Show Form

Print a report use when reviewing 1099 form data

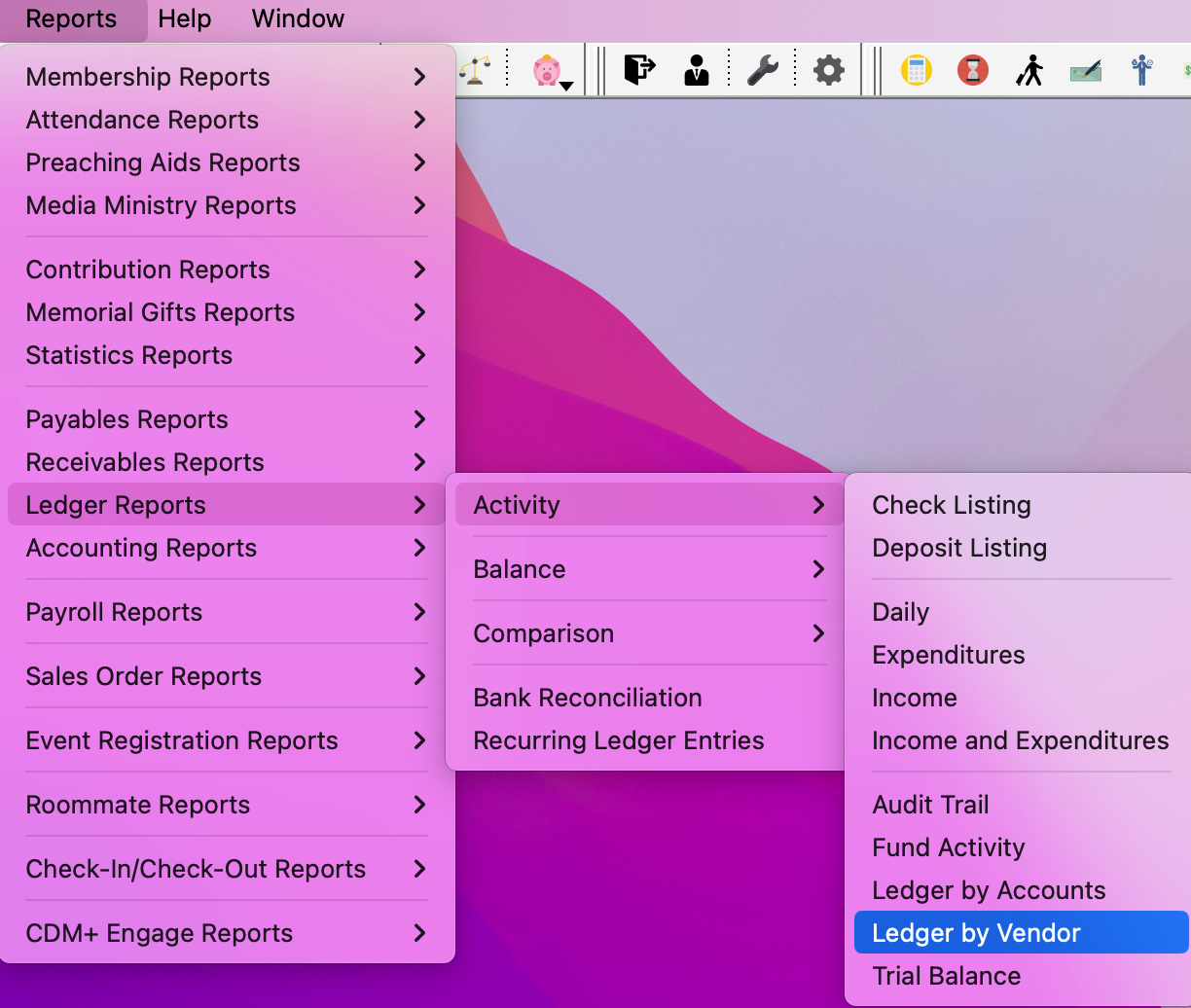

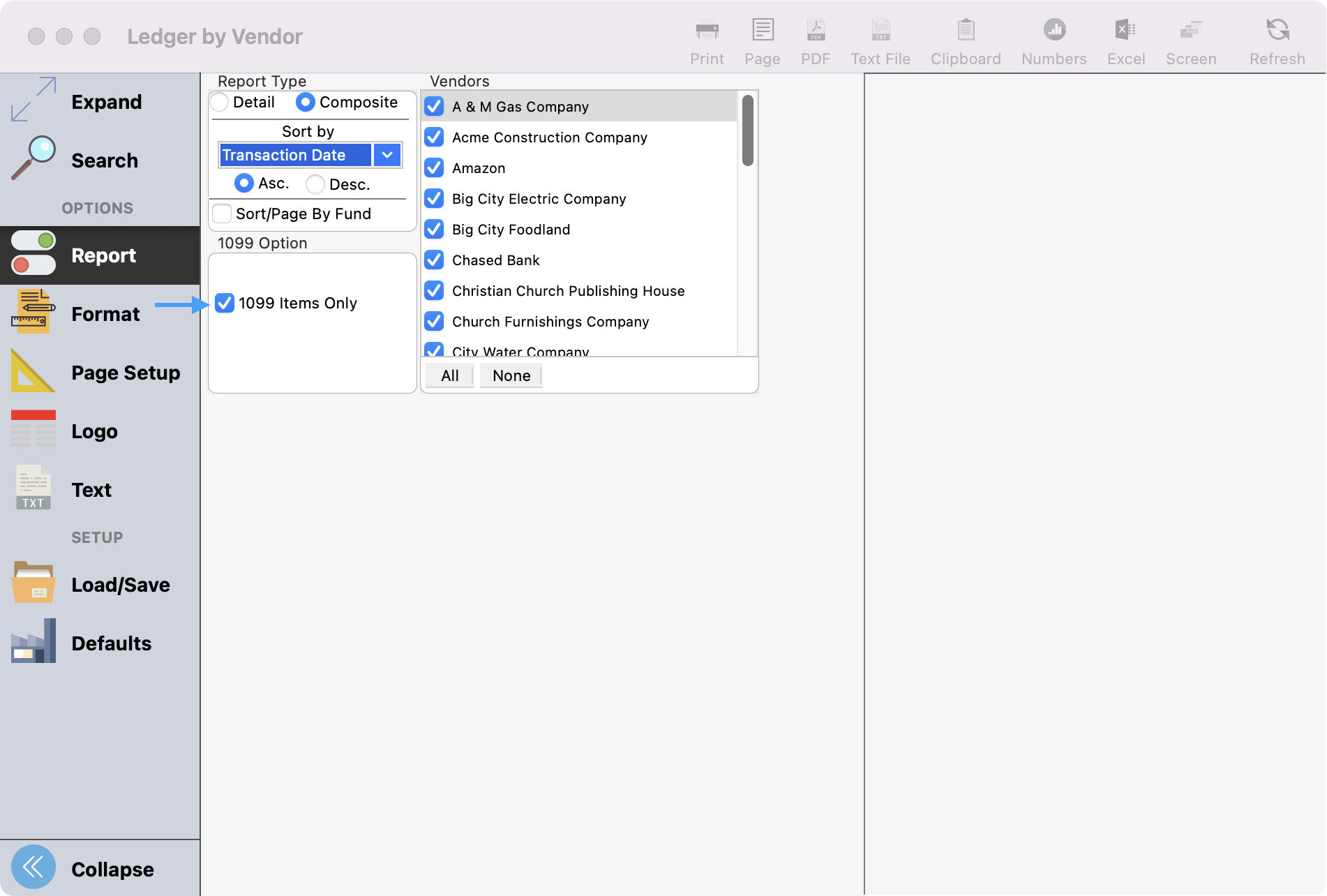

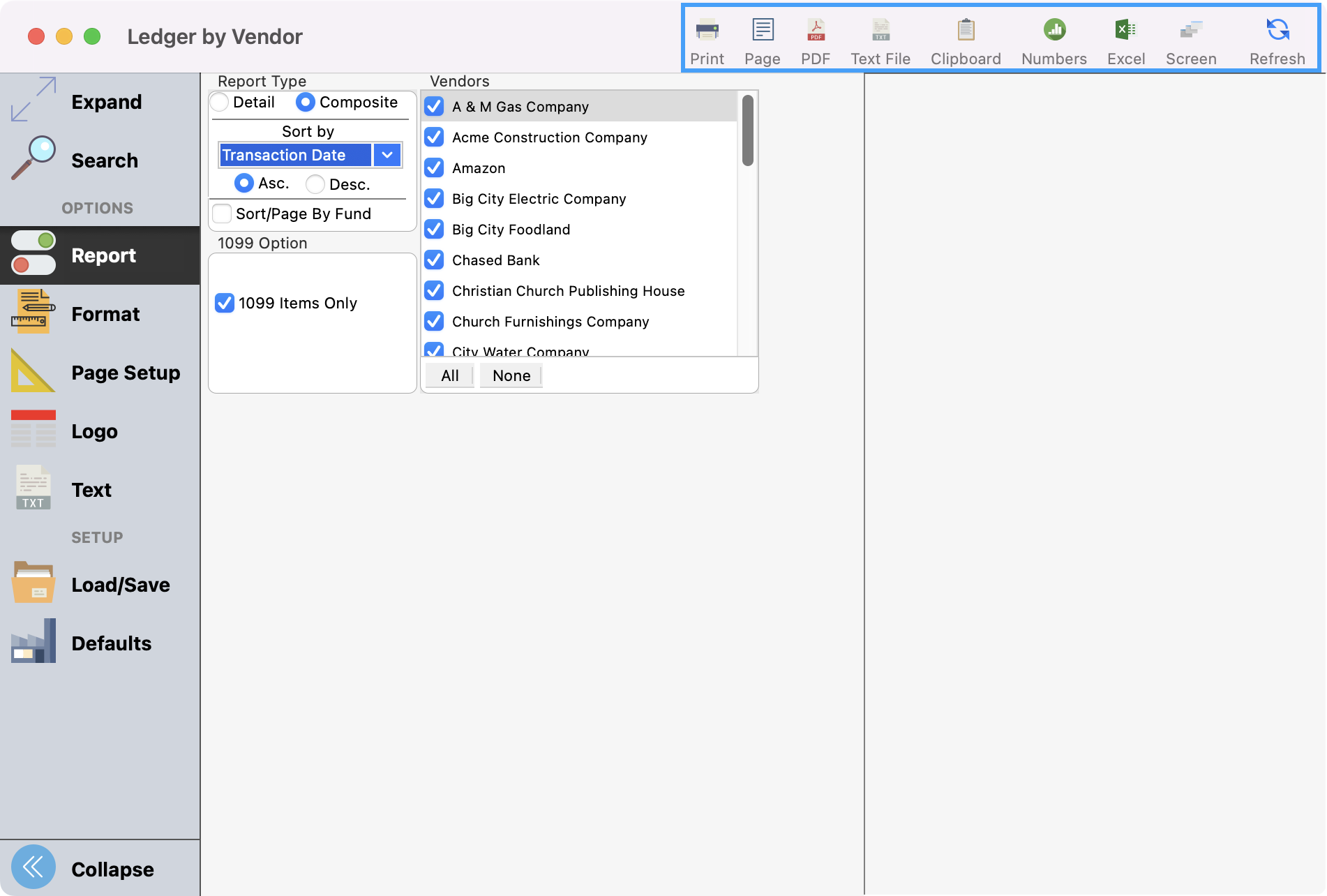

Go to Reports → Ledger Reports → Activity → Ledger by Vendor.

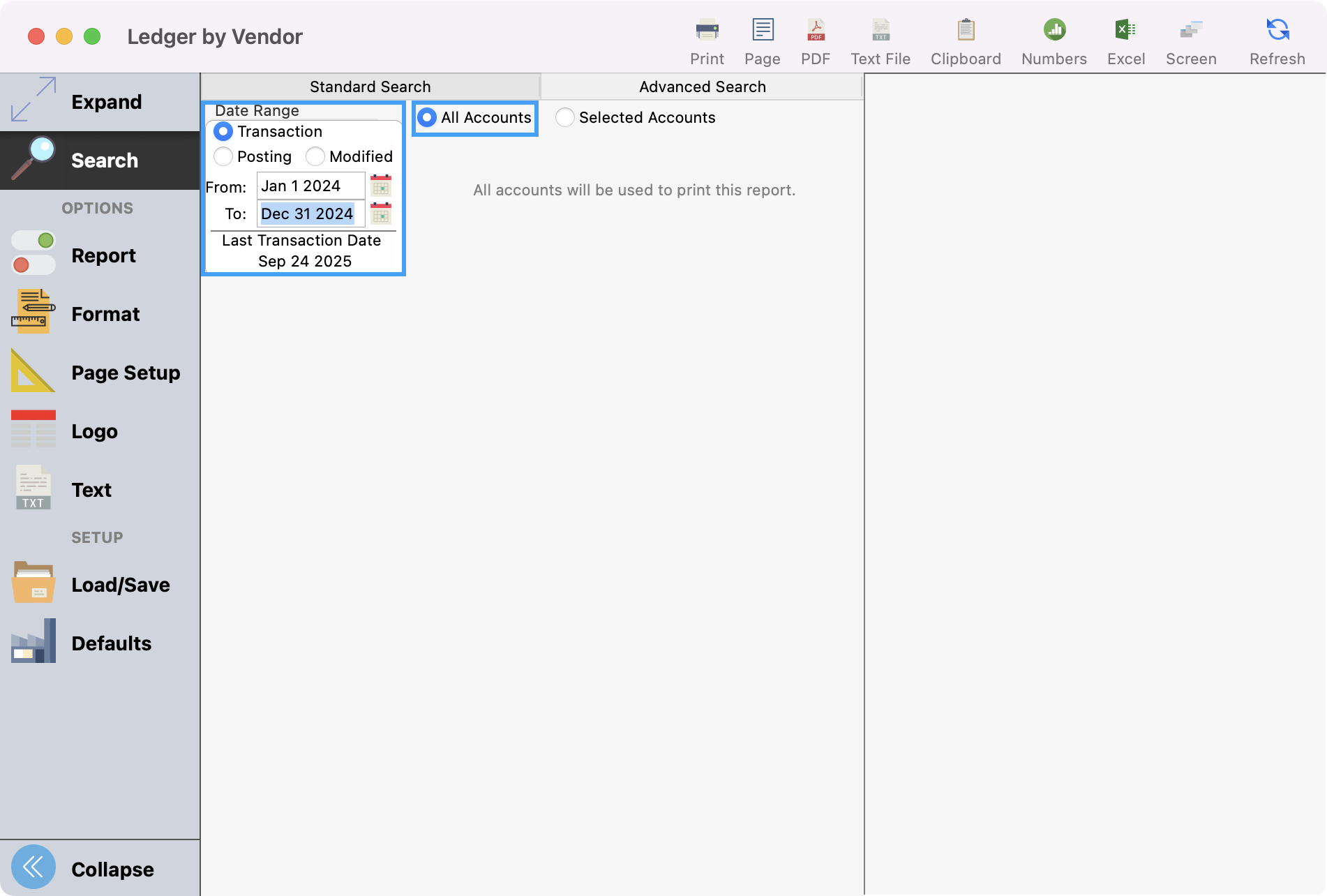

Set up your search to use the Transaction date for the calendar year (January 1 to December 31) and select the radio button for All Accounts.

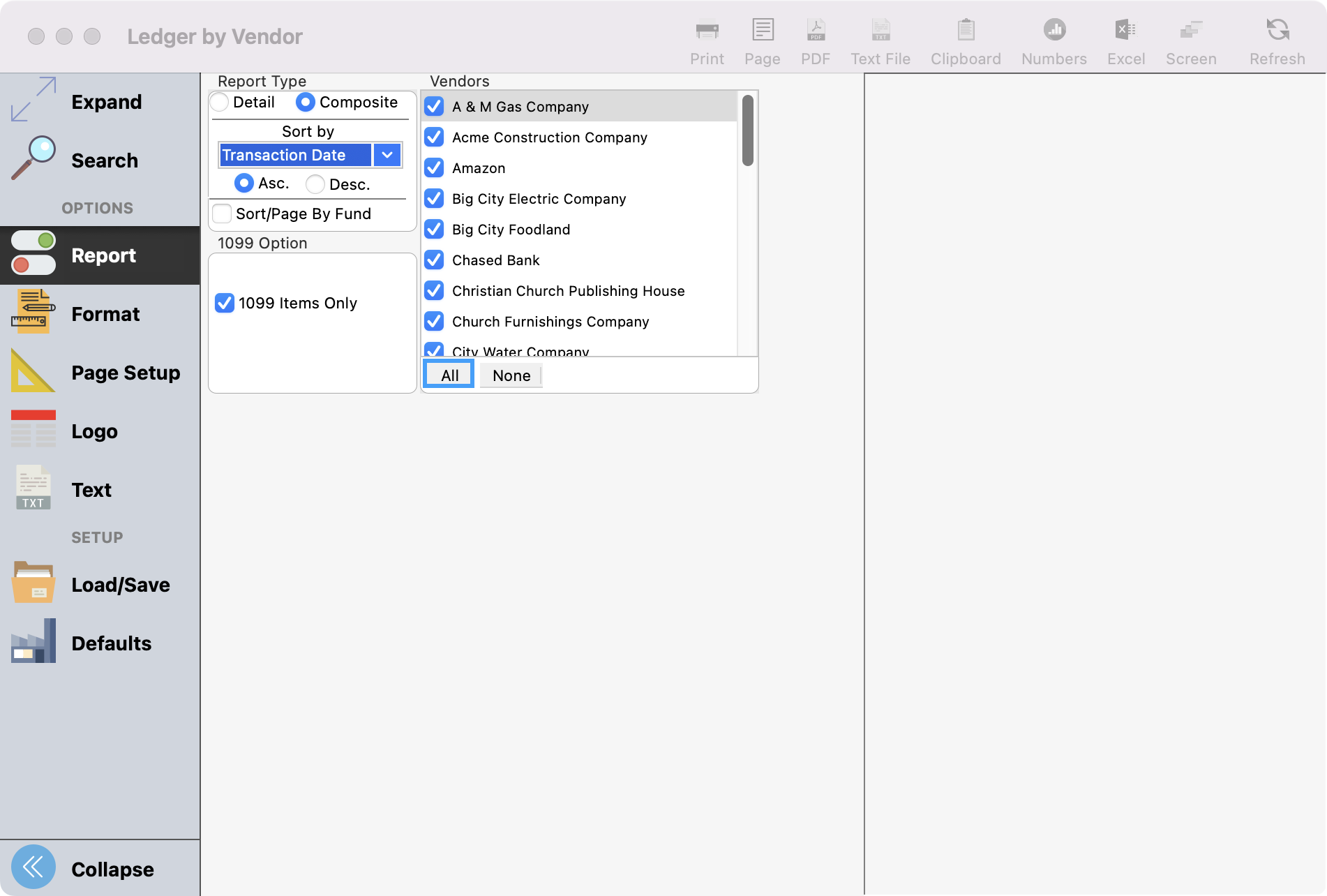

Click Reports under Options in the left-hand sidebar and click All under Vendors.

Our set up will only print those that have 1099 payments for the transaction date range you entered so you do not need to select individual vendors unless that is your preference.

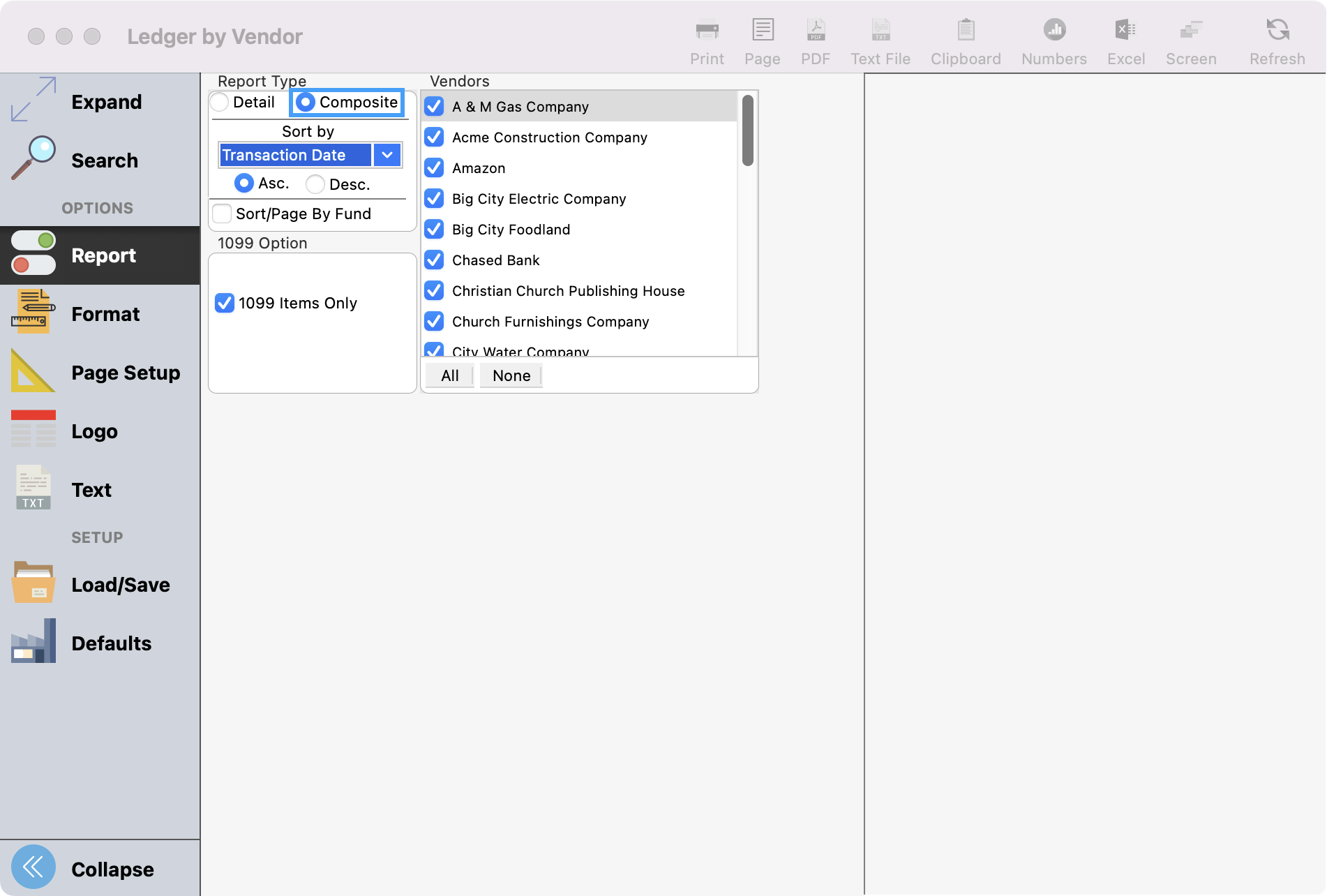

Choose the Composite Report Type.

Put a check in the 1099 Items Only checkbox.

Select how you wish to print the report.

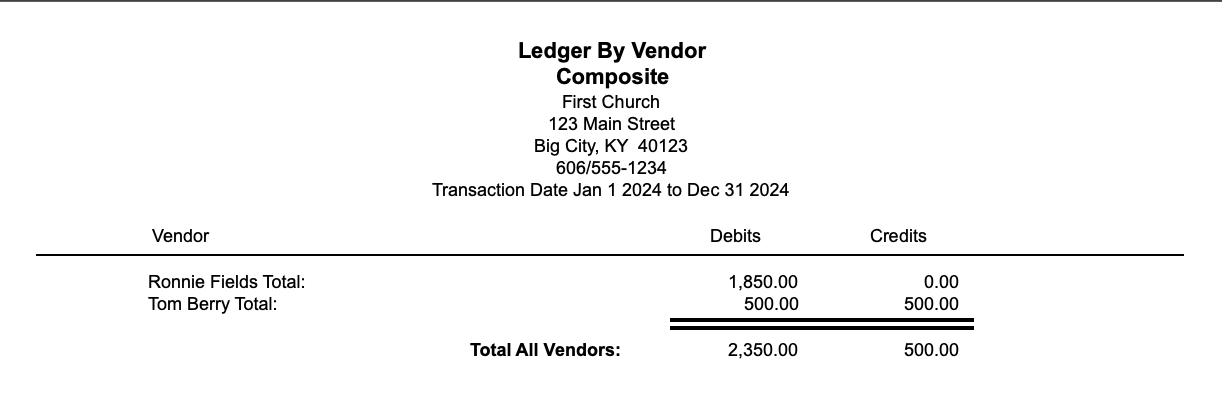

The selected report will look something like this:

Setup Aatrix

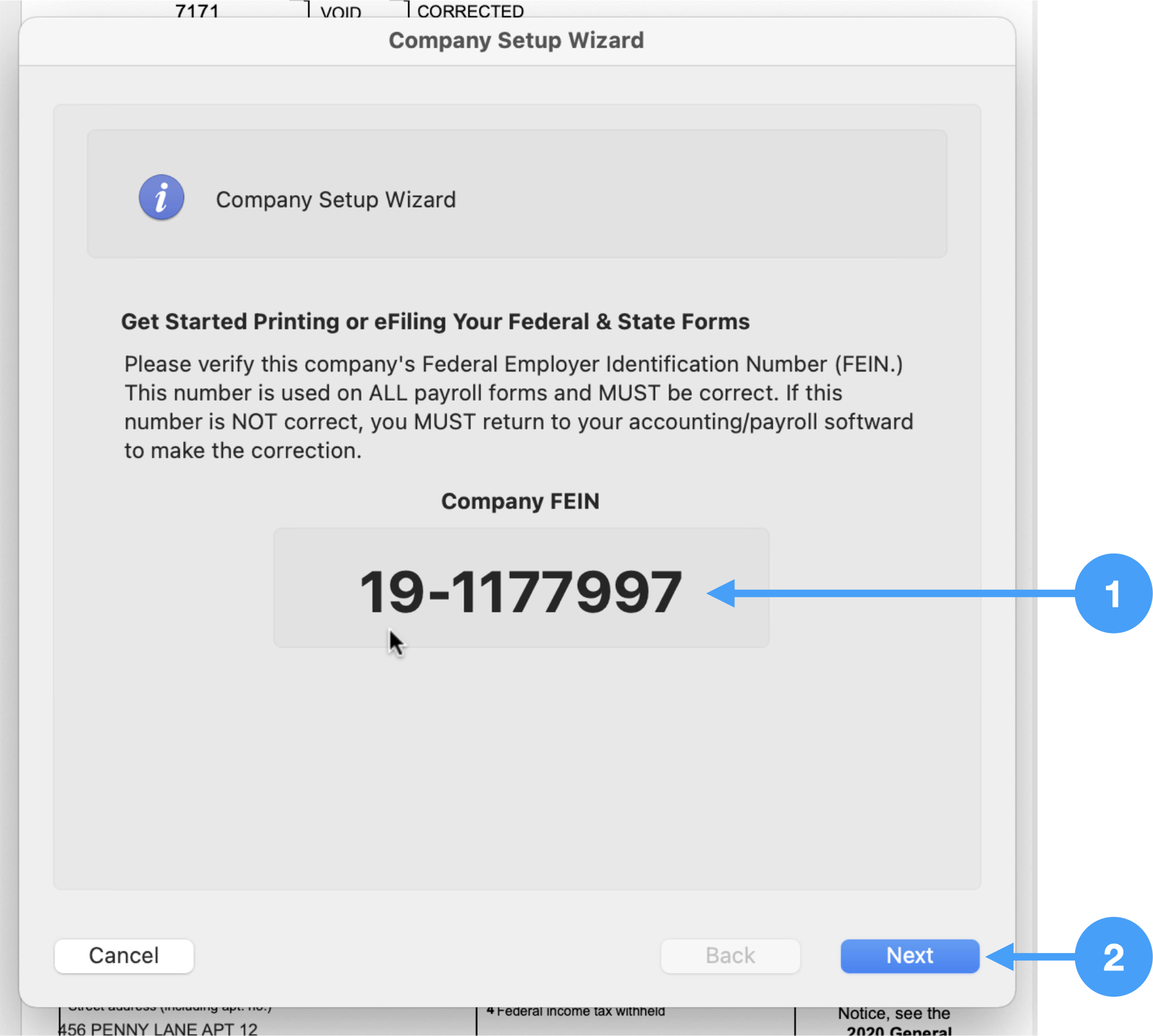

The Company Setup Wizard will display the first time you run the Forms Viewer.

Company Federal Employer Identification Number (FEIN)

- Review the FEIN number. If it is incorrect, the cancel the wizard and go back into CDM+ Payer Records window to correct.

- If it is correct, click Next.

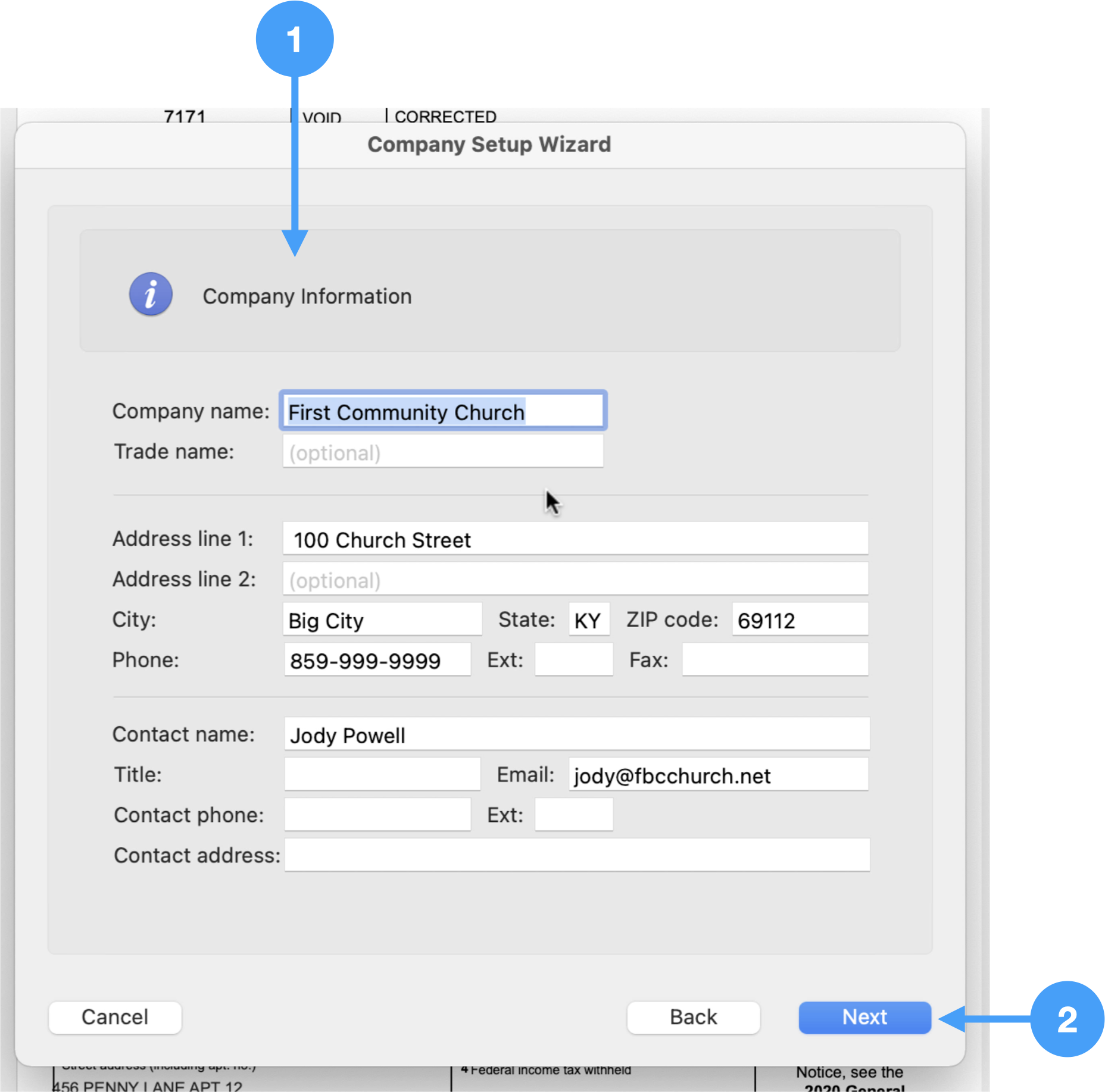

Company Information

- Review the information in this window carefully. If any of the information is incorrect, then you can make the change here. Please be aware that those changes will not be reflected in CDM+. You should make the changes to CDM+ when you are done printing your 1099-NEC forms.

- When the information is correct, click Next.

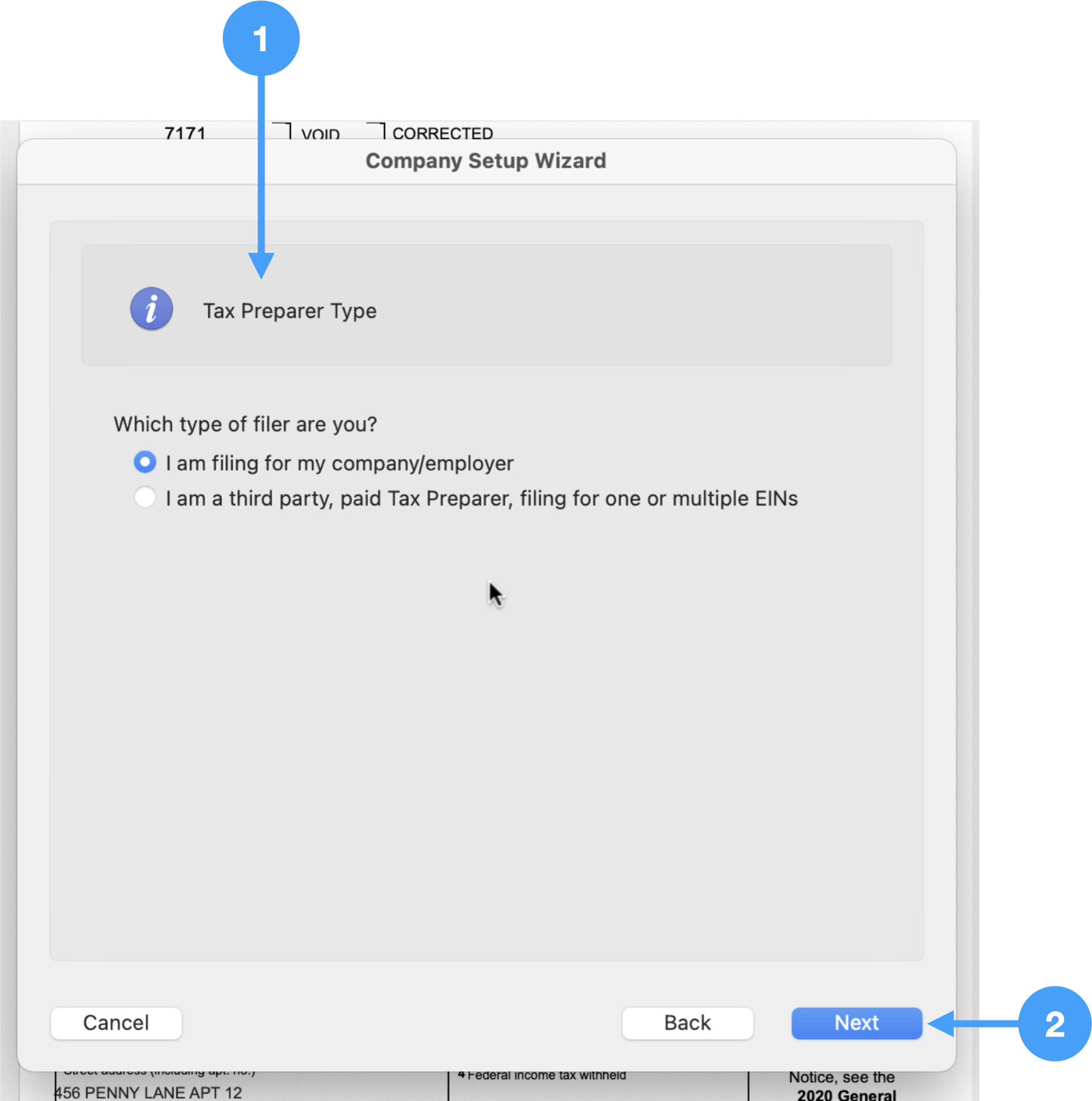

Tax Preparer Type

- Select the appropriate radio button.

- Click Next.

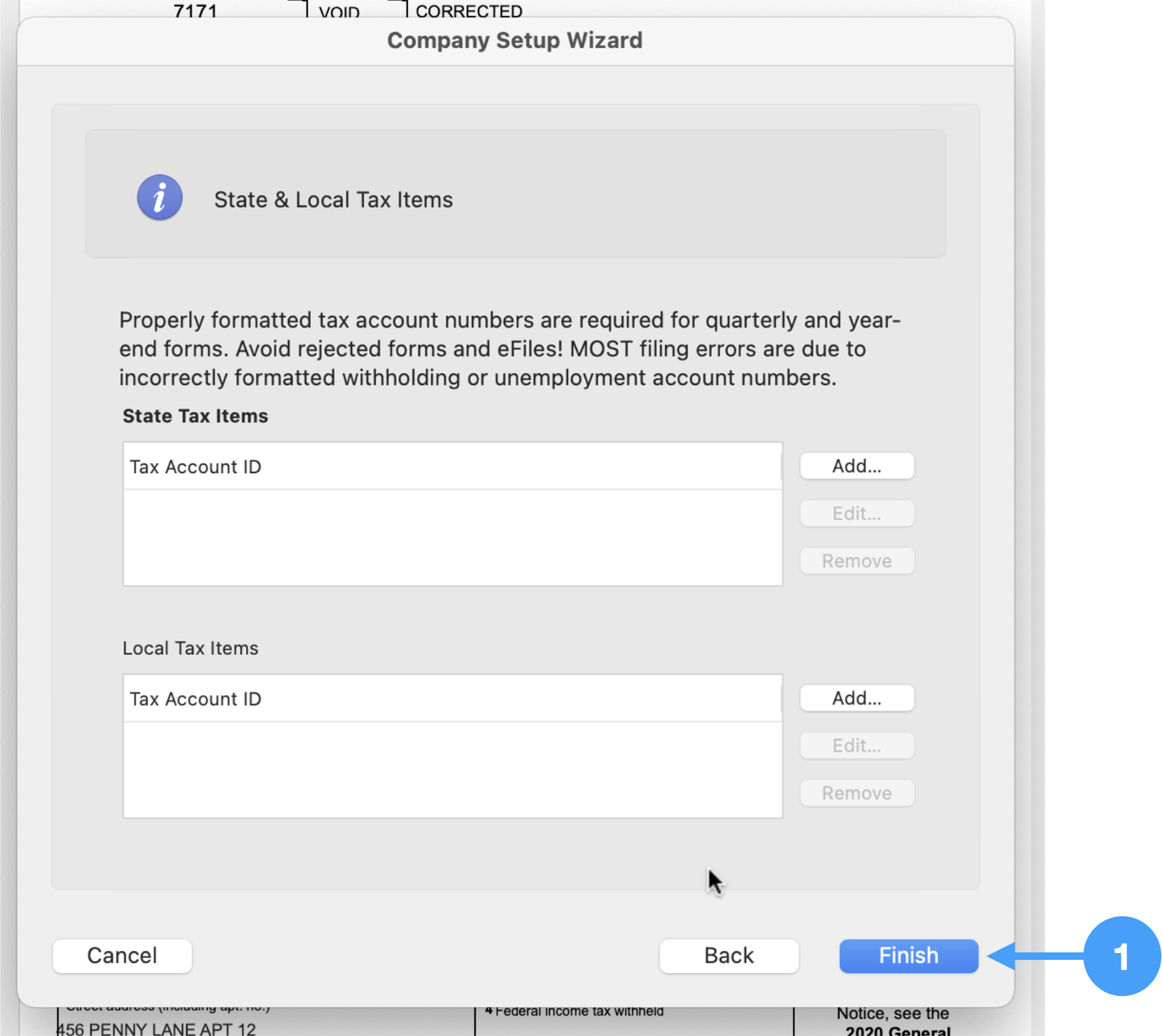

State and Local Tax Items Window

Nothing is needed for this window.

- Click Next to begin the review process.

Video of the 1099 Setup Wizard

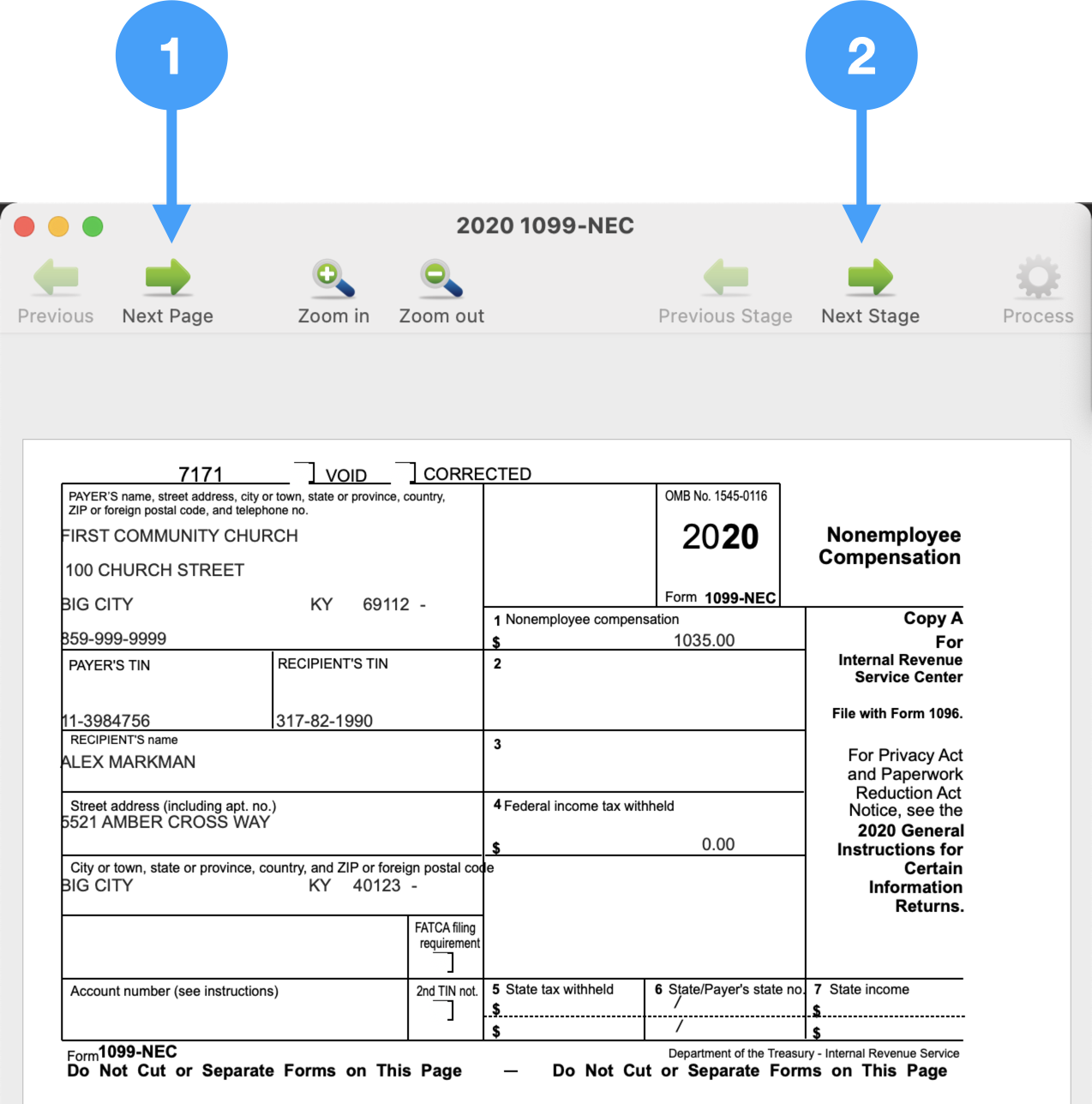

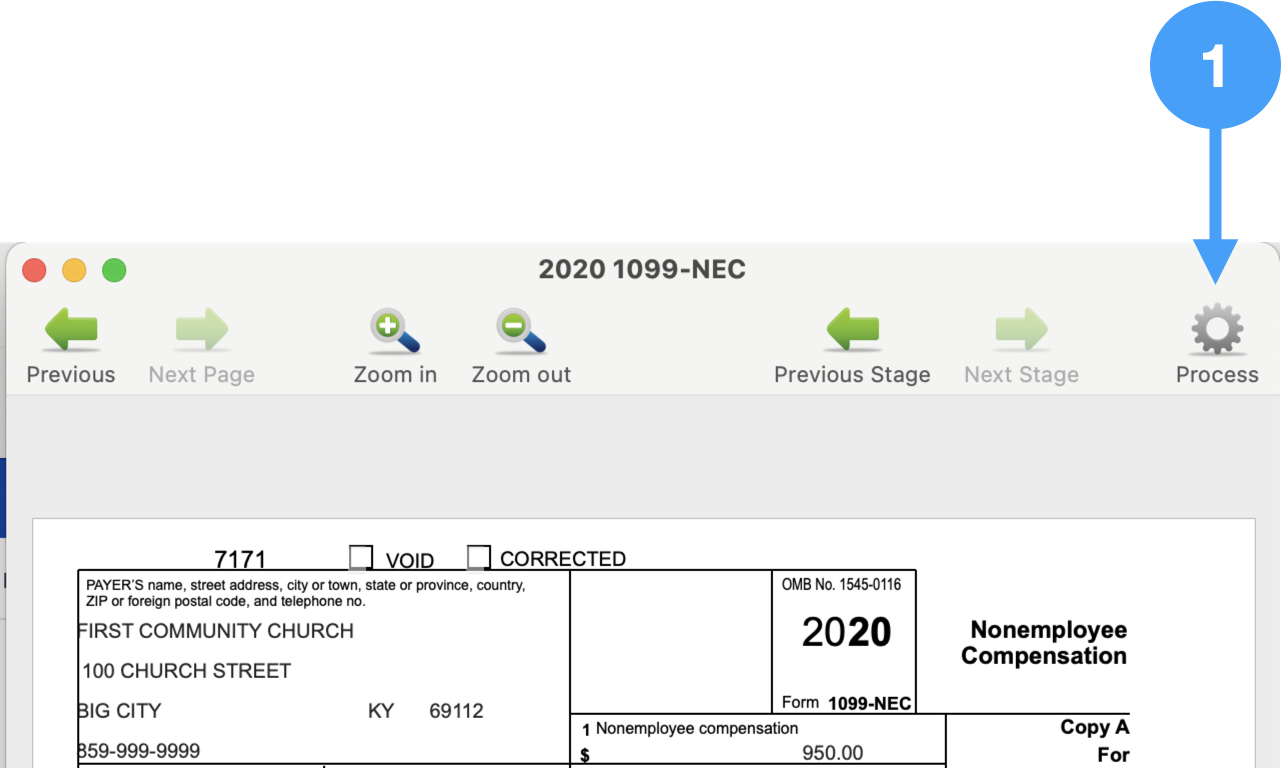

Review Forms

When the Forms Viewer opens, click OK in the 'Processing a Report' dialog.

- Review the number of records by clicking on the Next Page icon in the tool bar and review the information for accuracy.

- When done, click on the Next Stage icon.

Continue this process to the final step and then click Process.

Video of the Review Process

Print Forms

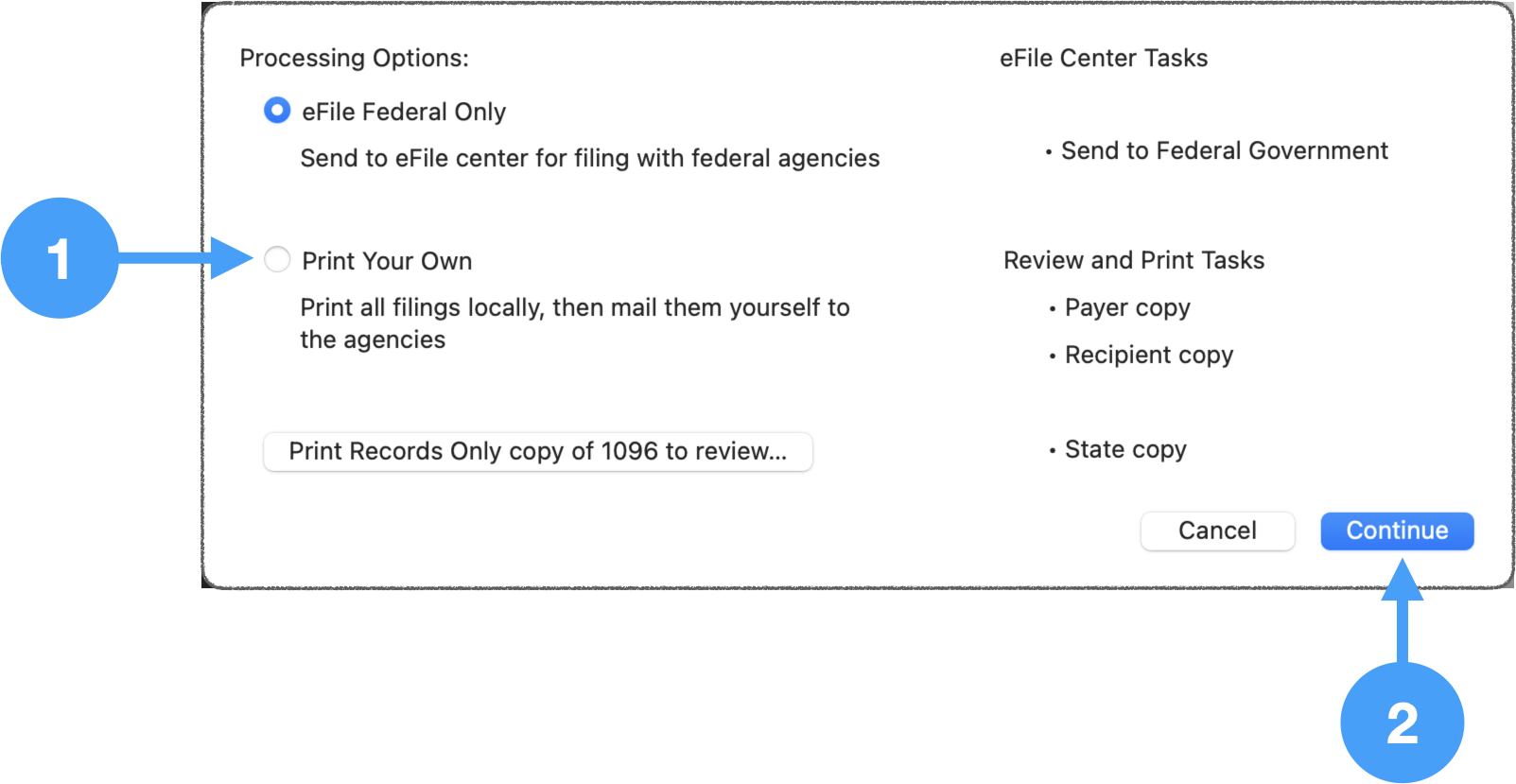

The Processing Options window opens.

- Select Print Your Own radio button

- Click Continue

2023 Federal 1099 forms can be printed on plain white paper using Aatrix and CDM+. Pre-printed red ink forms are no longer required when printing from Aatrix.

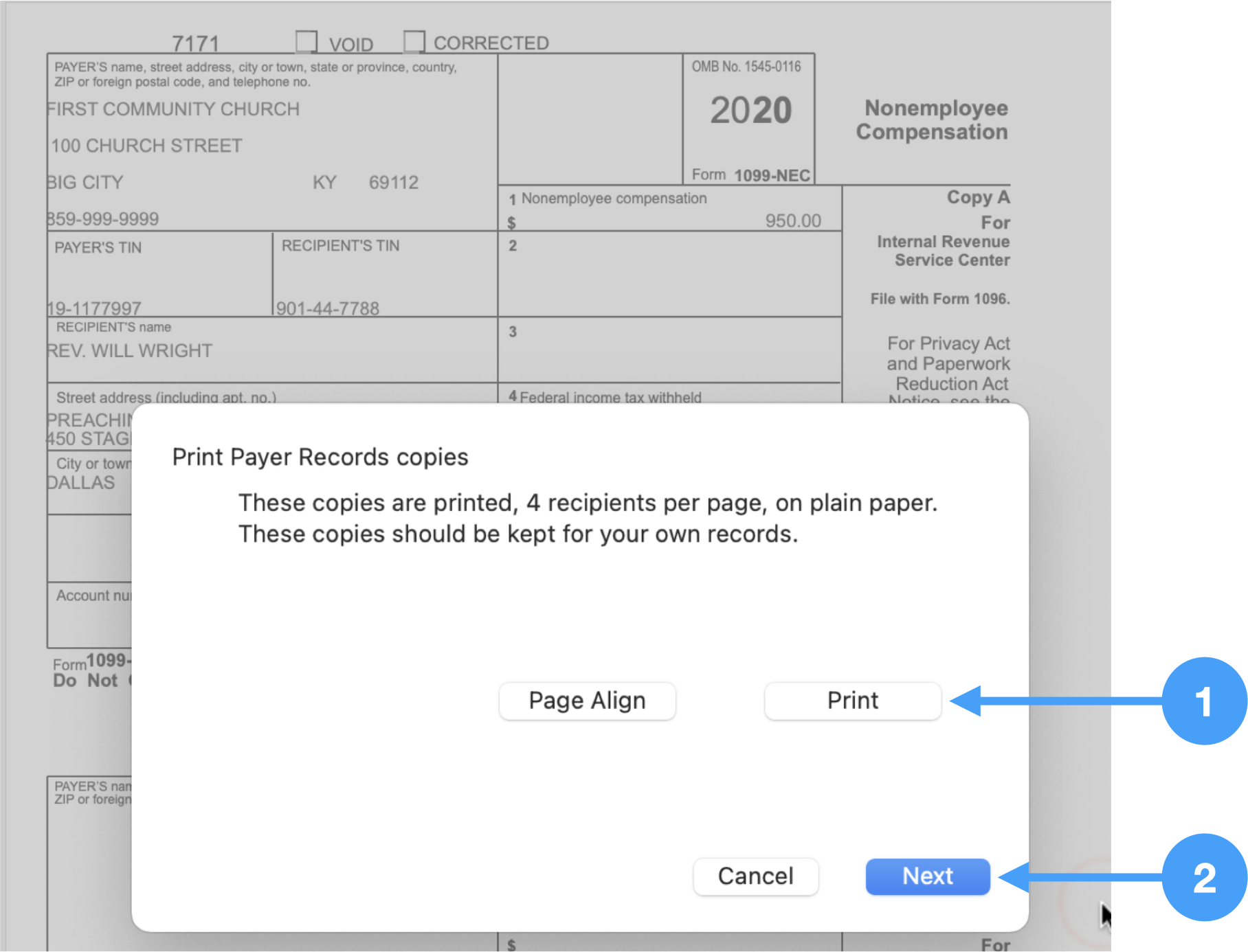

Printing 1099-NEC Forms

The first part of the filing process is to print the 1099 Payer Records, State copies and Recipient copies. The print window opens.

- Click Print and follow the steps in the Printer dialog window.

- Click Next.

Continue these steps until you get to the window that displays information for the 1096 form.

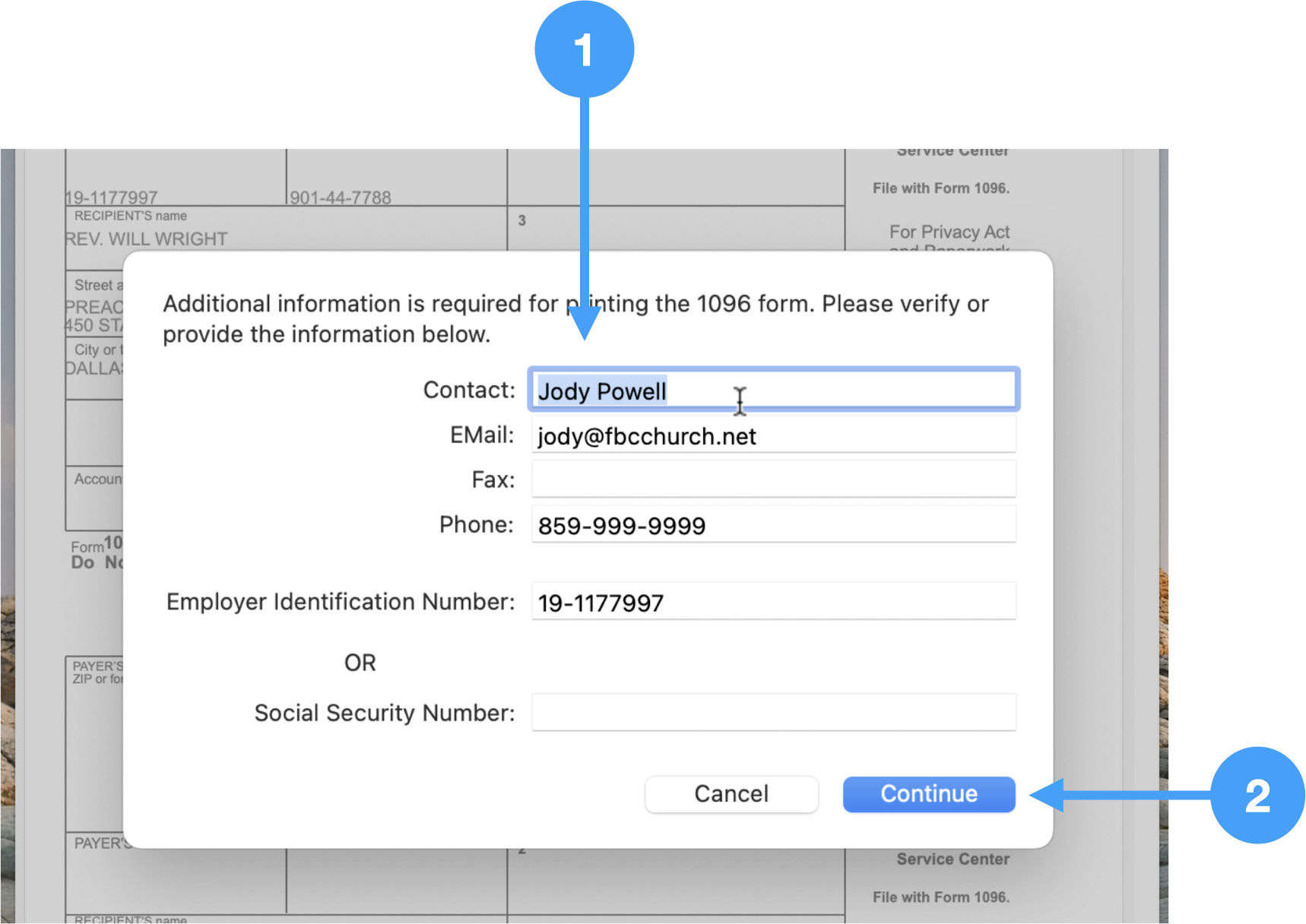

1096 Information Window

- Review the information in this window and make any necessary changes. Be aware that any updates to the data in this window will NOT be reflected in CDM+.

- Click Continue