Canadian Giving Receipts

CDM+ can produce Contributions Receipts that meet Canadian tax code requirements. Only organizations located in Canada need to produce Canadian Donation Receipts. Organizations located outside of Canada that receive donations from Canadian citizens generally do NOT need to produce Canadian Donation Receipts.

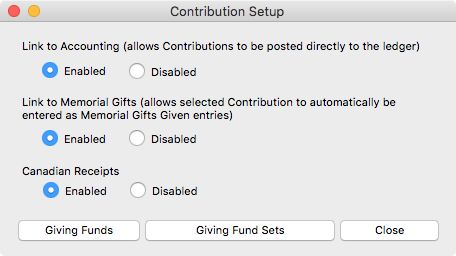

First, you will need to enable Canadian Receipts on the Contributions Setup window.

Once Canadian Receipts are enabled in Contributions Setup, an additional option, Canadian Donation Receipts, appears under Giving Statements on the Contributions Reports menu. Before you can print Canadian Donation Receipts, you must generate the detail information used on these receipts.

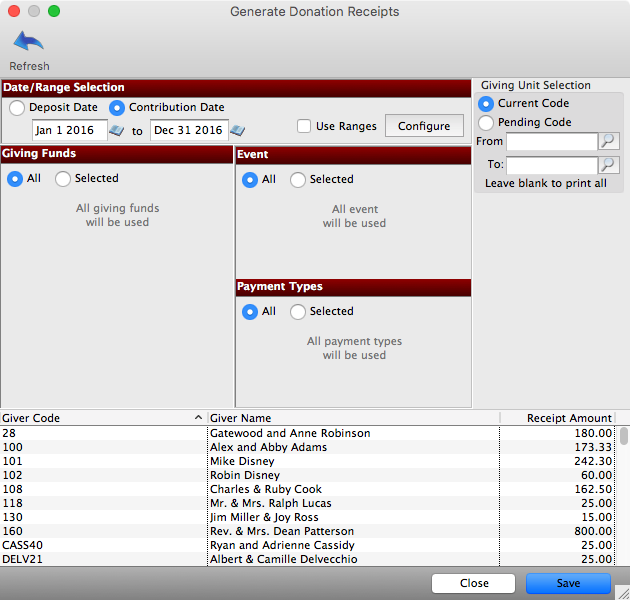

Under Program → Contributions → Canadian Receipts Maintenance, click the Generate button and make the appropriate selections.

Tax-deductible gifts will be ignored on Canadian receipts.

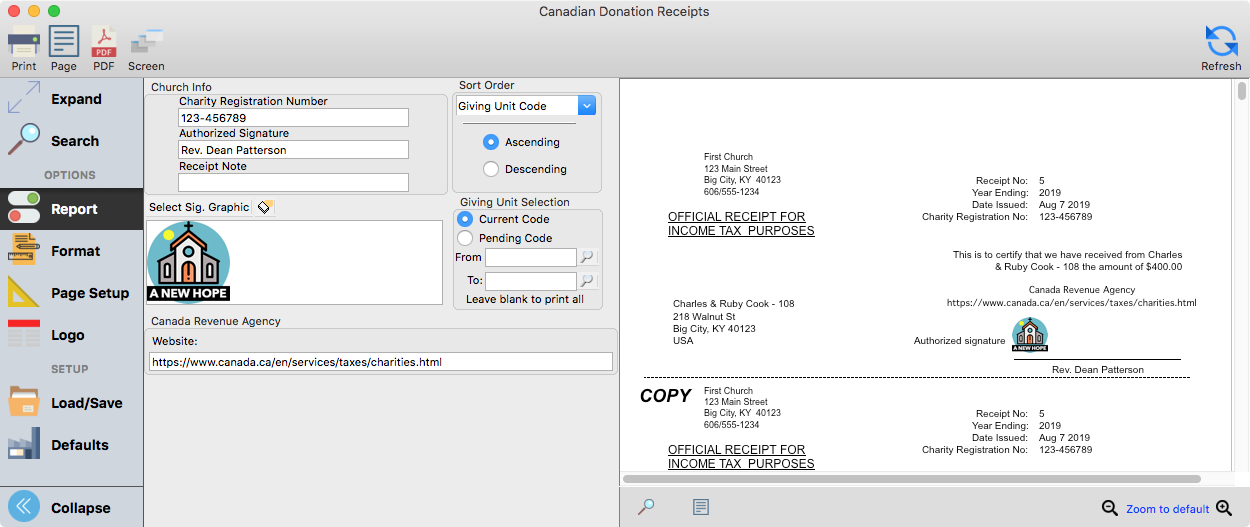

You will also need to enter the Charity Registration Number and Authorized Signature required by Canadian law for charitable receipts. You can add the charity's registration number and the authorized signature on the Report window under Reports → Contributions Reports → Statements/Receipts → Canadian Donation Receipts.

For more on adding an image of a scanned signature to your database, see the manual section on using a Graphic from the Database in your CDM+ reports and notices.