Advanced Fund Accounting

In Advanced Fund Accounting, balance sheet accounts are tied to specific Fund Codes. The overall purpose of Advanced Fund Accounting is to provide a balance sheet for each Fund and keep track of the specific location of monies for each Fund.

In Advanced Fund Accounting, there is a difference between Fund Codes and Fund Balances. A Fund Code (or the mega Fund which is trying to be tracked) will have assets, liabilities, and fund balances. Income and Expense accounts continue to be tied to specific fund balances. Therefore, a Fund in Advanced Fund Accounting will have at least one fund balance. When the Advanced Fund Accounting feature is used in CDM+, one checking account may have multiple fund designations within it. Each designation within that checking account will have its own Chart of Accounts line and balance. The use of category and sub-category and sub-category designations on the balance sheet accounts in Advanced Fund Accounting are important to represent the totals of specific assets, liabilities, and fund balances.

Note: Once Advanced Fund Accounting is turned on and being used it is not an easy process to return to basic fund accounting.

In order to enable Advanced Fund Accounting, you need to set this up in System Preferences.

Payroll Liabilities and Advanced Fund Accounting

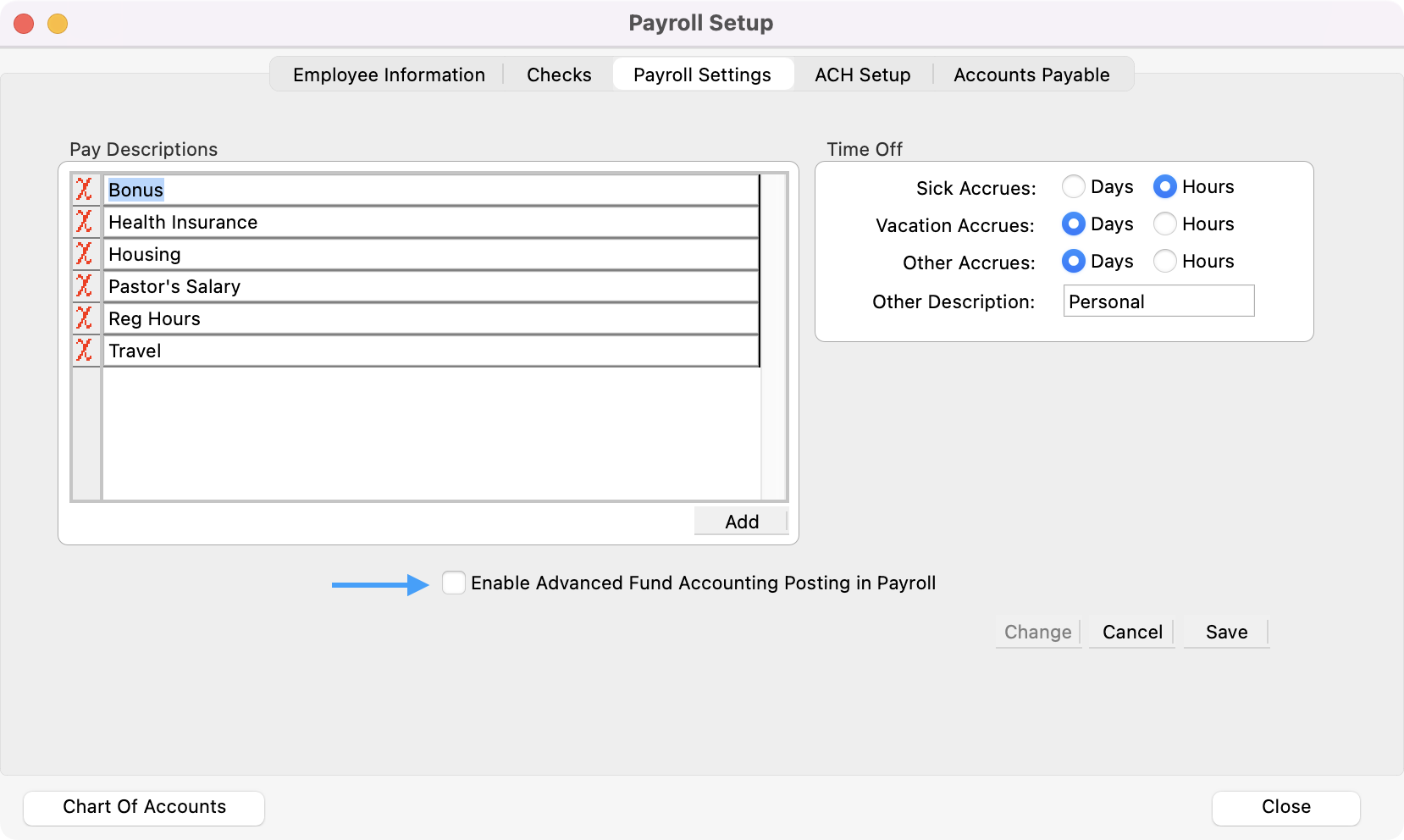

If you need to charge payroll liablilities to different Fund Codes, you need to activate that function on the Payroll Setting tab of the Payroll Setup window.

You will only see the option to Enable Advanced Fund Accounting Posting in Payroll after you have enabled Advanced Fund Accounting in System Preferences.

Click the checkbox next to Enable Advanced Fund Accounting Posting in Payroll. Then you need to specify on a per-employee/liability line the liability account to which it should post. If this function is not activated, then all payroll liabilities will show on just one Fund Code balance sheet.