Accounting Basics

Organization

A chart of accounts usually applies to a single organization; such as a church or non-profit organization. In accounting terms the organization is called an accounting entity.

Money Management

Accounts are kept in terms of money and the only math involved is addition and subtraction. Only items that can be stated in terms of money are recorded.

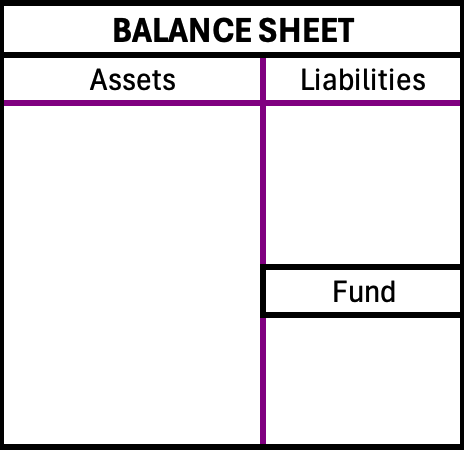

Balance Sheet

The balance sheet is the foundation of everything related to accounting and shows the financial position of the organization on a specific date. The balance sheet is based on the Accounting Equation and has two sides: the left side for assets; the right side for liabilities and funds. Income and expense transactions affect the balance sheet accounts.

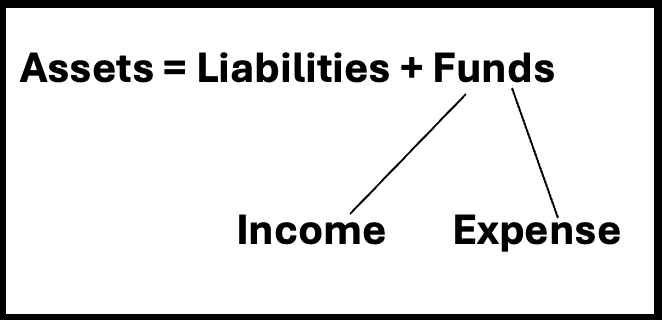

Accounting Equation:

Assets = Liabilities + Funds

The sum of the organization's assets equal the sum of the liabilities plus the sum of the funds.

All transactions can be stated in terms of their effect on the three account types of the accounting equation.

Transaction

A business transaction is an occurrence of an action or condition that must be recorded in monetary terms. Ex.: The church receives an offering and therefore it is income to the church. The utility bill is paid and therefore it is an expense to the church.

Accounts

Accounts track transaction activity related to a defined item. Accounts are user-defined with the goal of increasing the understanding of changes in income and expenses and the resulting consequences to assets, liabilities and funds. Ex.: Offering Income tracks the accumulated amount of offerings received during a selected time period; Pastor Salary tracks the accumulated amount of wages paid to the pastor during a selected time period.

Account Types

Five types of accounts are used in the accounting process.

Assets – resources owned by the organization expressed in money terms. Ex.: Money in a checking account; real property like building and land.

Liabilities – debts or claims of parties other than the organization that must be paid or distributed (i.e., creditors who maintain rights to some asset of the organization).

Funds – track the net balance of the assets of the organization. Often the organization will create multiple fund accounts to track the monetary balances for specific purposes; for example, General Fund; Building Fund; and Missions Fund.

Income – the revenue received from various sources by the organization. Income accounts are associated with a fund.

Expenses – the costs paid for a service or disbursements made by the organization. Expense accounts are associated with a fund

Fund Balance Accounts

In non-profit fund accounting, fund balance accounts are used to track the net balance of the assets of the organization in separate accounts to ensure proper use of the monies. Fund Balance accounts are Balance Sheet accounts and they are reported on the Balance Sheet report.

Each Fund Balance account will have both income and expense accounts associated with it; this association is created when entering income and expense accounts into the chart of accounts. The monetary value of the Fund Balance account is normally changed by an income or expense transaction. A transaction involving an income account increases the fund balance account; a transaction involving an expense account normally decreases the fund balance account. The net change between these income and expense transactions results in either an increase or decrease of the fund balance account.

Income and Expense Relationship to the Accounting Equation

The net difference between the Income (revenue) and Expense (costs) either increases or decreases the Fund balance.

If INCOME exceeds EXPENSES then the FUND BALANCE = INCREASES

If EXPENSES exceed INCOME then the FUND BALANCE = DECREASES

This increase or decrease to the Fund Balance calculates automatically in CDM+ with each transaction and adjusts the total in the Fund Balance appropriately. Every transaction that includes an income or expense account affects the associated Fund Balance total. The difference between income and expenses is reported on the Income and Expenditures reports as an Over/Under amount (Increased/Decreased amount). The difference affects both the Fund Balance and Asset accounts on the Balance Sheet.

Double Entry

The double entry principle is based on each accounting transaction affecting at least two accounts which results in a balance of the accounting equation. The change in the two accounts is represented by a “debit” and a “credit.” The double entry recording system of accounting requires the debits and credit of each transaction to be equal. If debits and credits DO NOT equal for a transaction then something is wrong.

Debits = Credits

The Charts below are basic to fund accounting.

Double Entry Ledger

Debit | Credit | |

|---|---|---|

Assets | + | - |

Liabilitites | - | + |

Funds | - | + |

Income | - | + |

Expenses | + | - |

In double- entry accounting, Debits and Credits must equal on every transaction. Example:

Transaction | Debit | Credit |

|---|---|---|

Check or Expense | Expense account | Checking (Asset) account |

Deposit | Checking (Asset) account | Income account |

Asset to Asset Transfer | Asset the money goes into | Asset the money goes out of |

Fund to Fund Transfer | Fund the money goes out of | Fund the money goes into |